MSFT 425.025 -0.9035% AAPL 220.43 0.8648% NVDA 115.85 1.4004% GOOGL 172.44 -0.1101% GOOG 174.27 -0.0573% AMZN 182.99 1.1945% META 460.09 -0.2558% AVGO 152.64 0.859% TSLA 224.8499 4.102% TSM 161.61 1.1327% LLY 823.56 -4.2238% V 257.56 1.3338% JPM 209.535 0.453% UNH 562.83 0.5502% NVO 129.31 -1.7401% WMT 70.206 -0.5581% LVMUY 143.15 0.9022% XOM 116.85 1.5999% LVMHF 714.04 0.4982% MA 436.96 1.0429%

Section1: Company Overview

Galaxy Digital Holdings Ltd (TSX: GLXY) is a is a diversified financial services and investment management company dedicated to the digital assets and blockchain technology industry. The company operates through five business lines: Trading, Principal investing, Asset management, mining, and Investment Banking. This Report covers the Investment Highlights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

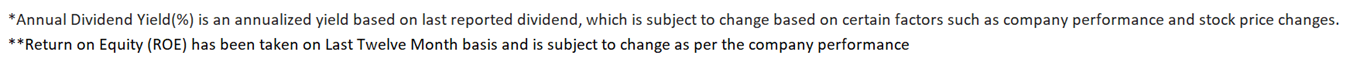

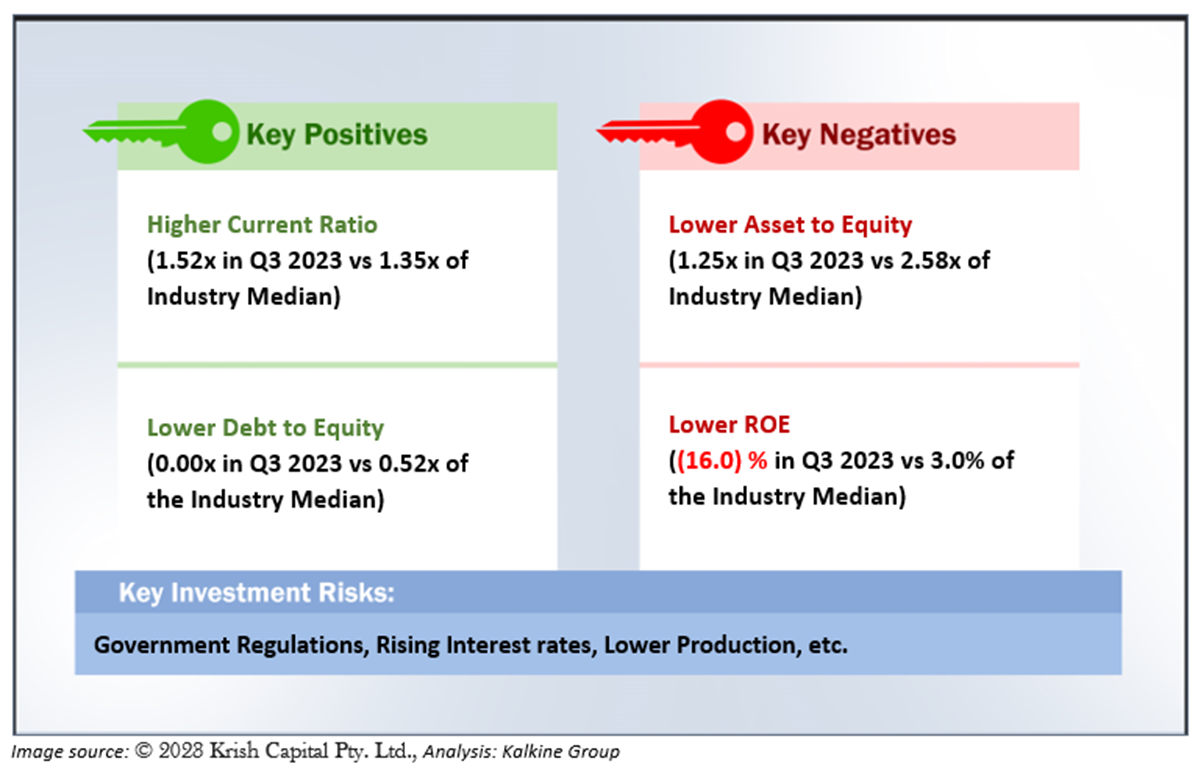

1.1 The Key Positives, Negatives, Investment Highlights, and Risks

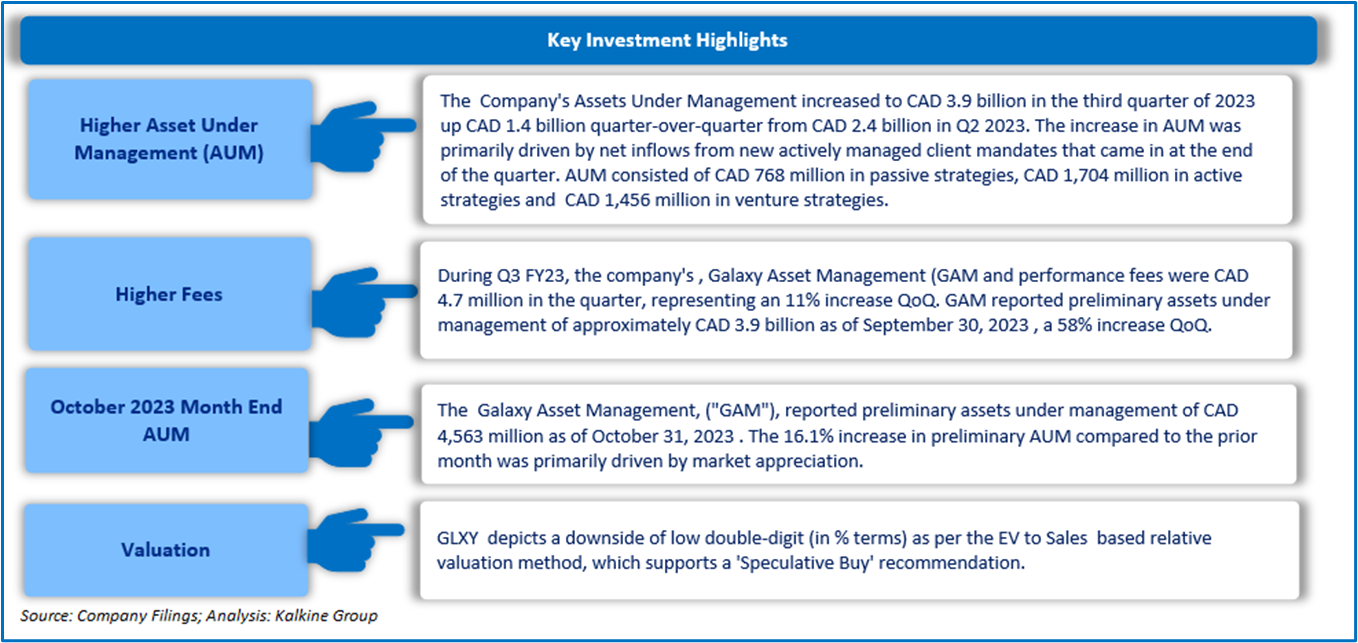

Section2: Financial Highlights

2.1 Key Financial Highlights

Section 3: Stock Recommendation Summary

3.1 Valuation Methodology

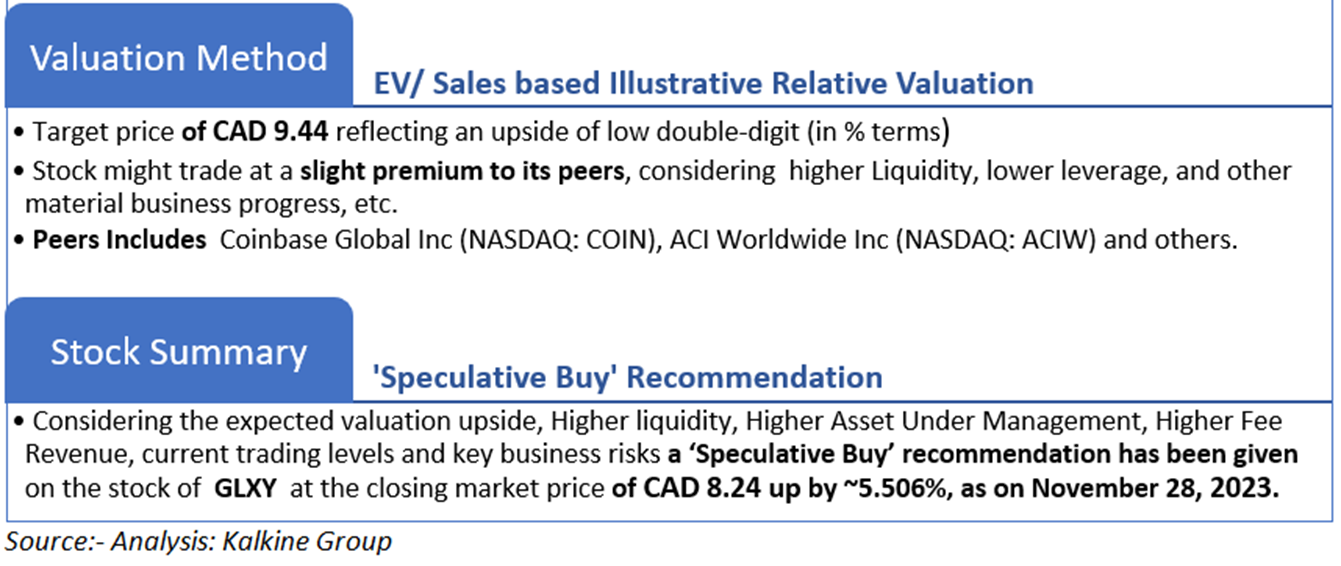

Valuation Methodology (Illustrative): EV to Sales based

3.2 Price Performance and Stock Recommendation

The stock has witnessed an upside of ~30.17% in 1 month and ~48.73% over the last 3 months. Moreover, the stock is trading below the average 52-week high price of CAD 8.60 and 52-week low price of CAD 3.325 providing an opportunity to accumulate the stock.

3.3 One-Year Technical Price Chart

One-Year Technical Price Chart (as of November 28, 2023). Source: REFINITIV, Analysis: Kalkine Group

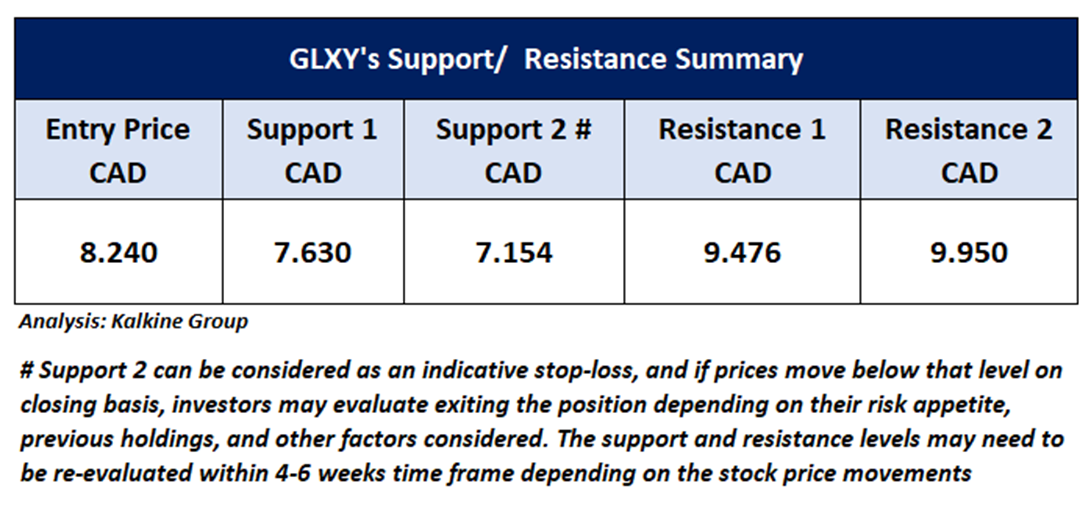

3.4 Technical Summary

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels as on November 28, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and the uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.