AAPL 209.68 -3.3644% MSFT 378.77 -1.1741% NVDA 115.58 -0.1382% GOOGL 162.76 -2.6031% GOOG 164.73 -2.5266% AMZN 193.89 -2.514% META 590.64 -4.6678% AVGO 191.36 -1.4776% LLY 801.65 -2.4591% TSLA 240.68 -2.9868% TSM 171.59 -3.1495% V 328.55 -1.2889% JPM 225.19 -1.1891% UNH 481.52 0.0852% NVO 75.89 1.4708% WMT 84.5 -0.8216% LVMUY 129.76 -2.7942% XOM 108.67 -0.4215% LVMHF 655.0 -2.0693% MA 519.83 -0.9168%

1.Exit Case: Vipshop Holdings Limited

Overview: Vipshop Holdings Ltd is an online discount retailer for brands in China. The Company offers branded products to consumers in China through flash sales mainly on its vip.com Website. The Company's segment is sales, product distribution and offering of goods on its online platforms. The Company conducts its business through its subsidiaries and consolidated affiliated entities in China.

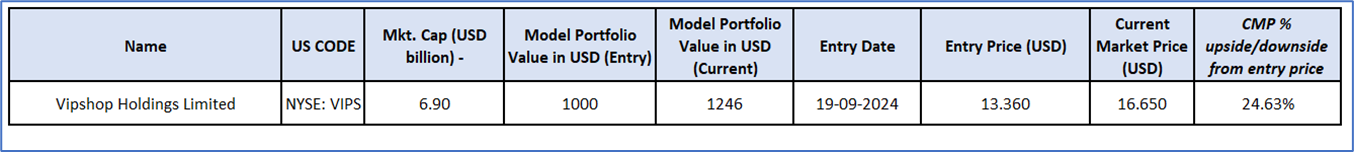

VIPS has been a part of the ‘Growth Model Portolio’ since 19 September 2024, however, considering the recent rally, trading near the resistance in the stock, support & resistance levels, and ~24.63% upside from the entry price, an ‘Exit’ is recommended from the stock near the resistance of USD 16.65, as on (30th September 2024).

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

Kalkine Equities LLC, with Delaware File Number 4697384, Foreign Qualification Registration in California File Number 202109211078, and Texas File Number 805521396, is authorized to provide general advice only. The information on https://kalkine.com/ does not take into account any of your investment objectives, financial situation or needs. You should consider the appropriateness of advice taking into account your own objectives, financial situation and needs and seek independent financial advice before making any financial decisions. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing the reports (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.

Copyright © 2024 Krish Capital Pty Ltd. All rights reserved.