AAPL 211.52 -2.5164% MSFT 378.22 -1.3176% NVDA 115.18 -0.4838% GOOGL 162.55 -2.7287% GOOG 164.4959 -2.6651% AMZN 192.85 -3.0369% META 592.2001 -4.416% AVGO 191.39 -1.4622% LLY 800.66 -2.5795% TSLA 234.89 -5.3206% TSM 171.37 -3.2737% V 330.44 -0.7211% JPM 225.225 -1.1738% UNH 481.67 0.1164% NVO 76.025 1.6513% WMT 84.215 -1.1561% LVMUY 130.52 -2.2249% XOM 108.37 -0.6964% LVMHF 660.0 -1.3217% MA 521.82 -0.5375%

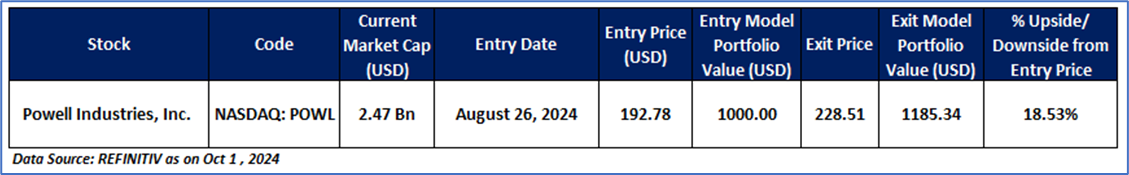

Exit Case: Powell Industries, Inc. (NASDAQ: POWL)

Overview: Powell Industries, Inc. (NASDAQ: POWL) develops, designs, manufactures and services custom-engineered equipment and systems. The Company distributes, controls and monitors the flow of electrical energy and provides protection to motors, transformers and other electrically powered equipment. POWL has been a part of the 'Momentum Model Portfolio' since Aug 26, 2024. Therefore, an 'Exit' stance from the Momentum Model Portfolio is recommended on the stock at the close price of USD 228.51 as on Oct 1, 2024.

POWL’s Daily Chart

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

Kalkine Equities LLC, with Delaware File Number 4697384, Foreign Qualification Registration in California File Number 202109211078, and Texas File Number 805521396, is authorized to provide general advice only. The information on https://kalkine.com/ does not take into account any of your investment objectives, financial situation or needs. You should consider the appropriateness of advice taking into account your own objectives, financial situation and needs and seek independent financial advice before making any financial decisions. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing the reports (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.

Copyright © 2024 Krish Capital Pty Ltd. All rights reserved.