AAPL 250.9362 1.1636% MSFT 439.85 0.5624% NVDA 132.26 2.5987% GOOGL 190.36 1.0403% GOOG 191.585 0.7547% AMZN 224.7026 1.8967% META 605.1 1.3245% AVGO 221.57 -0.9167% TSLA 434.8 -1.211% TSM 195.3 -0.133% LLY 758.87 -0.7637% V 315.9 1.9756% JPM 234.325 1.7168% UNH 493.79 -1.1867% NVO 103.7 -2.1329% WMT 93.89 0.3634% LVMUY 130.52 0.7721% XOM 105.67 -0.7048% LVMHF 649.5 0.6649% MA 526.755 1.3068%

This report is an updated version of the report published on 25 July 2023 at 07:30 AM GMT +1.

1.1: Company Overview: Ecora Resources PLC (LON: ECOR) is a UK-based royalty company. The group hold royalties and investments in mining and exploration interests mainly in Australia, South America, North America, and Europe, with diversified exposure to commodities like cobalt, copper, iron ore, vanadium, steel-making coal, uranium, and gold. Kalkine’s Global Fully Charged Report covers the Investment Highlights, Management Insights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

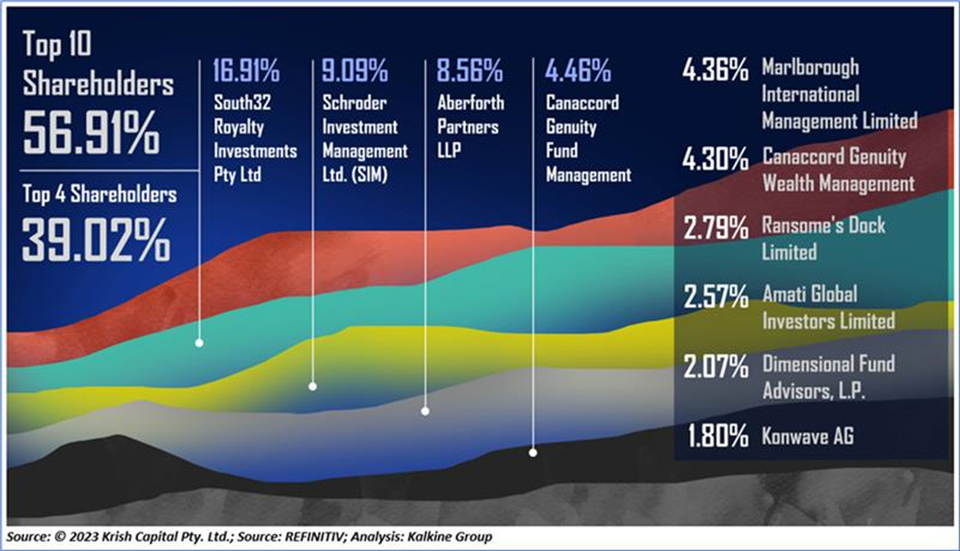

The top 10 shareholders together form ~56.91% of the total shareholding. South32 Royalty Investments Pty Ltd and Schroder Investment Management Ltd. (SIM) are holding maximum stakes in the company at ~16.91% and ~9.09%, respectively.

In FY22, ECOR delivered a record portfolio contribution of USD 143.2mn, considerably up by 67% YoY. Adjusted earnings per share advanced by 49% YoY to US 37.55 cents per share. The favourable portfolio contribution and earnings growth supported metrics like return on equity and net income margin. Below is captured other metrics showing the annual trend of return on equity and net income margin since FY18:

The stock price surged by ~2.42% in last 1 month and over the last 6 months, stock prices went down by ~22.58%. The stock has a 52-week low and 52-week high of GBX 109.18 and GBX 184.80, respectively, and is currently trading below the mid-range of the 52-week-high-low levels. ECOR was last covered in a report dated ’9 May 2023’.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 24 July 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.