Section 1: Company Fundamentals

1.1 Company Overview and Performance summary

Company Overview:

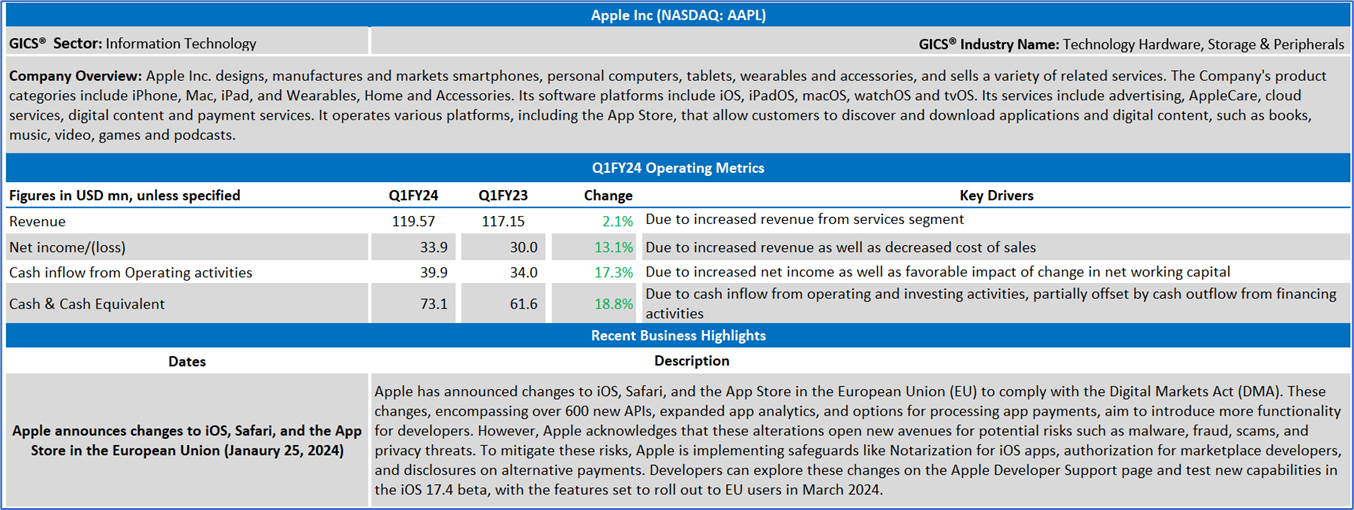

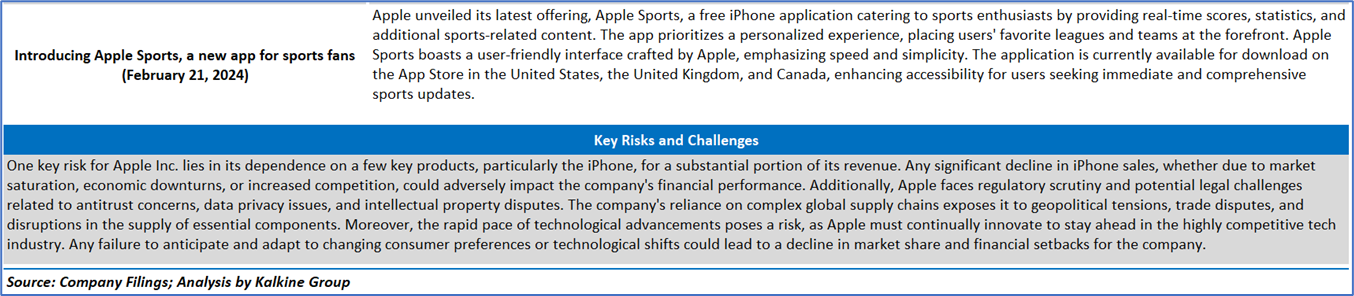

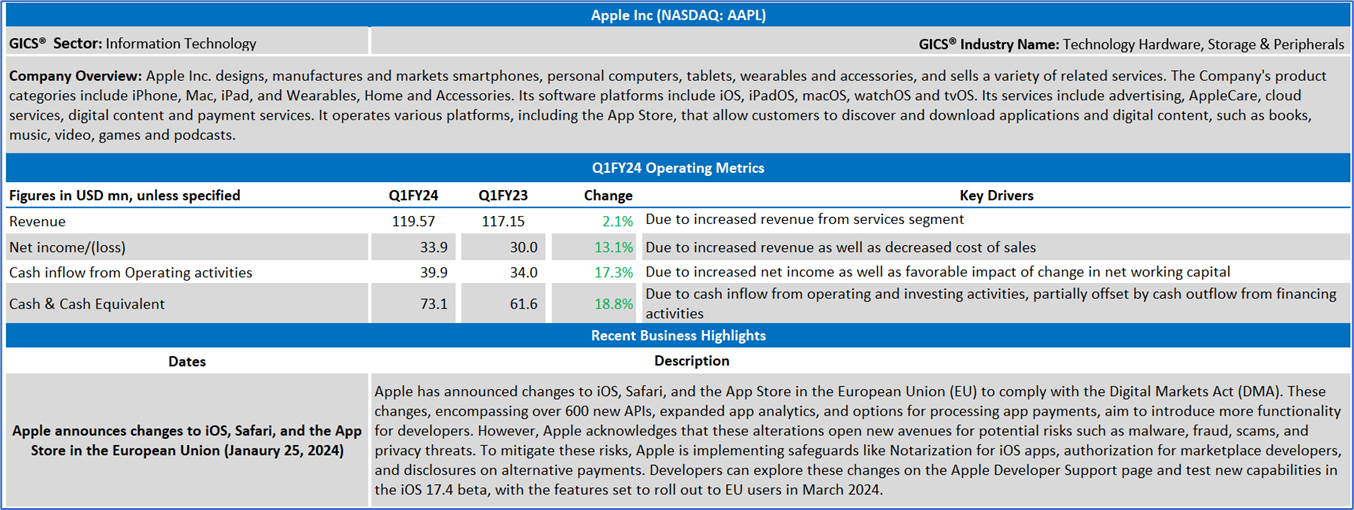

Apple Inc. (NASDAQ: AAPL) designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's product categories include iPhone, Mac, iPad, and Wearables, Home and Accessories. Its software platforms include iOS, iPadOS, macOS, watchOS and tvOS. Its services include advertising, AppleCare, cloud services, digital content and payment services. It operates various platforms, including the App Store, that allow customers to discover and download applications and digital content, such as books, music, video, games and podcasts.

This US Inflation Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Price Performance:

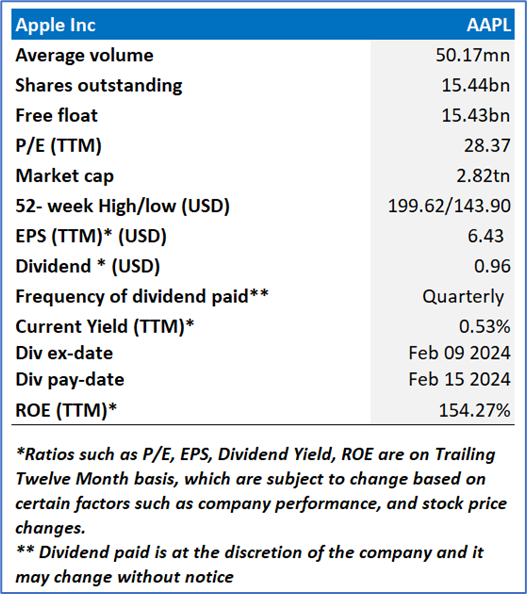

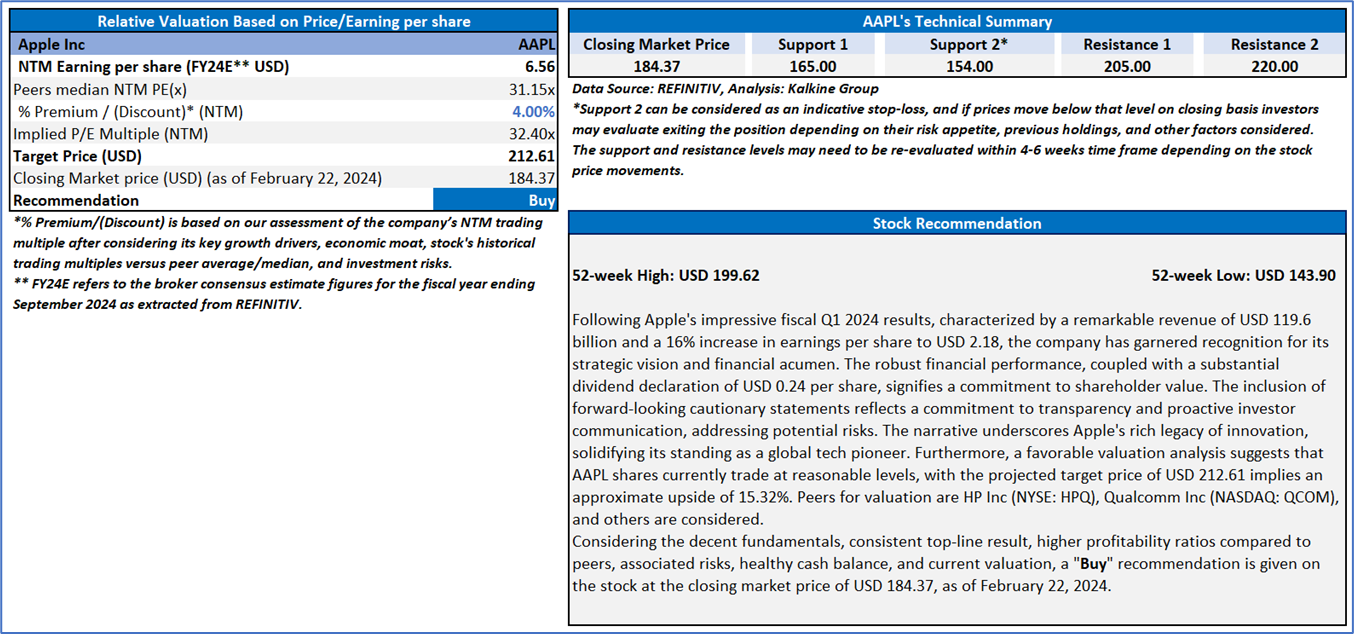

- AAPL's share price has corrected by 3.62% in the past three months. While, in the long term, the stock has given a return of 23.81% over the past year.

- The stock is currently trading near to the higher end of its 52-week range of USD 62 and 52-week low price of USD 143.90, with the expectations of an upside movement from the current support levels.

- The price is currently between its short-term (50-day) SMA and long-term (200-day) SMA, with the current RSI of around 44.05.

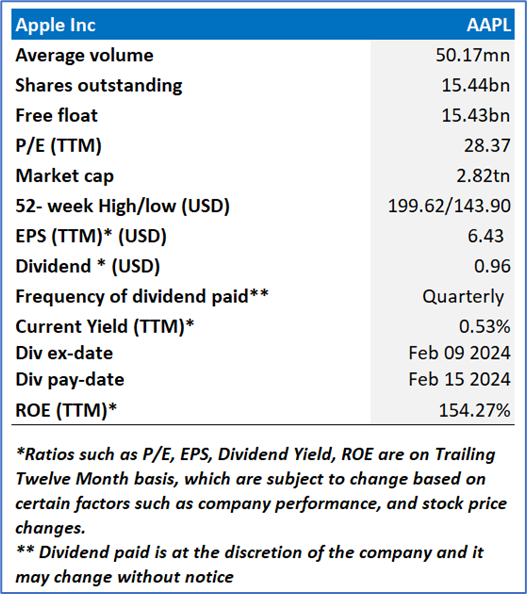

1.2 Summary Table

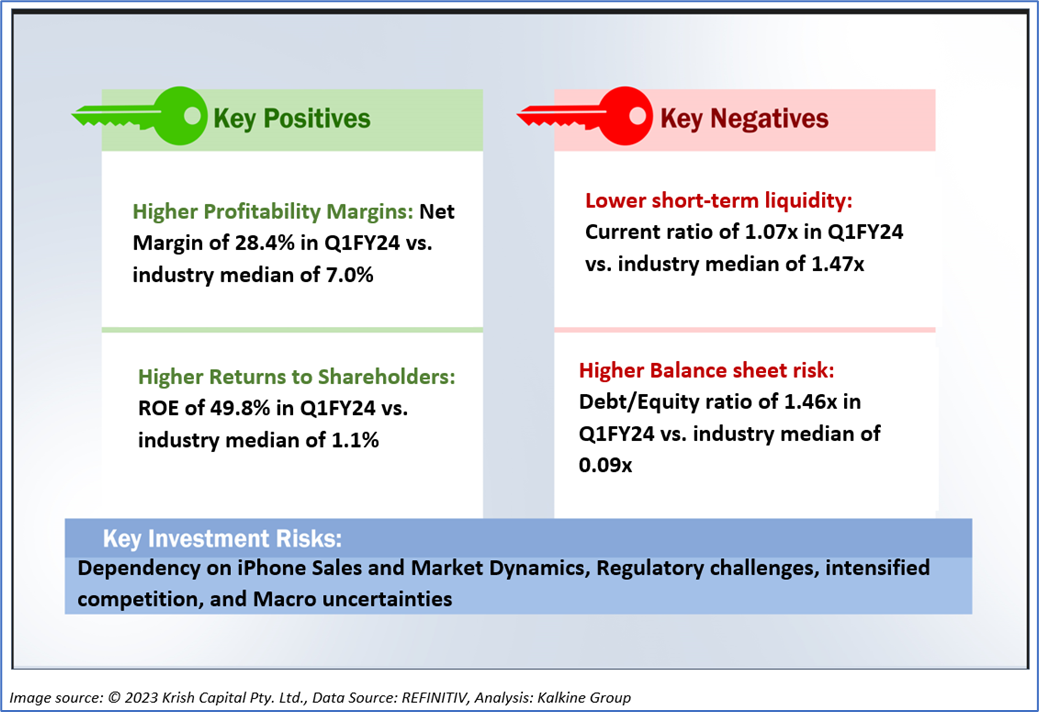

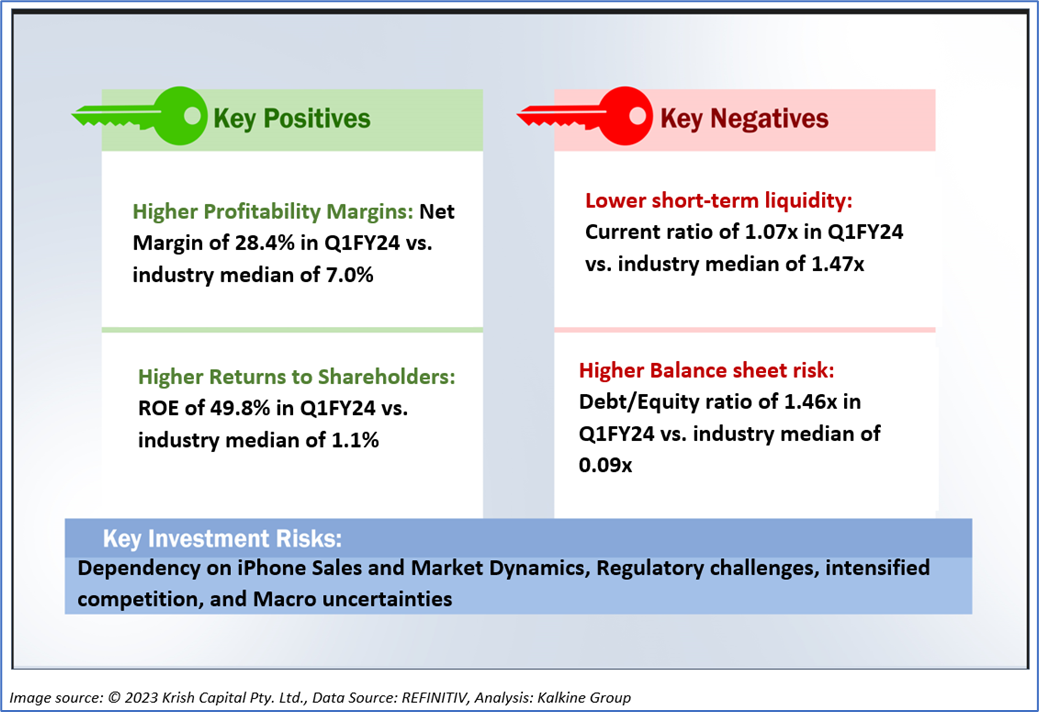

1.3 The Key Positives & Negatives

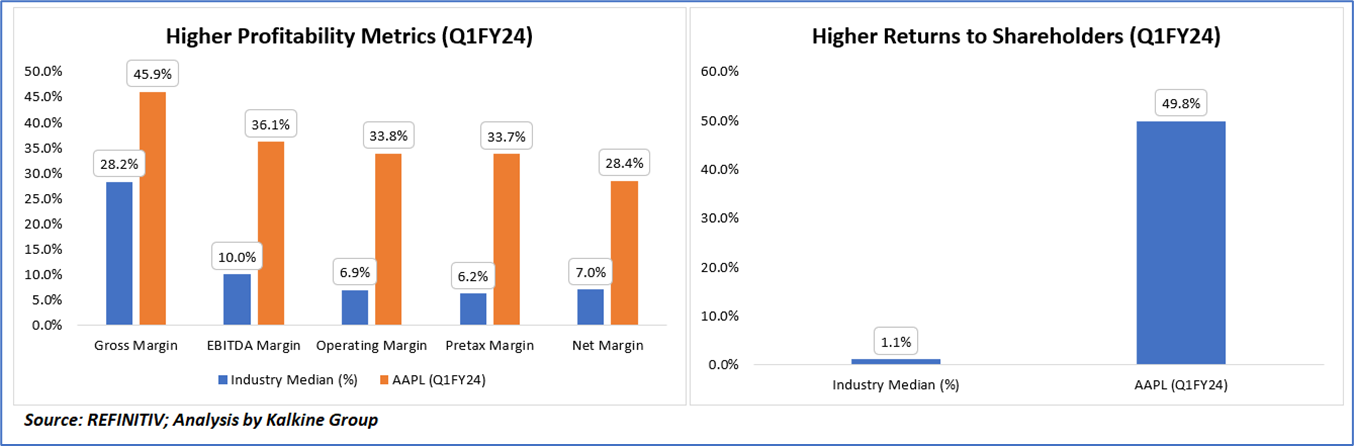

1.4 Key Metrics:

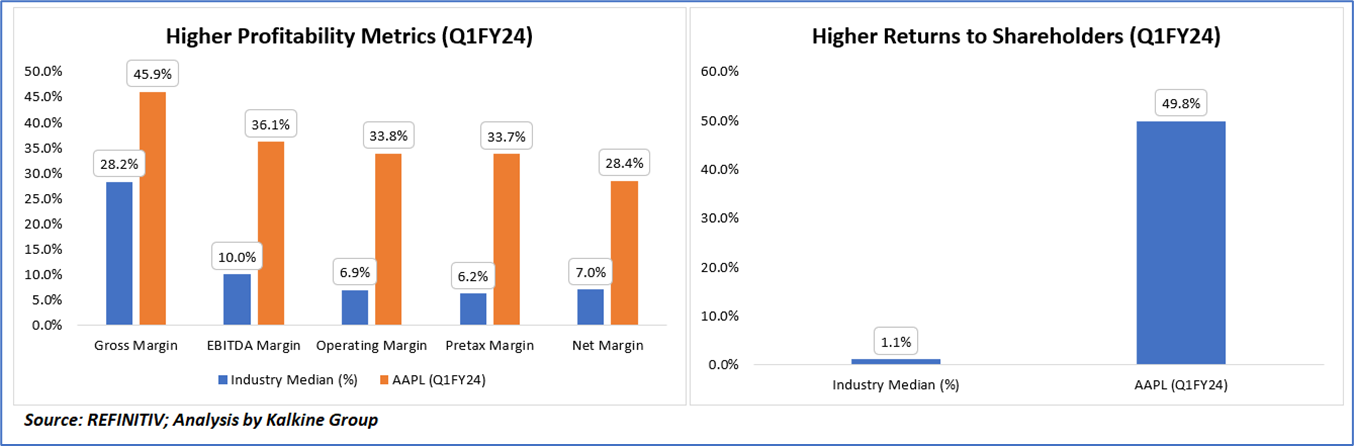

In the first quarter of fiscal year 2024, Apple Inc. (AAPL) exhibited financial performance metrics significantly surpassing industry medians. The gross margin for AAPL stood at an impressive 45.9%, notably higher than the industry median of 28.2%. The EBITDA margin, operating margin, pretax margin, and net margin for AAPL were also remarkable at 36.1%, 33.8%, 33.7%, and 28.4%, respectively, outperforming industry medians across the board. Additionally, the return on equity (ROE) for AAPL during the same period reached an outstanding 49.8%, far exceeding the industry median of 1.1%. These robust financial indicators underscore Apple's exceptional profitability and efficiency compared to industry benchmarks.

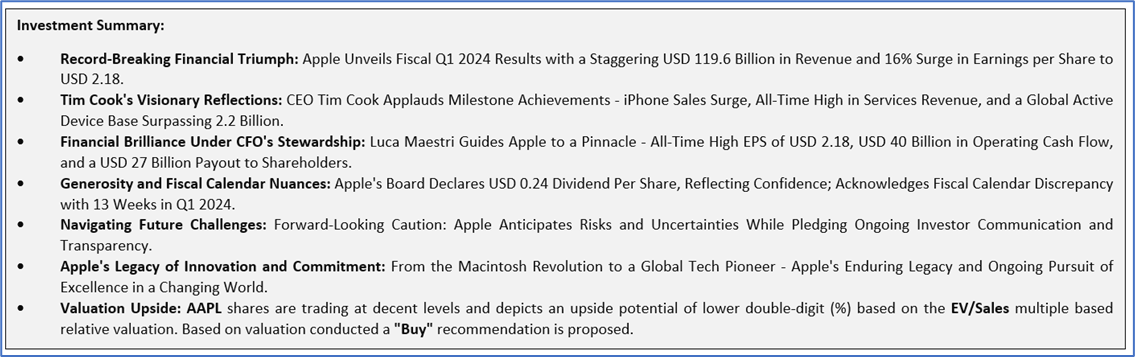

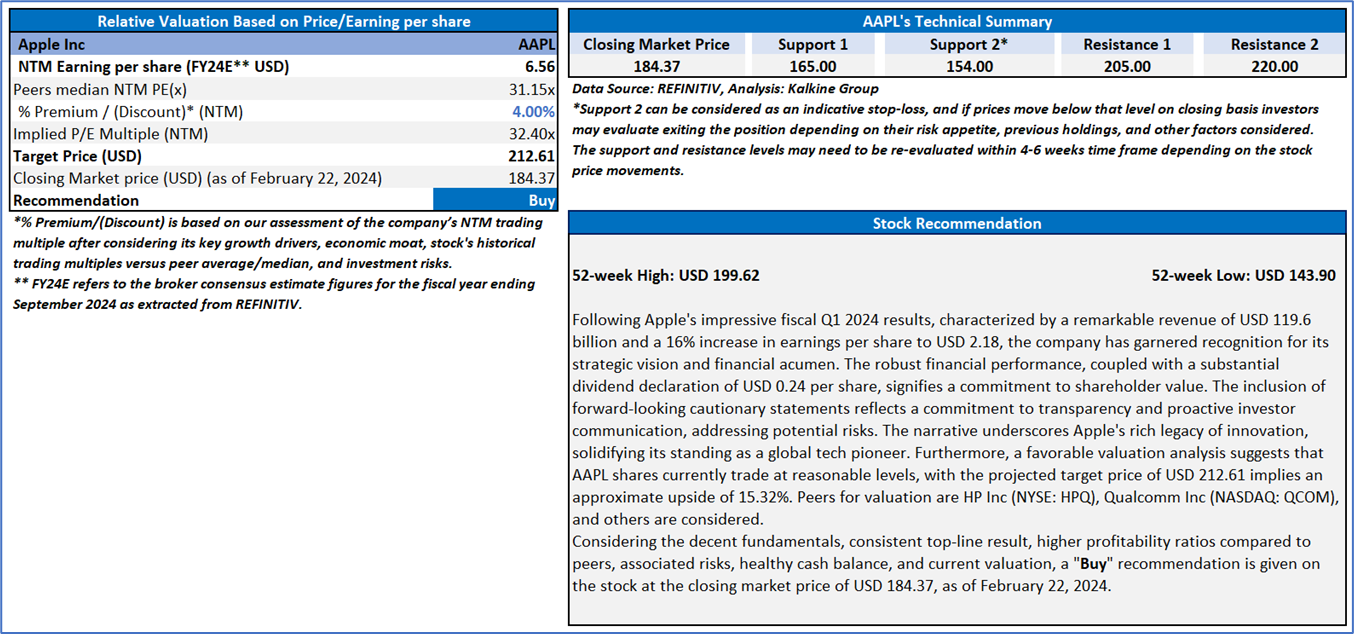

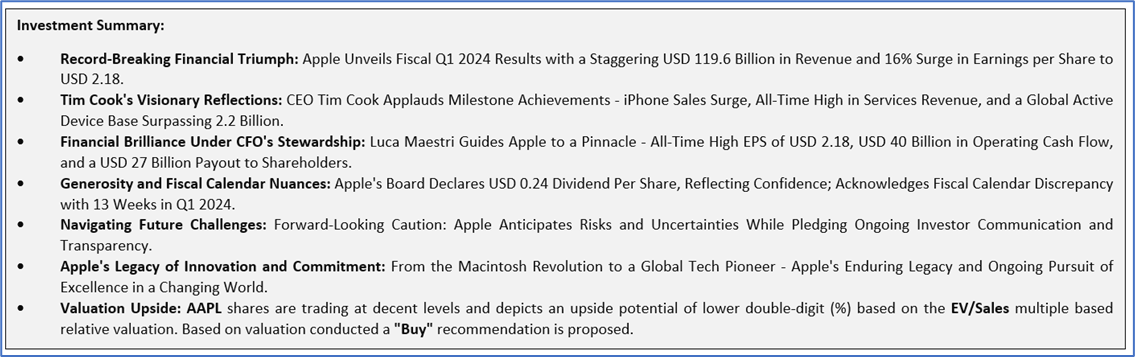

Section 2: Apple Inc (“Buy” at the closing market price of USD 184.37, as of February 22, 2024)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 22, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stocks prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

US

US

AU

AU UK

UK CA

CA NZ

NZ

Please wait processing your request...

Please wait processing your request...