AAPL 258.2 1.1478% MSFT 439.33 0.9374% NVDA 140.22 0.3938% GOOGL 196.11 0.7604% GOOG 197.57 0.8062% AMZN 229.05 1.7729% META 607.75 1.317% AVGO 239.68 3.1547% TSLA 462.28 7.3572% TSM 206.33 -0.4967% LLY 795.67 -0.0766% V 320.65 1.0813% JPM 242.31 1.6444% UNH 506.1 -0.0474% NVO 87.37 -1.5105% WMT 92.68 2.5789% LVMUY 132.15 0.1516% XOM 106.4 0.0941% LVMHF 655.0 -0.2543% MA 535.71 1.2761%

Plug Power Inc

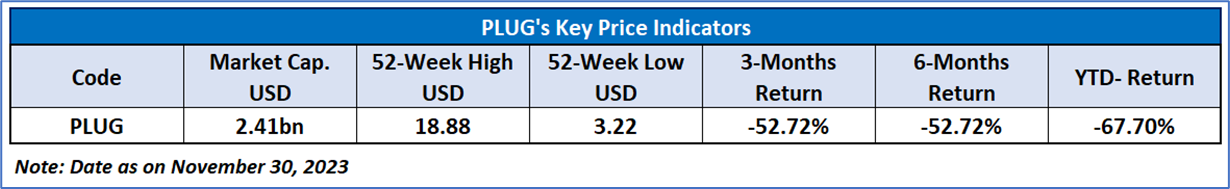

Plug Power Inc. (NASDAQ: PLUG) is a provider of hydrogen fuel cell turnkey solutions. The Company provides electrolyzers that allow customers, such as refineries, producers of chemicals, steel, fertilizer and commercial refueling stations, to generate hydrogen on-site. It focuses on industrial mobility applications, including electric forklifts and electric industrial vehicles, at multi-shift high volume manufacturing and high throughput distribution sites and environmental benefits; stationary power systems that supports critical operations, such as data centers, microgrids and generation facilities, in either a backup power or continuous power role and replace batteries, diesel generators or the grid for telecommunication logistics, transportation, and utility customers; and production of hydrogen.

Recent Financial and Business Updates:

Technical Observation (on the daily chart)

The Relative Strength Index (RSI) over a 14-day period stands at 38.80, rising from the oversold zone. The stock price has given a healthy correction from levels of around USD 6.00, with the announcement of the recent quarterly results. Additionally, the stock's current positioning is below both 21-period SMA and 50-period SMA, which may serve as a dynamic short-term resistance level. Meanwhile, the stock price is currently taking resistance from the 21-day Simple Moving Average (SMA).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is November 30, 2023. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by the individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.