MSFT 425.025 -0.9035% AAPL 220.43 0.8648% NVDA 115.85 1.4004% GOOGL 172.44 -0.1101% GOOG 174.27 -0.0573% AMZN 182.99 1.1945% META 460.09 -0.2558% AVGO 152.64 0.859% TSLA 224.8499 4.102% TSM 161.61 1.1327% LLY 823.56 -4.2238% V 257.56 1.3338% JPM 209.535 0.453% UNH 562.83 0.5502% NVO 129.31 -1.7401% WMT 70.206 -0.5581% LVMUY 143.15 0.9022% XOM 116.85 1.5999% LVMHF 714.04 0.4982% MA 436.96 1.0429%

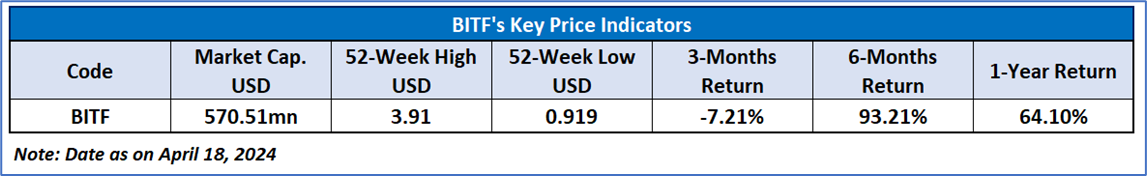

Bitfarms Ltd.

Bitfarms Ltd. (NASDAQ: BITF) engages in the business of mining cryptocurrency. The firm is also involved in the ownership and operation of server farms comprised of computers designed for the purpose of validating transactions on the Bitcoin blockchain.

Recent Business and Financial Updates:

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.