What is Wholesale Banking?

Wholesale banking refers to the different banking services provided by the banks to the large scale companies, institutes, government agencies. Wholesale banking services are offered to only those institutes who have strong financial statements such as mortgage brokers, corporates, MNCs, government agencies, real estate investors, and other financial institutions.

Source: Copyright © 2021 Kalkine Media

Understanding Wholesale Banking

The wholesale banking provides so many different services such as fund management, finance wholesaling, M&A, market making and underwriting. Wholesale banking is needed to meet the requirements of large scale business as it involves huge cost financial transactions. Wholesale banking is helpful for business entities as in national or international corporate deals, and provides expert advice, special and customised product recommendations as per the corporate needs.

The wholesale banking involves a number of transactions, after which the banks lend the funds to business entities at low rate in comparison of lending rates for an individual. The wholesale banking includes the different baking services provided by the banks to its large customer, also known as commercial banking and corporate banking. The wholesale banking may define the process of borrowing and lending money between bank and large institution.

Frequently Asked Questions (FAQs)

What are features of Wholesale Banking?

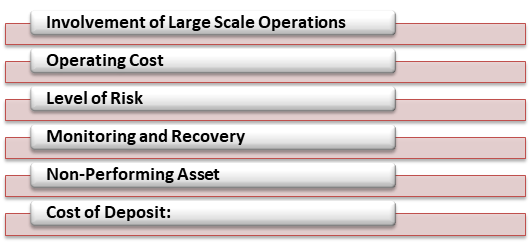

Wholesale banking includes the following features:

Source: Copyright © 2021 Kalkine Media

- Involvement of Large-Scale Operations: Wholesale banking includes the borrowing and lending of money between bank and large-scale entity such as mortgage brokers, corporates, MNCs, government agencies, real estate investors, and other financial.

- Operating Cost: In wholesale banking, operational and transaction cost is very low as it has limited customer base.

- Level of Risk: Talking about the risk, in wholesale marketing risk is very high as it deals with huge amount of transactions.

- Monitoring and Recovery: Wholesale banking deals with limited number of customers that make the banks process more convenient and easier to monitor and control the financial transactions and recover the loans and advances.

- Non-Performing Asset: Wholesale banking provides the loans and advances to the large-scale operations and if any delay and default occurs in the repayment, it will increase the non-performing assets of a bank.

- Cost of Deposit: Wholesale banking provides high rate of interest on the deposits.

What are the functions of Wholesale Banking?

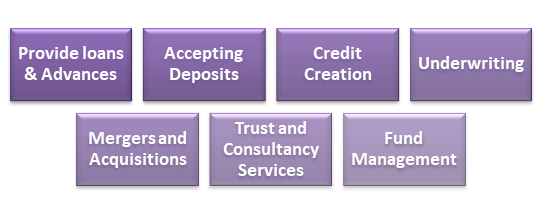

There are several functions of wholesale banking:

Source: Copyright © 2021 Kalkine Media

- Provide loans & advances: Wholesale banking provides loans and advances to the large-scale companies, institutes, corporates, and government agencies which have sound financial position.

- Accepting Deposits: Accepting deposit is one of the primary functions of wholesale banking as the banks accept the deposits from the large companies and institutes and offer high rate of interest on the deposited amount.

- Credit Creation: Wholesale banking plays a vital role in credit creation in the economy of a country by accepting deposit and providing loan. Wholesale banking helps in increasing the flow of money in the economy by offering loans and accepting deposits by the large-scale operations and government.

- Underwriting: The wholesale banking offers the services of raising capital for large business and companies by issuing debt or equity shares on the company’s behalf. Companies chooses this option to generate funds to start different projects and for expanding their business.

- Mergers and Acquisitions: Wholesale banking also facilitates the merger and acquisition services across the world along with the conversion currency.

- Trust and Consultancy Services: Wholesale banking also offers consultancy services such as advice on investments and trust-building.

- Fund Management: Wholesale banking offers the service of fund management, it can handle and manage the deposited fund effectively.

What are the advantages of Wholesale Banking?

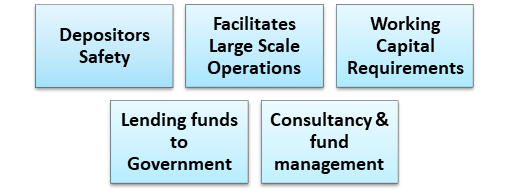

There are several advantages of wholesale banking:

Source: Copyright © 2021 Kalkine Media

- Depositors Safety: Wholesale banking treats the deposited funds with extra safety and put it on secured investment opportunities.

- Facilitates Large Scale Operations: Wholesale banking services offer to the the large scale industries, companies and businesses which deal in high-value transactions.

- Working Capital Requirements: Wholesale banking helps in fulfilling the requirement of large scale operations that require a huge amount of funds to carry out daily operations. Thus, wholesale banking accomplishes this need by providing funds for working capital.

- Lending funds to Government: Wholesale banking helps the government by lending funds for long-term projects. Sometimes government borrows money from wholesale banking to carry out various projects.

- Consultancy & fund management: Wholesale banking offers the service of fund management and provides cash management solutions.

What are the disadvantages of Wholesale Banking?

Some of the disadvantages of Wholesale banking include:

Source: Copyright © 2021 Kalkine Media

- Level of Risk: Wholesale banking involves high risk as it deals with huge amount and large number of transactions.

- High cost of Business Accounts: In wholesale banking maintaining accounts is very costly comparison of traditional bank accounts.

- Rates and Processing Fees: Wholesale banking provides loan and advances in high rate of interest and processing fee on them.

- Unnecessary Payments: In wholesale banking, customers have to pay even for unused services.

- Client’s Exploitation: Sometimes bank exploit the client if the sum of borrowed money is high.

US

US  AU

AU UK

UK CA

CA NZ

NZ Please wait processing your request...

Please wait processing your request...