Section 1: Company Fundamentals

1.1 Company Overview and Performance summary

Company Overview:

Diageo plc (NYSE: DEO) is a United Kingdom-based international manufacturer and distributor of drinks. The Company is engaged in beverage alcohol with a collection of brands across spirits and beer. The Company has a portfolio of approximately 200 brands and sales in 180 countries. The Company’s segments include North America, Europe, Asia Pacific, Africa, Latin America and Caribbean, and Supply Chain and Procurement (SC&P).

This US Inflation Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Price Performance:

- DEO's share price has corrected by 4.03% in the past three months. Moreover, the stock has corrected by 18.92% over the six months.

- The stock is currently trading near to the lower end of its 52-week range of USD 02 and 52-week low price of USD 135.63, with the expectations of an upside movement from the current support levels.

- The price is currently below its short-term (50-day) SMA and long-term (200-day) SMA, with the current oversold RSI of around 47.76.

1.2 Summary Table

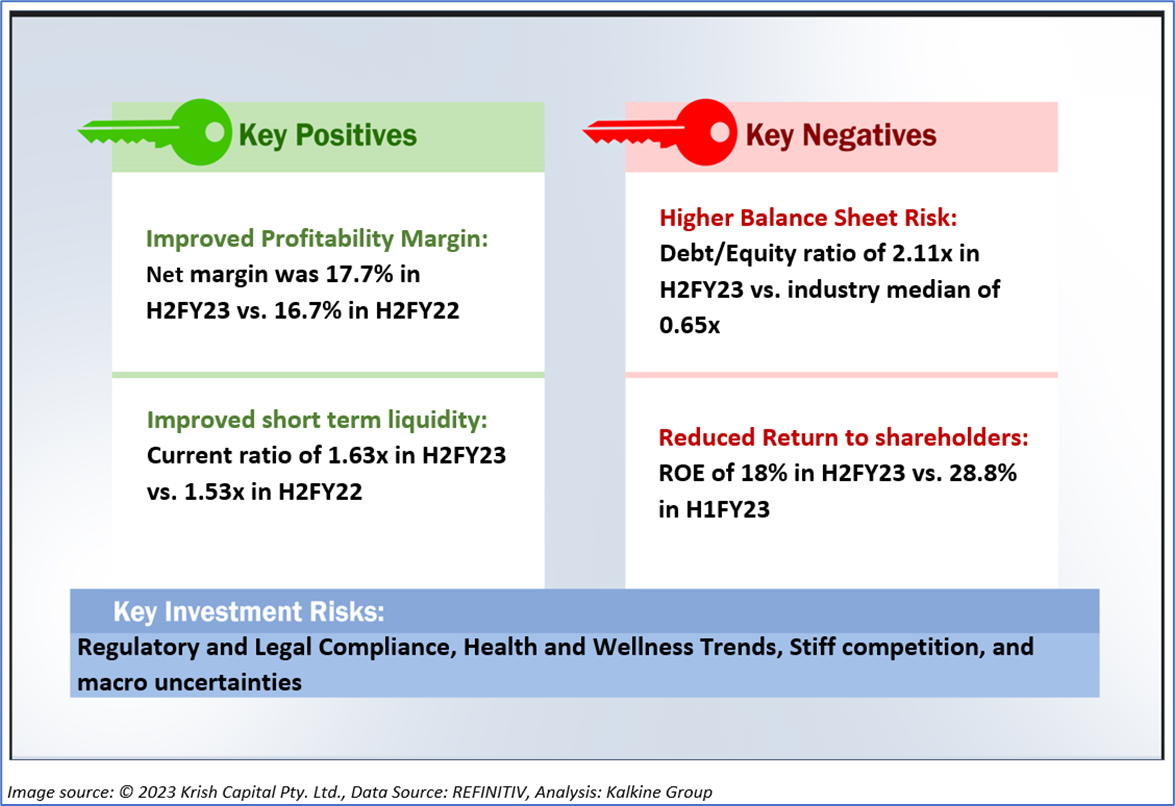

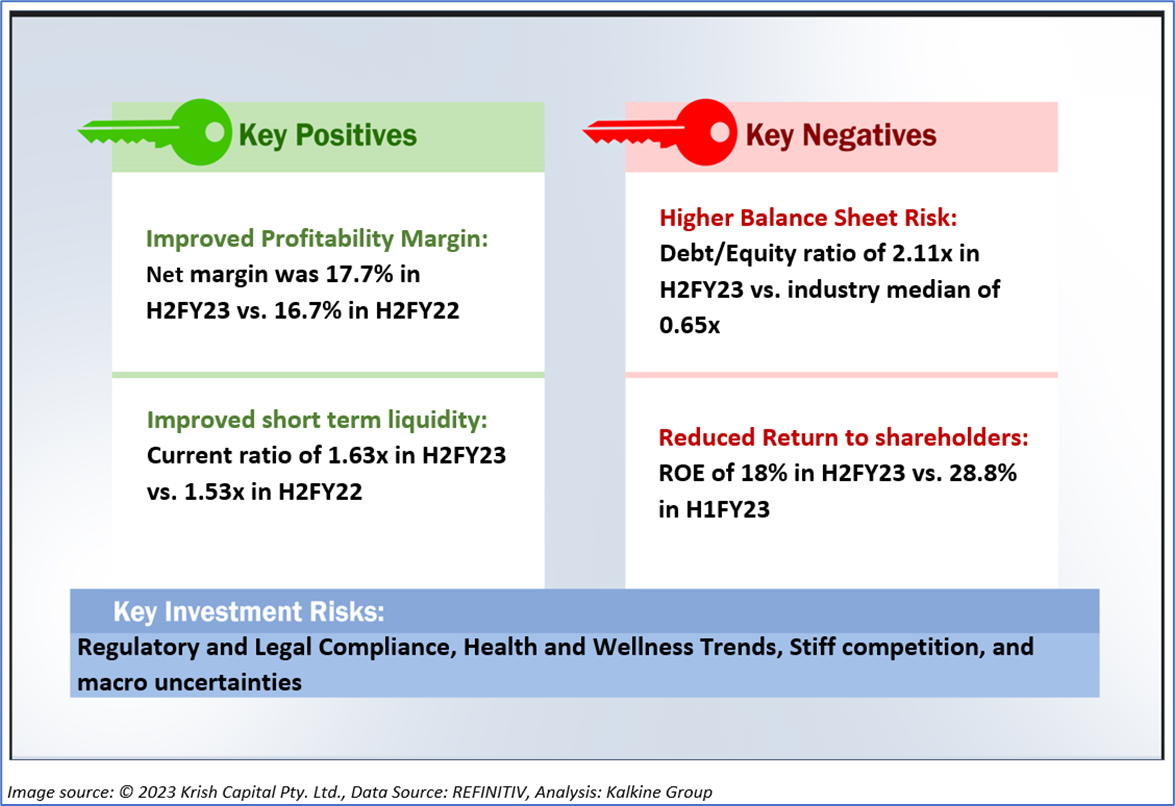

1.3 The Key Positives & Negatives

1.4 Key Metrics

DEO has adeptly navigated economic challenges by effectively managing its expenditures, thereby maintaining revenue stability even amid periods of escalating global inflation. This strategic fiscal approach has led to superior net margins compared to industry peers. Furthermore, DEO has demonstrated significant progress in enhancing its Return on Equity (ROE) over the past year. This judicious financial management underscores DEO's resilience in safeguarding profitability and securing a favorable position in the competitive landscape. Through optimized spending and strengthened revenue streams, the company not only sustained its financial well-being but also elevated its profitability metrics, as evidenced by the improved ROE. This highlights DEO's steadfast commitment to delivering value to shareholders while successfully navigating economic uncertainties.

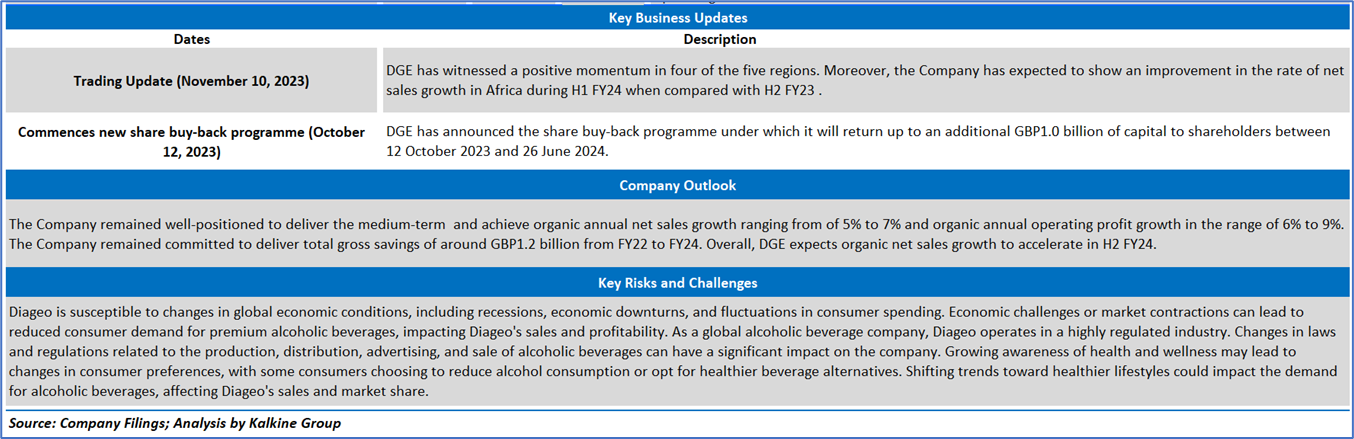

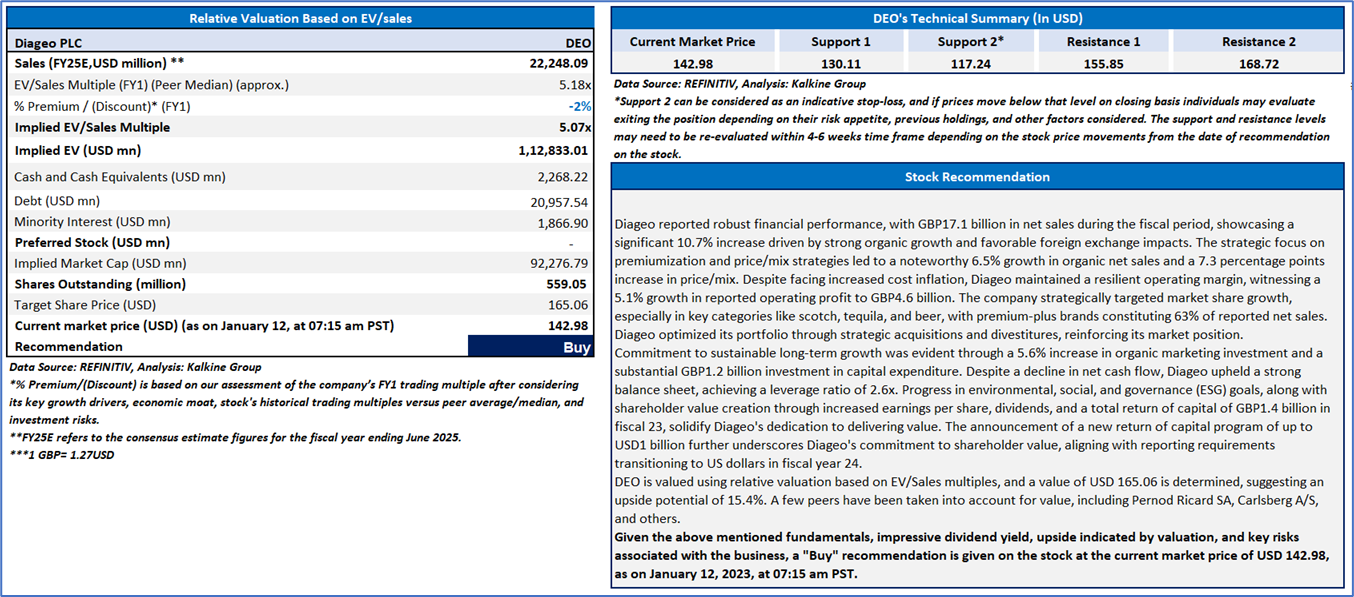

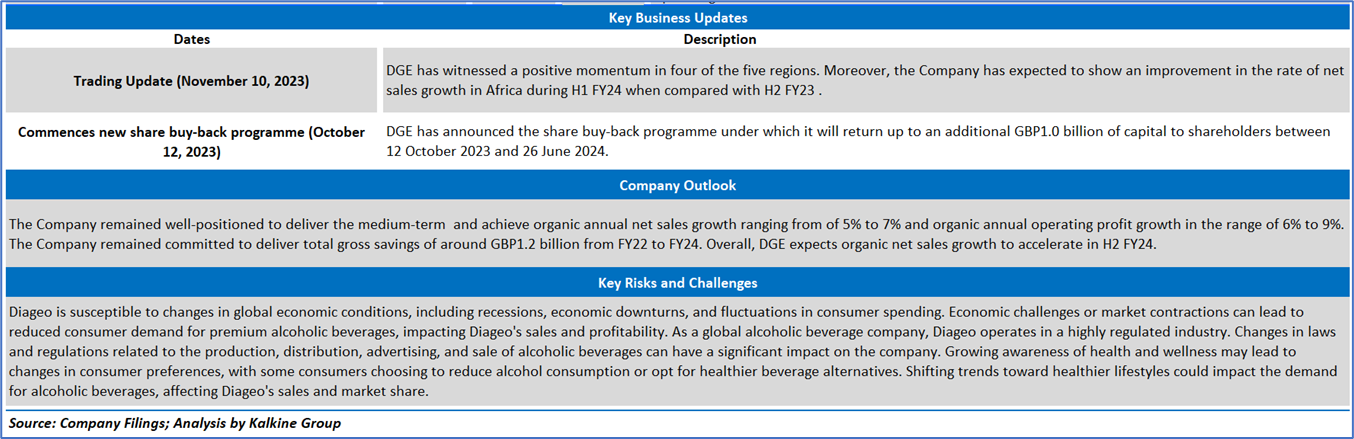

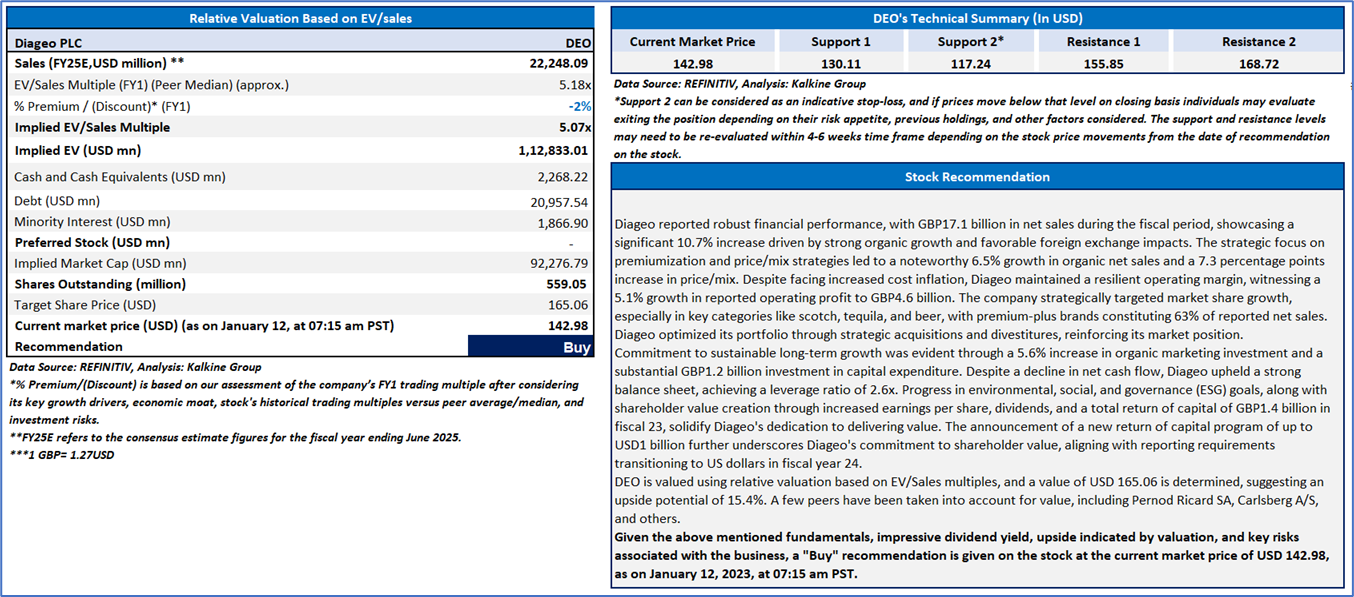

Section 2: Diageo PLC (NYSE: DEO) (“Buy” at the current market price of USD 142.98, as of January 12, 2023, at 07:15 am PST)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is January 12, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

US

US

AU

AU UK

UK CA

CA NZ

NZ

Please wait processing your request...

Please wait processing your request...