Global Commodity Market Wrap-Up

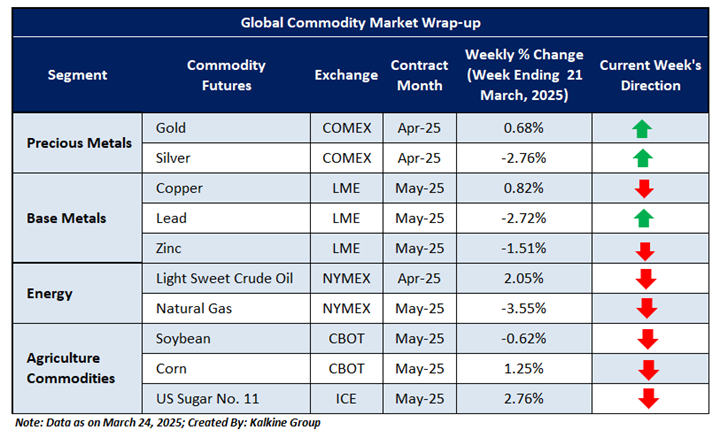

The metals market experienced a mixed performance last week, with precious metals showing upward momentum, while base metals had varying results. Gold rose by 0.68%, supported by ongoing demand for safe-haven assets, while silver saw a decline of 2.76%, reflecting a shift in investor sentiment. Base metals also saw divergent trends, with copper increasing by 0.82% due to strong industrial demand, while lead and zinc faced losses of 2.72% and 1.51%, respectively, as concerns over global economic conditions weighed on prices. This volatility reflects shifting investor sentiment, with ongoing uncertainty likely to continue influencing price fluctuations in the near term.

Last week, natural gas prices dropped by 3.55%, driven by ongoing supply constraints and a surge in seasonal demand. Crude oil, in contrast, experienced a modest increase of 2.05%, as market uncertainty and shifting investor sentiment weighed on prices. U.S. sugar prices surged by 2.76%, aligning with the broader upward trend in agricultural commodities. These price movements underscore persistent supply-demand imbalances, with investors adjusting strategies in response to global economic instability. The energy and agricultural sectors are encountering heightened volatility, influenced by supply disruptions and evolving demand patterns. This market environment is expected to continue influencing trends in the near term.

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

Kalkine Equities LLC, with Delaware File Number 4697384, Foreign Qualification Registration in California File Number 202109211078, and Texas File Number 805521396, is authorized to provide general advice only. The information on https://kalkine.com/ does not take into account any of your investment objectives, financial situation or needs. You should consider the appropriateness of advice taking into account your own objectives, financial situation and needs and seek independent financial advice before making any financial decisions. The link to our Terms and Conditions and Privacy Policy has been provided for your reference. On the date of publishing the reports (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.