Section 1: Company Fundamentals

1.1 Company Overview and Performance summary

Company Overview:

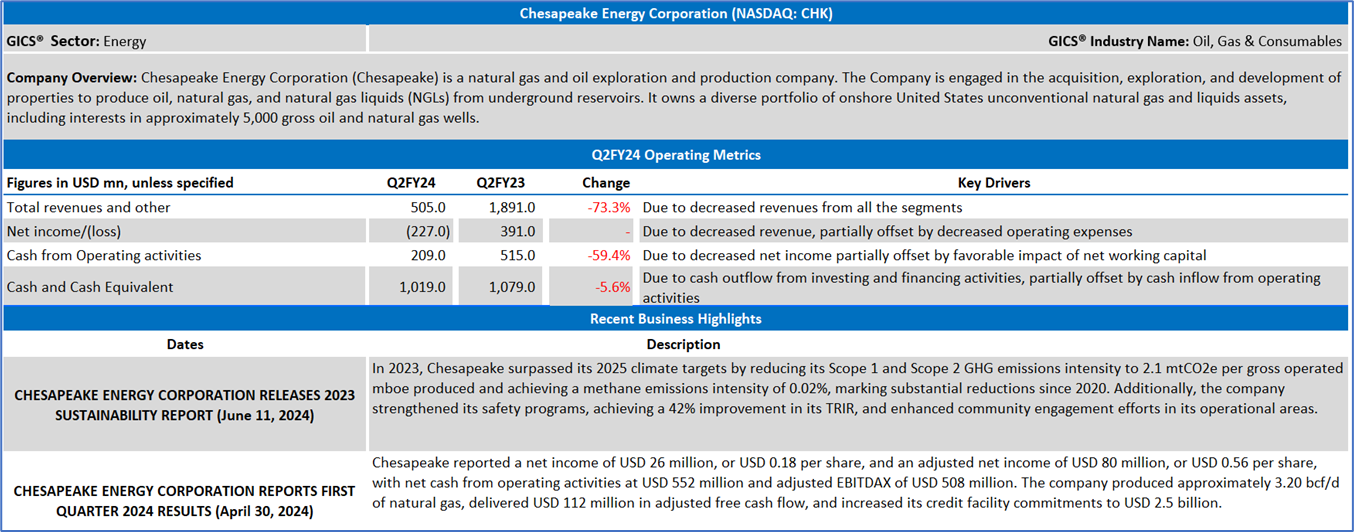

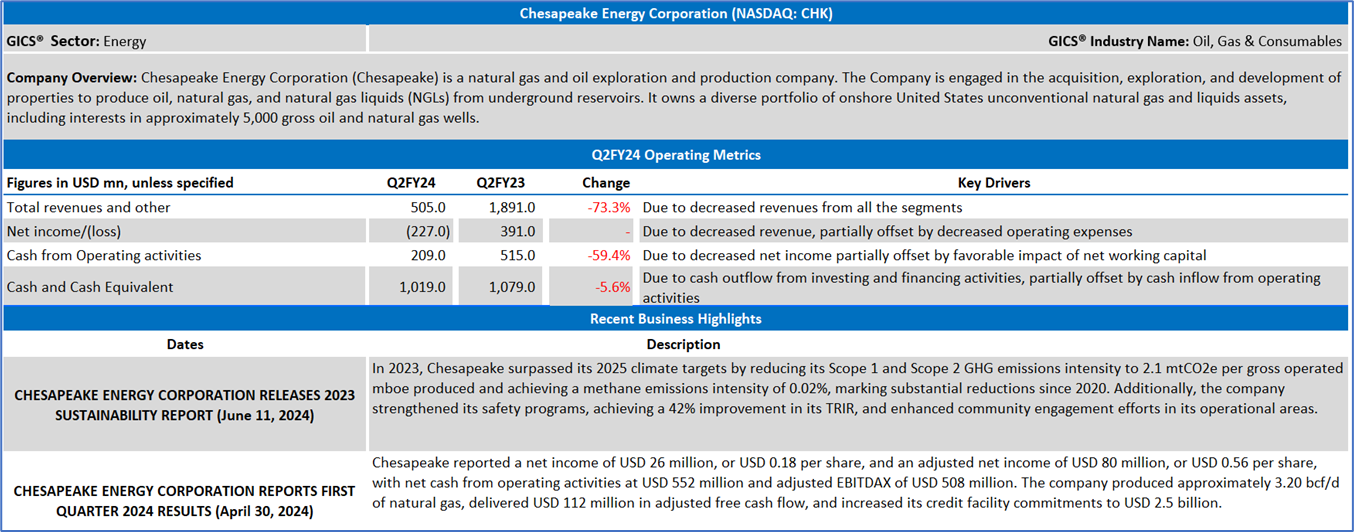

Chesapeake Energy Corporation (Chesapeake) (NASDAQ: CHK) is a natural gas and oil exploration and production company. The Company is engaged in the acquisition, exploration, and development of properties to produce oil, natural gas, and natural gas liquids (NGLs) from underground reservoirs. It owns a diverse portfolio of onshore United States unconventional natural gas and liquids assets, including interests in approximately 5,000 gross oil and natural gas wells.

This US Inflation Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Price Performance:

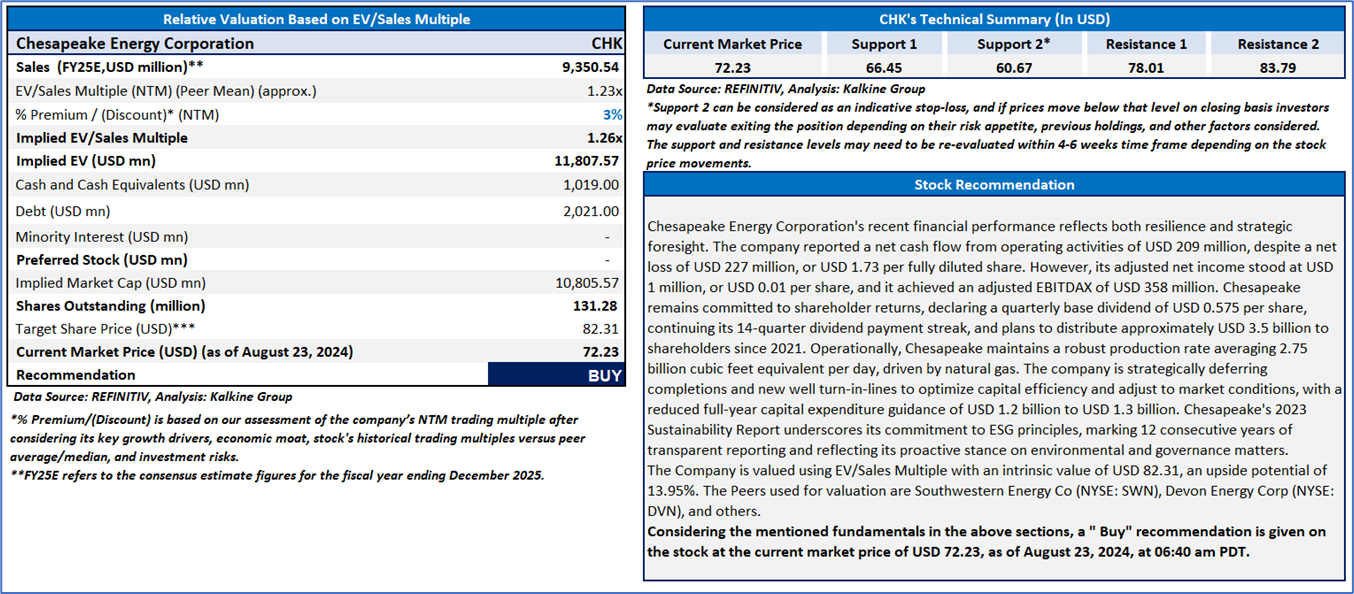

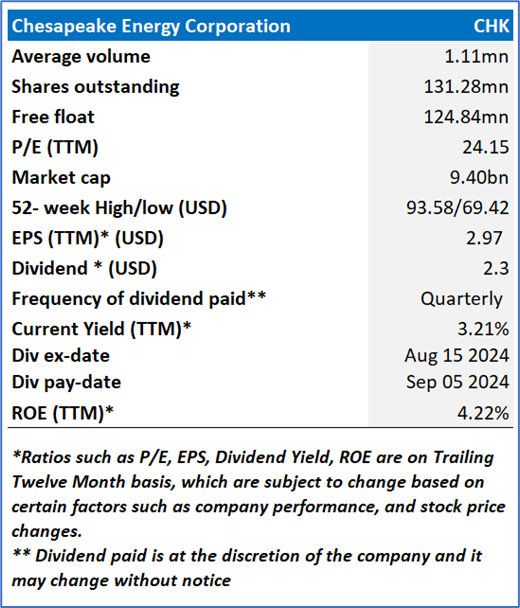

- CHK's share price has corrected by 19.19% in the past three months. Similarly, in the long term, the stock has corrected by 11.72% over the past nine months.

- The stock is currently trading near to the higher end of its 52-week range of USD 93.58 and 52-week low price of USD 69.42, with the expectations of an upside movement in case the USD 70 support holds.

- The price is currently below both its short-term (50-day) SMA and long-term (200-day) SMA, with the current RSI of around 36.44.

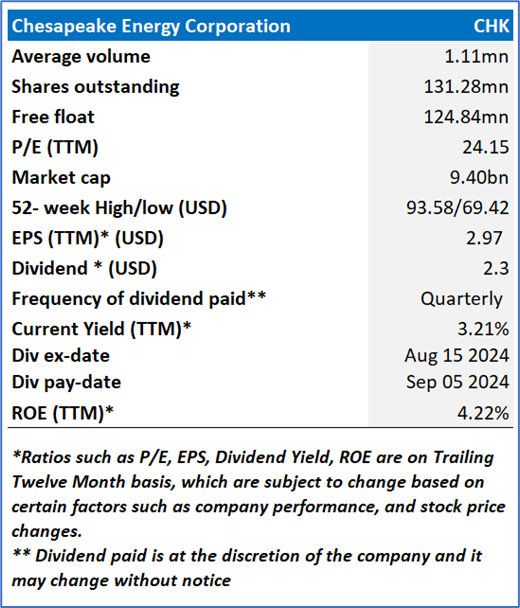

1.2 Summary Table

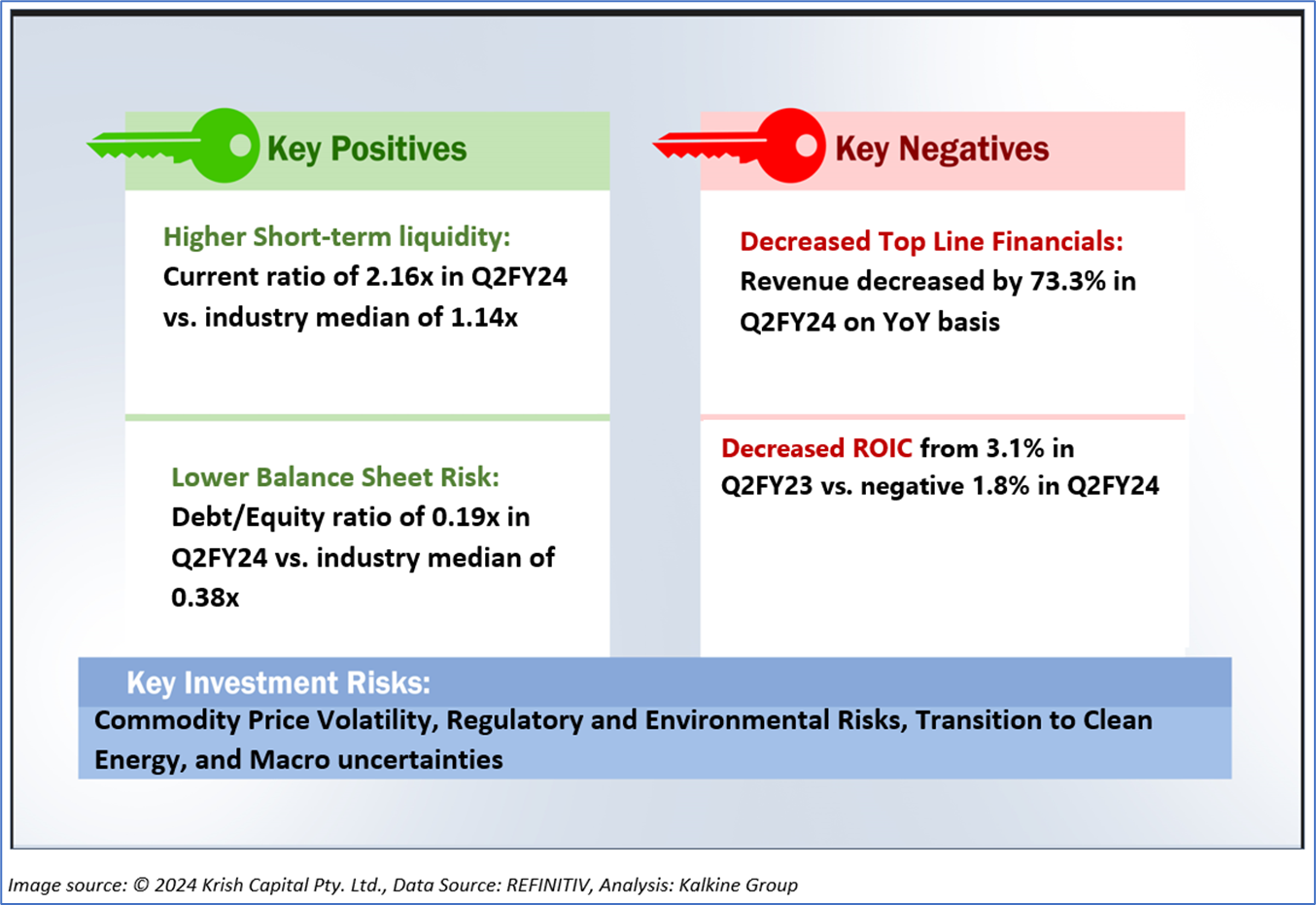

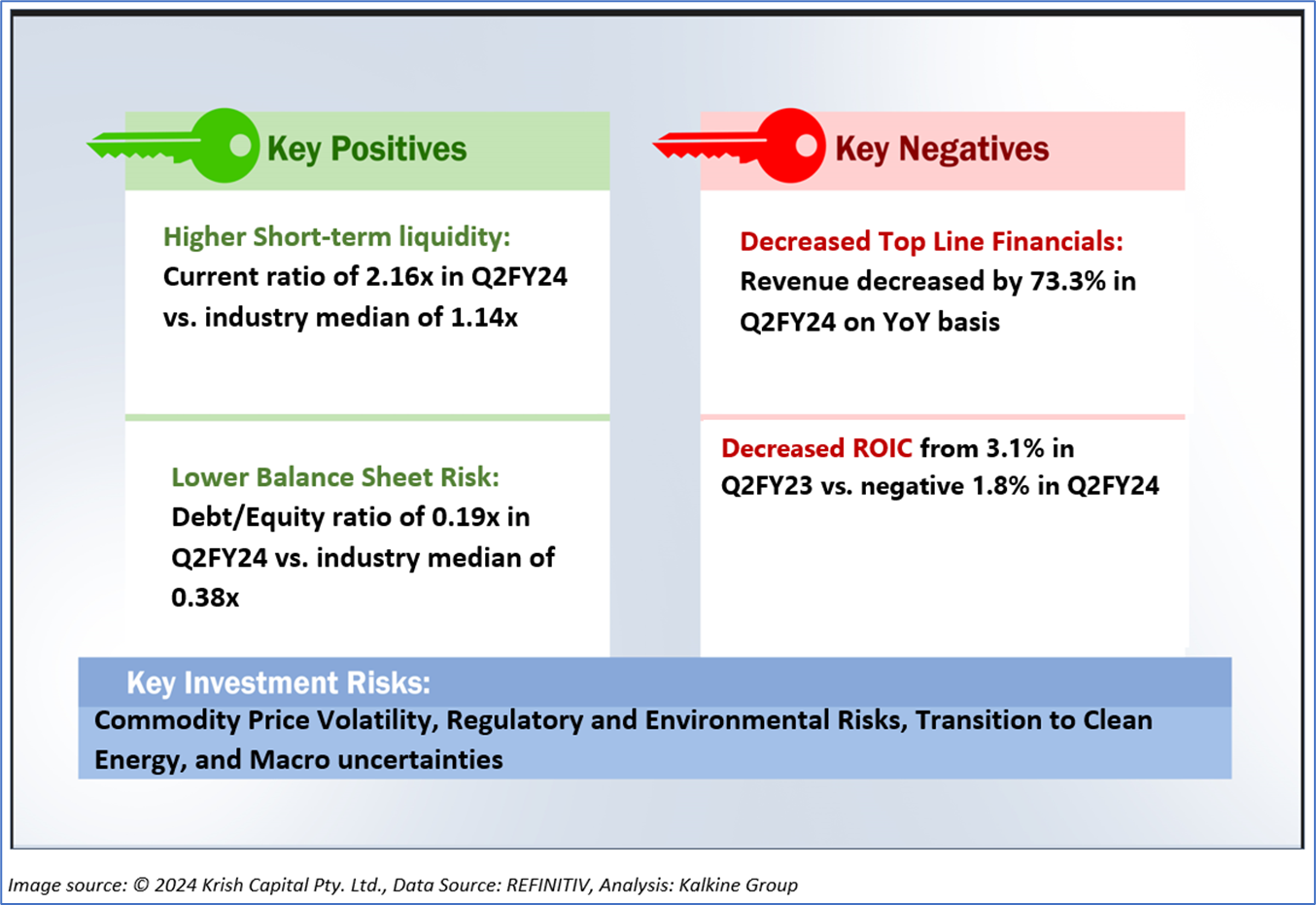

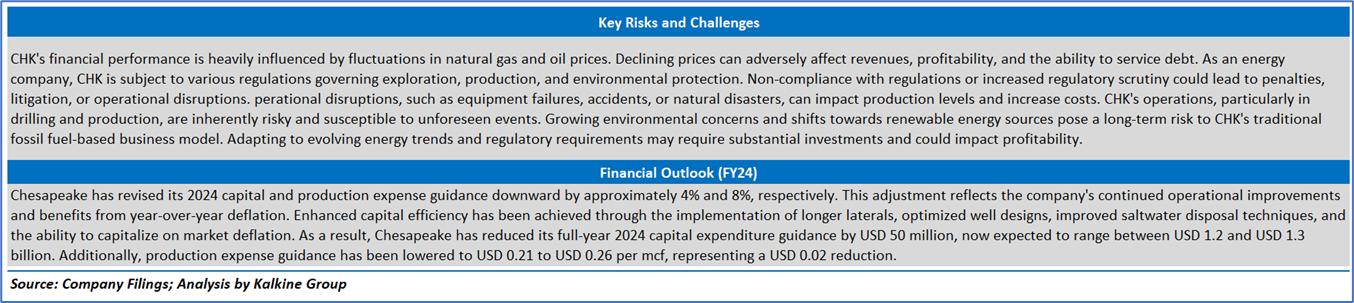

1.3 The Key Positives & Negatives

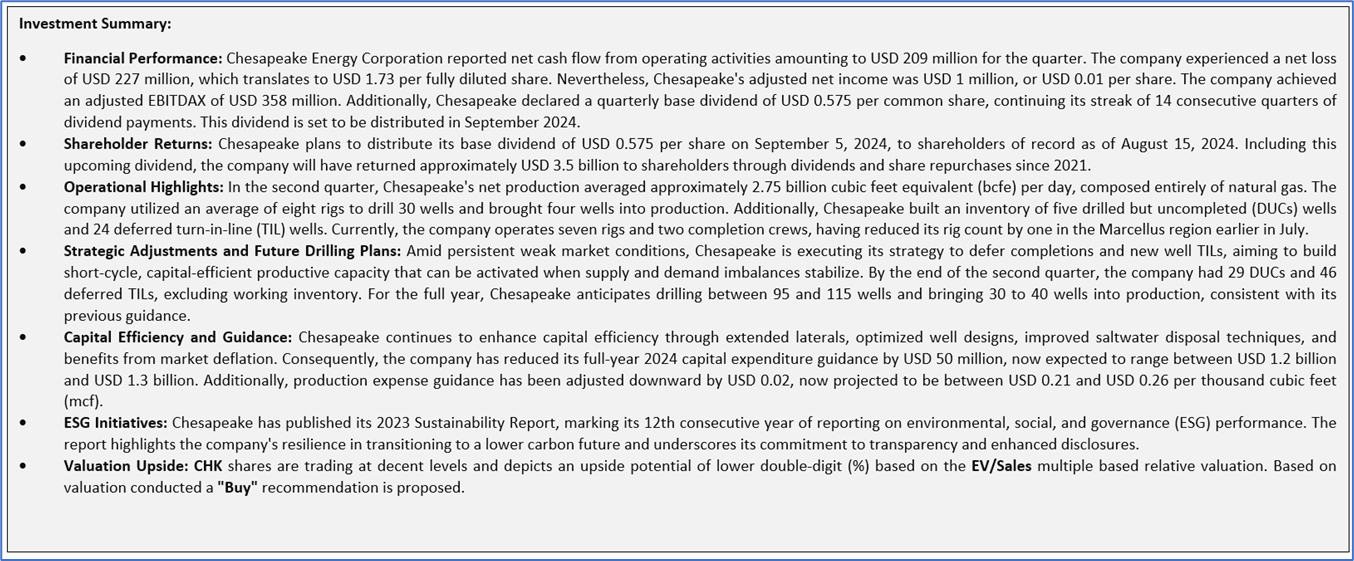

1.4 Key Metrics

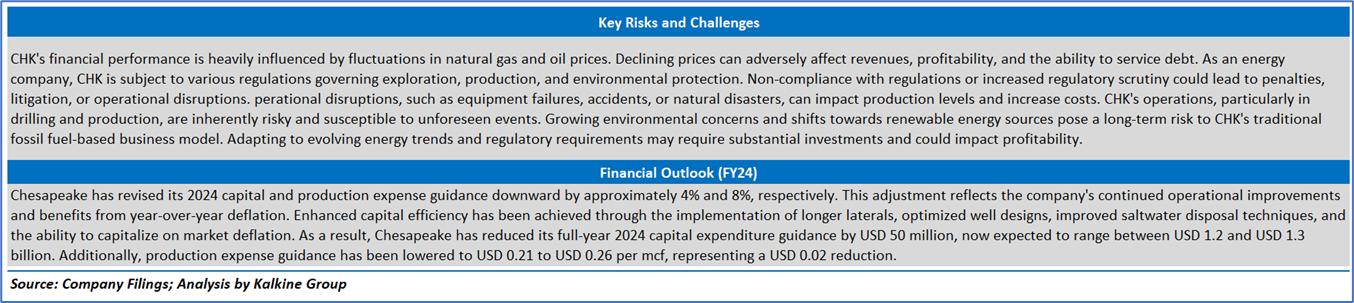

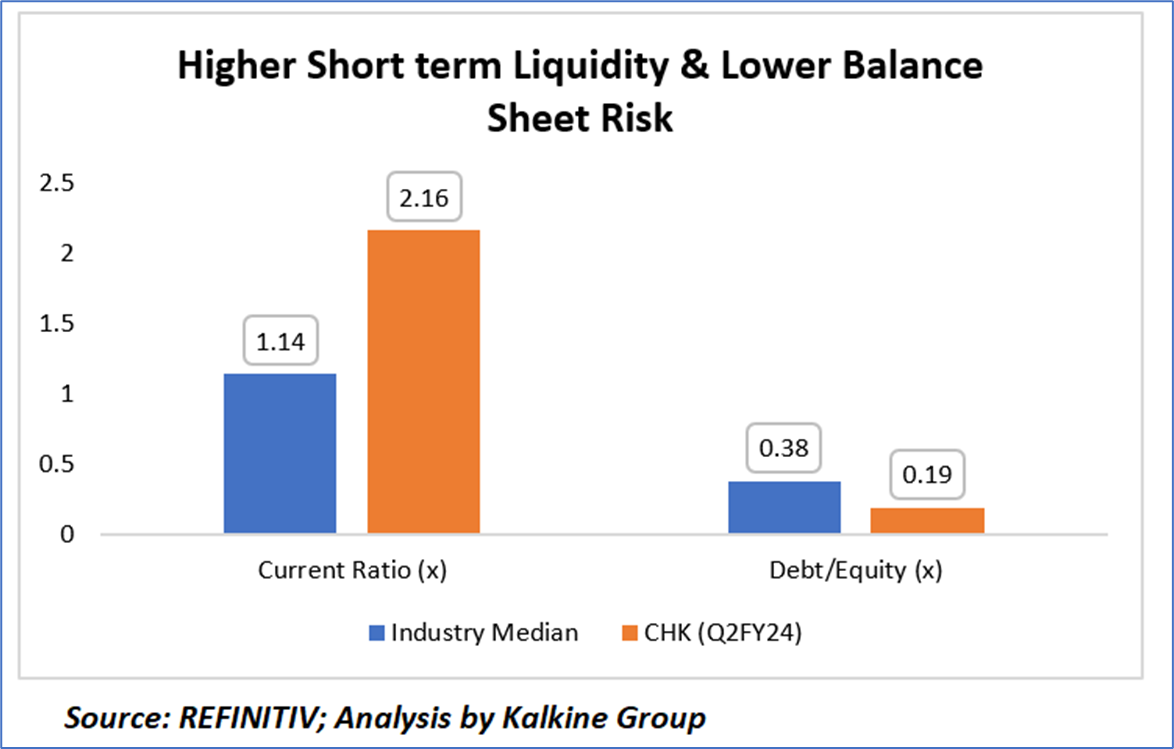

Chesapeake Energy's (CHK) financial health for the second quarter of fiscal year 2024 compared to the industry median, notable metrics reveal a robust position. The current ratio for CHK stands at 2.16, significantly exceeding the industry median of 1.14, indicating a strong liquidity position and the company's ability to meet its short-term obligations effectively. Additionally, CHK's debt-to-equity ratio is 0.19, well below the industry median of 0.38. This lower leverage ratio suggests that CHK maintains a conservative capital structure, which may enhance financial stability and reduce risk exposure. Overall, these figures demonstrate Chesapeake's solid financial footing relative to its peers.

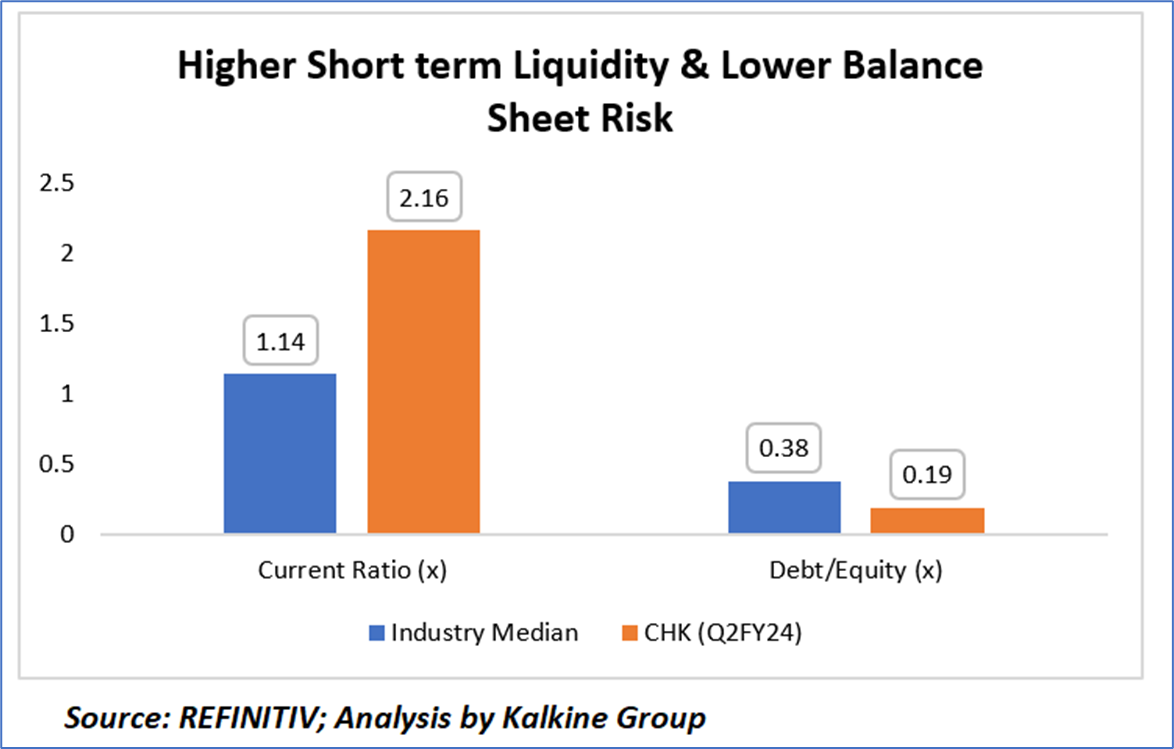

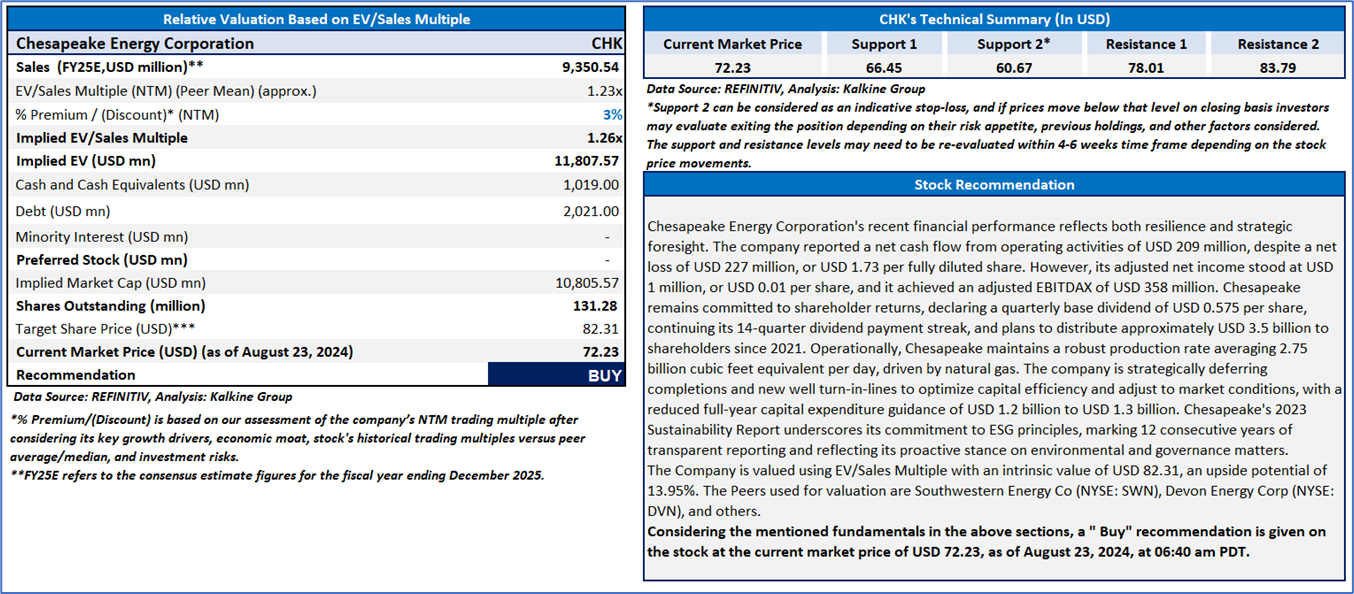

Section 2: Chesapeake Energy Corporation (“Buy” at the current market price of USD 72.23, as of August 23, 2024)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is August 23, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stocks prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

US

US

AU

AU UK

UK CA

CA NZ

NZ

Please wait processing your request...

Please wait processing your request...