AAPL 250.9362 1.1636% MSFT 439.85 0.5624% NVDA 132.26 2.5987% GOOGL 190.36 1.0403% GOOG 191.585 0.7547% AMZN 224.7026 1.8967% META 605.1 1.3245% AVGO 221.57 -0.9167% TSLA 434.8 -1.211% TSM 195.3 -0.133% LLY 758.87 -0.7637% V 315.9 1.9756% JPM 234.325 1.7168% UNH 493.79 -1.1867% NVO 103.7 -2.1329% WMT 93.89 0.3634% LVMUY 130.52 0.7721% XOM 105.67 -0.7048% LVMHF 649.5 0.6649% MA 526.755 1.3068%

Section 1: Company Overview and Fundamentals

1.1 Company Overview:

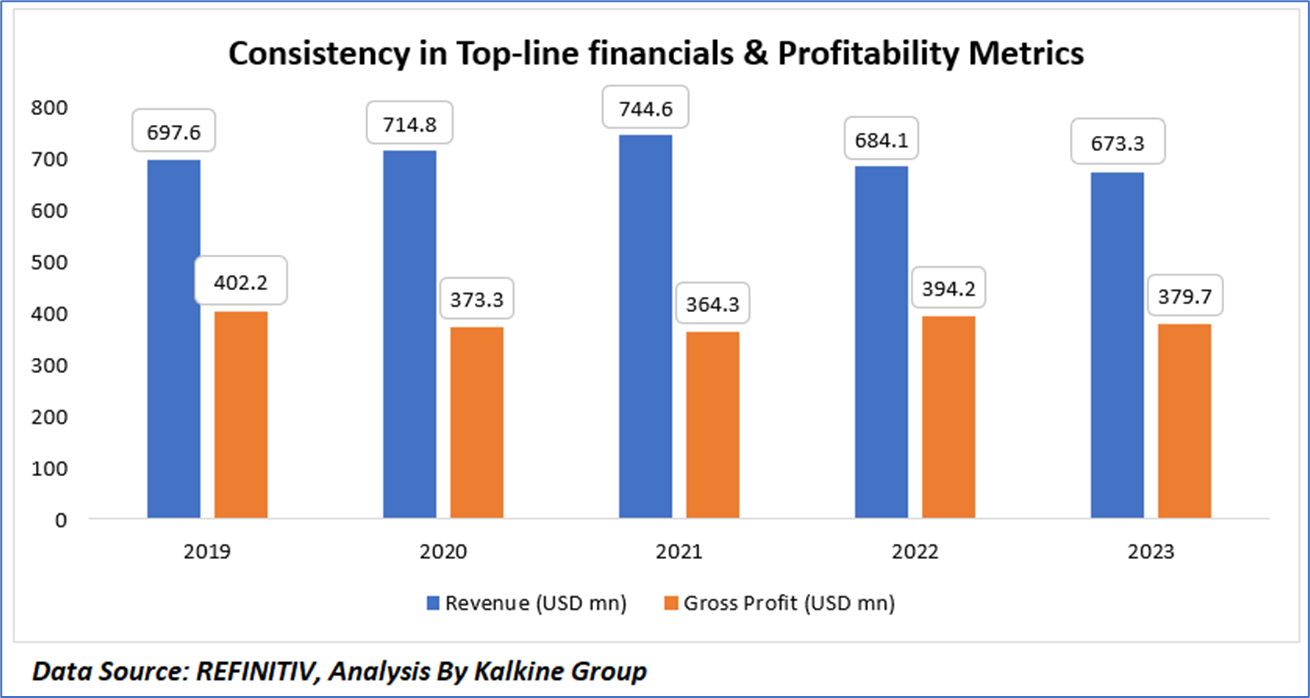

Avanos Medical, Inc. (NYSE: AVNS) is a medical device company, which is focused on delivering solutions. The Company offers healthcare needs, such as providing nutrition to patients from hospital to home and reducing the use of opioids while helping patients move from surgery to recovery. The Company conducts its business in one segment that provides its medical device products to healthcare providers and patients globally with manufacturing facilities in the United States and Mexico.

Kalkine’s Diversified Opportunities Report covers the Company Overview, Key positives & negatives, Investment summary, Key investment metrics, Top 10 shareholding, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

Stock Performance:

1.2 The Key Positives, Negatives, and Investment summary

1.3 Top 10 shareholders:

The top 10 shareholders together form ~61.31% of the total shareholding, signifying concentrated shareholding. BlackRock Institutional Trust Company, N.A. and The Vanguard Group, Inc. are the biggest shareholders, holding the maximum stake in the company at ~14.78% and ~11.74%, respectively.

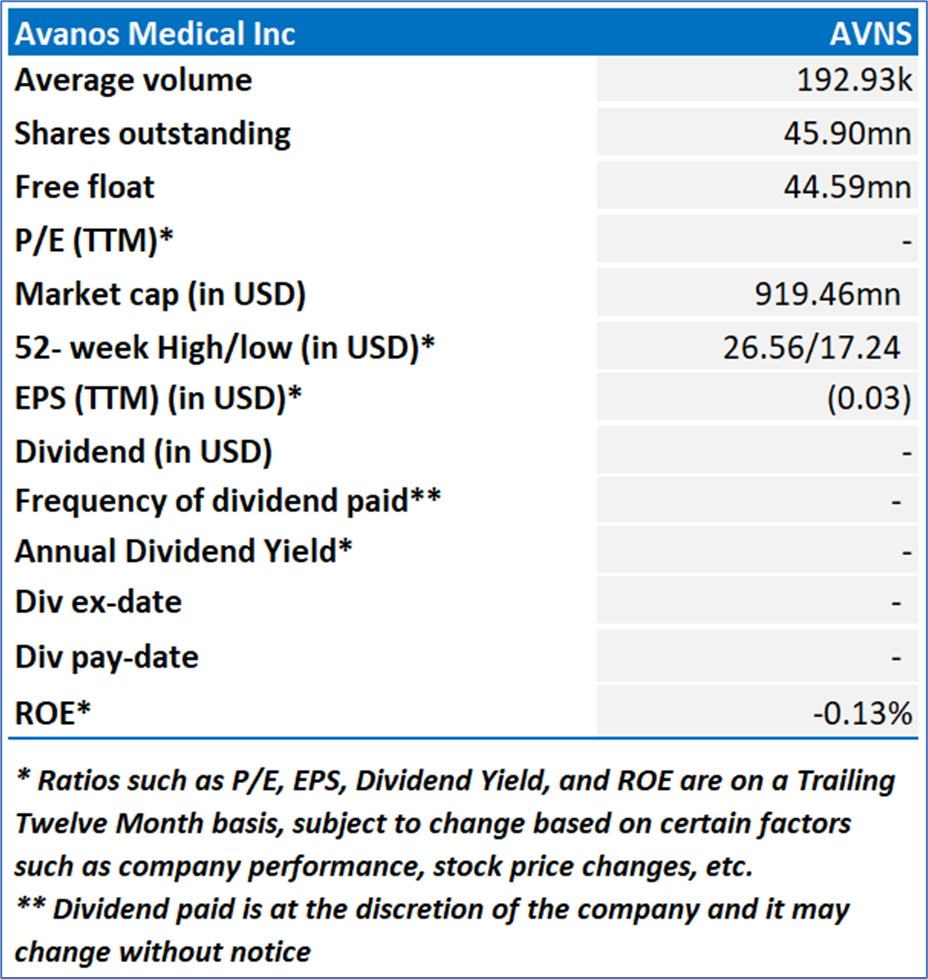

1.4 Key Metrics:

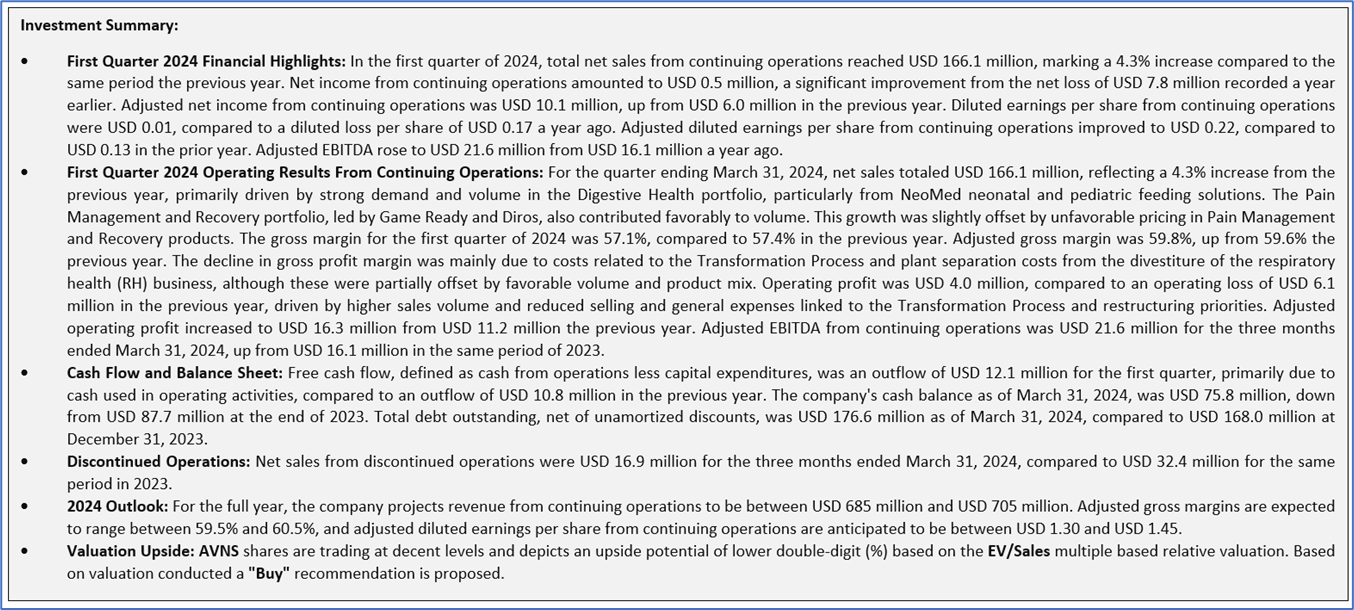

Revenue Trends: From 2019 to 2023, AVNS experienced fluctuations in its annual revenue. In 2019, the company reported a revenue of USD 697.6 million. This figure increased slightly to USD 714.8 million in 2020, indicating a modest growth during that period. The upward trend continued in 2021, with revenue reaching USD 744.6 million, marking the peak of this five-year span. However, in 2022, revenue declined to USD 684.1 million, a significant drop from the previous year's high. This downward trend persisted in 2023, with revenue further decreasing to USD 673.3 million. These figures suggest that while AVNS saw initial growth, the latter years were characterized by a decline in revenue, which could be attributed to market challenges or changes in demand.

Gross Profit Trends: The gross profit of AVNS also exhibited notable variations over the same period. In 2019, gross profit stood at USD 402.2 million. This figure decreased to USD 373.3 million in 2020, reflecting a reduction in profitability. The decline continued into 2021, with gross profit further dropping to USD 364.3 million. In 2022, there was a rebound, as gross profit increased to USD 394.2 million. However, this recovery was short-lived, as gross profit slightly decreased to USD 379.7 million in 2023. These trends indicate that while AVNS managed to regain some profitability in 2022, it faced ongoing challenges in maintaining consistent gross profit levels across the five-year period.

Combined Analysis: Overall, the analysis of AVNS's revenue and gross profit from 2019 to 2023 reveals a period of initial growth followed by a decline in revenue, accompanied by fluctuating gross profit margins. The peak revenue and subsequent decline, alongside the gross profit variability, highlight potential issues such as market volatility, competitive pressures, or operational inefficiencies that the company needs to address to stabilize and enhance its financial performance moving forward.

Section 2: Business Updates and Corporate Business Highlights

2.1 Recent Updates:

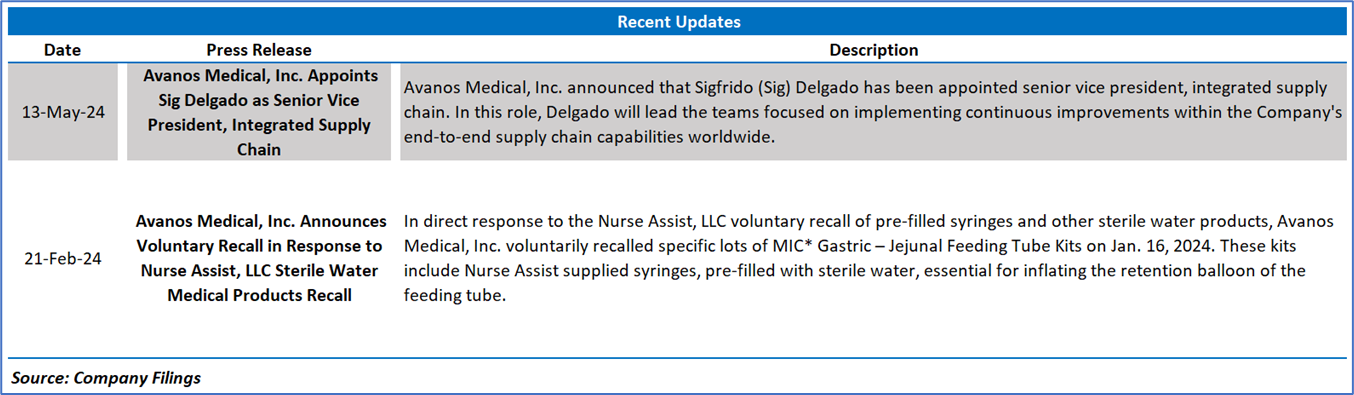

The below picture gives an overview of the recent updates:

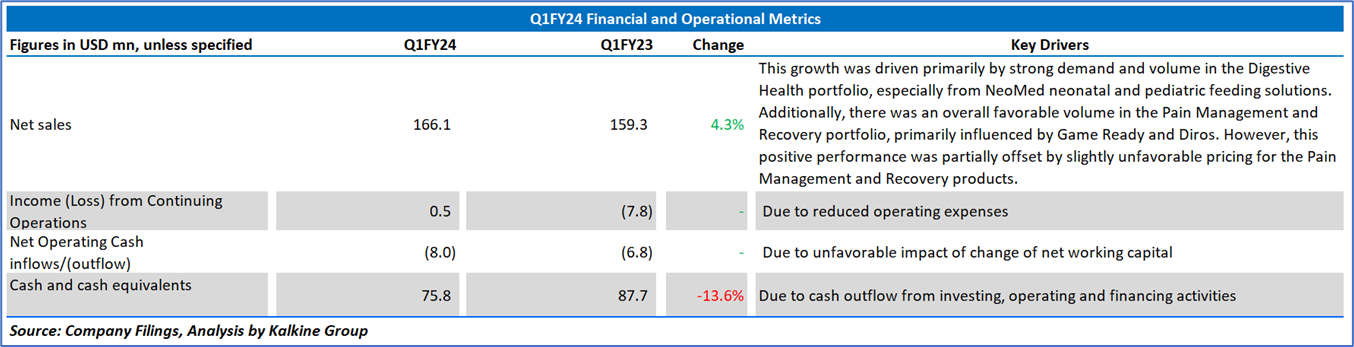

2.2 Insights of Q1FY24:

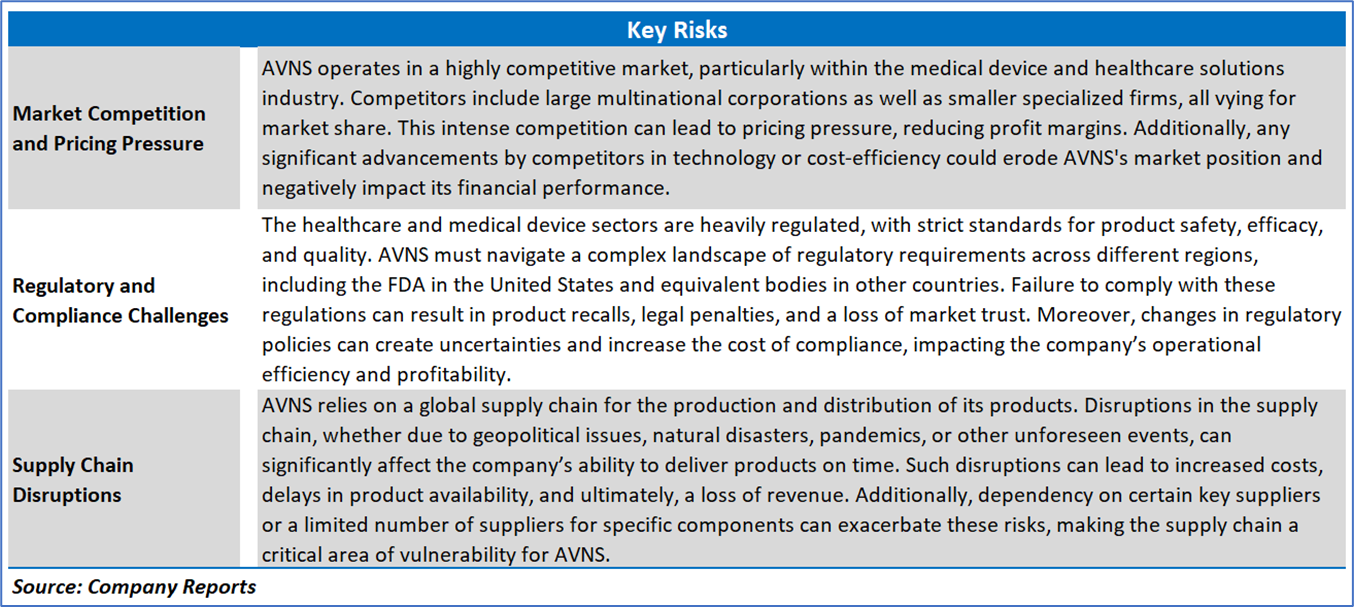

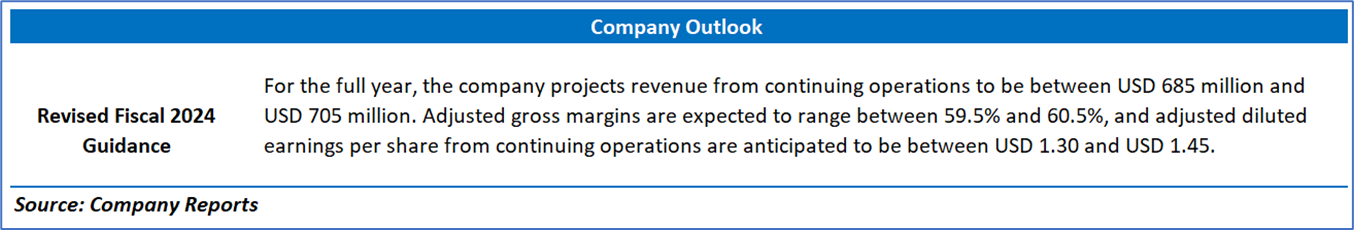

Section 3: Key Risks & Outlook

Section 4: Stock Recommendation Summary:

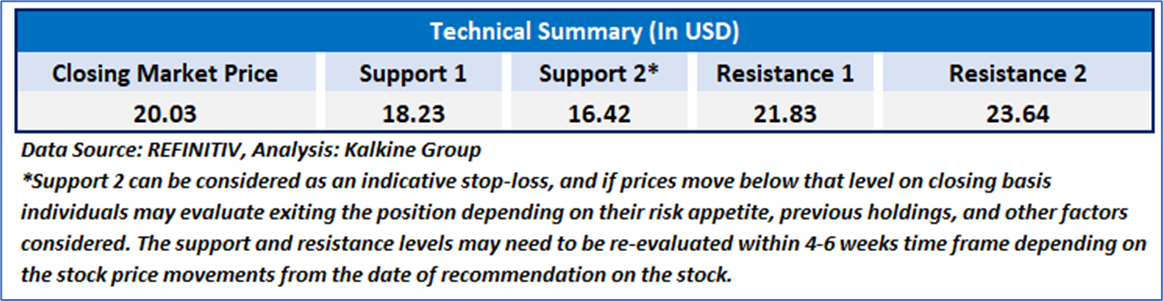

4.1 Price Performance and Technical Summary:

Stock Performance:

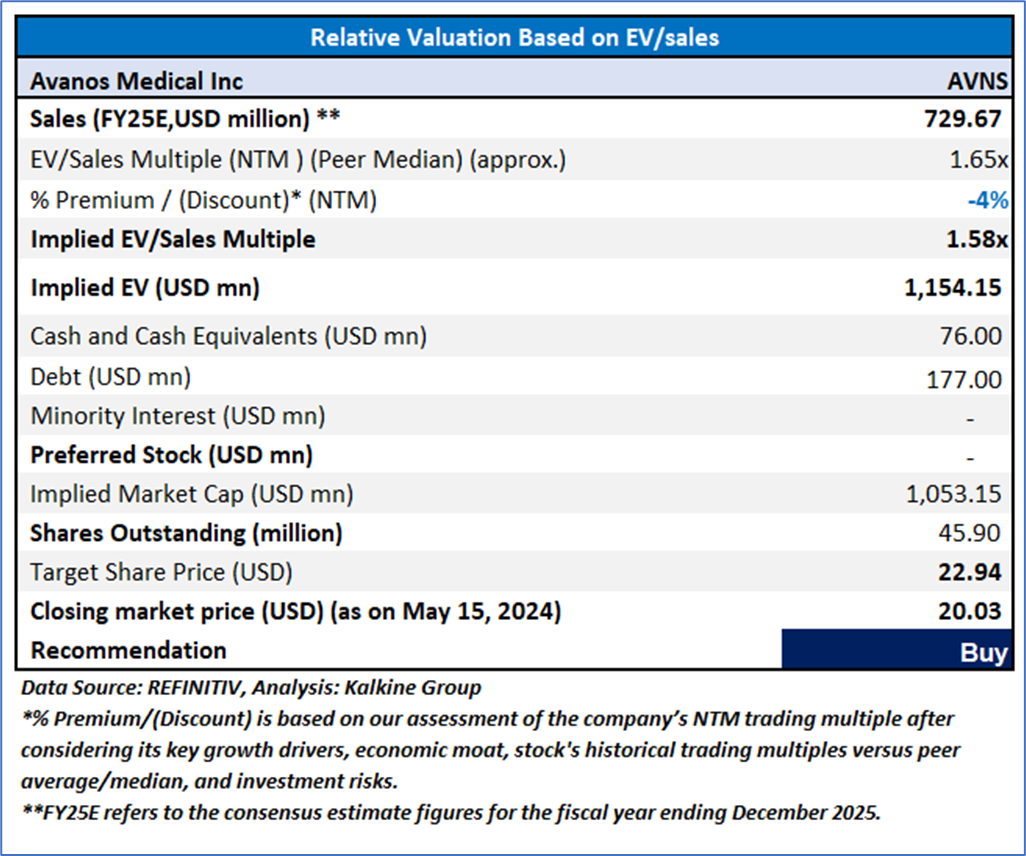

4.2 Fundamental Valuation

Valuation Methodology: EV/Sales Multiple Based Relative Valuation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is May 15, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.