MSFT 430.59 0.8407% AAPL 222.5 -0.1212% NVDA 119.1 -0.0336% GOOGL 157.46 1.7907% GOOG 158.37 1.8195% AMZN 186.49 -0.2727% META 524.62 -0.1865% AVGO 167.69 1.902% TSLA 230.29 0.2089% TSM 172.5 0.6242% LLY 923.71 -1.2096% V 287.35 0.6938% JPM 204.32 -1.1036% UNH 594.32 1.0027% NVO 137.0 0.2488% WMT 80.6 1.18% LVMUY 134.665 -0.226% XOM 111.15 -0.0719% LVMHF 675.14 0.1691% MA 493.36 0.254%

Global Commodity Market Wrap-Up

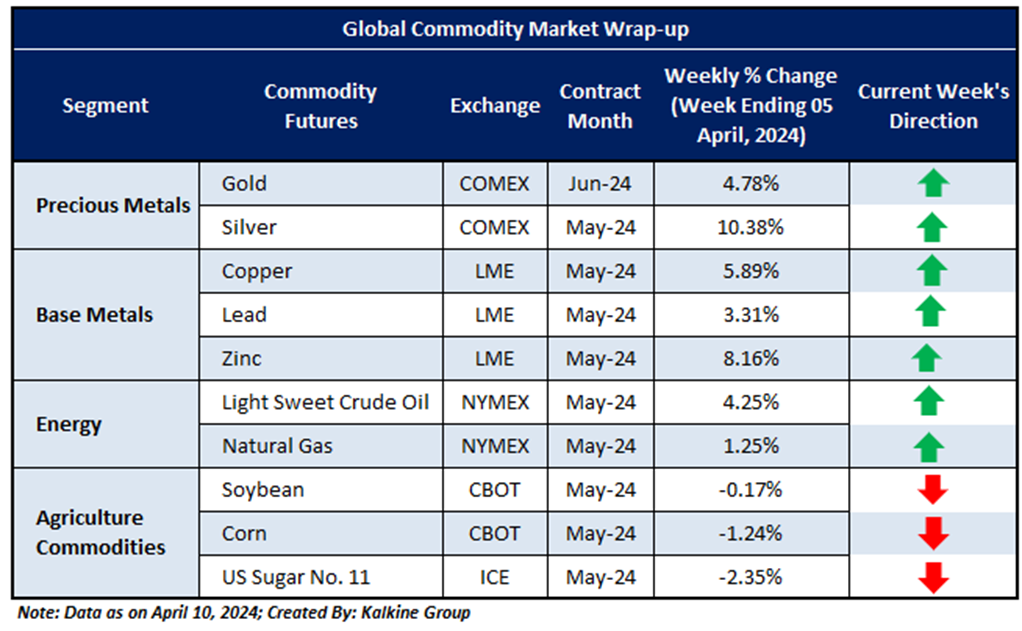

Last week, metal commodities prices witnessed an extended rally, and closed in positive gains. Gold prices traded in a positive range and settled with a weekly gain of ~4.78%. Moreover, Silver also rallied and closed at ~10.38% and other base metals also saw a rally. Base metals ended in green last week. Copper and Zinc prices witnessed a weekly gain of ~5.89% and ~8.16% and Lead closed in positive of ~3.31%.

On the Energy front, Natural Gas prices trading in range bound zone due to weaker demand and settled at a weekly gain of ~1.25%. Moreover, Crude Oil prices also recovered from the lower level and settled with a weekly gain of ~4.25%. Meanwhile, agricultural commodities prices traded negatively and closed in the negative zone and US Sugar also faced resistance and closed in negative of ~2.35%.

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.