What is a Subprime Loan?

A loan accessible to entities, which don’t qualify for conservative loans. They are at an interest rate above prime lending rate. People who have low salaries, imperfect credit past, poor quality security, or deprived credit, usually qualify for such loans.

Subprime loans are given in different categories like, vehicle loans and personal credits. Some borrowers are financially accomplished to pay off loans but unable to secure a finance due to their meagre overall credit total. In such loans, creditors focus on repayment capability of borrowers in place of their credit score.

Normally, subprime loans are for people with a blemished or inadequate credit past. These credits bear a higher interest rate than conventional loans to pay off for the amplified risk to the lending organisations. To uphold safe and complete operations, lenders generally decide if the risk is tolerable and easy to deal with given its workforce, financial situation, size, and level of resources provision.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What is the importance of a Subprime Loan?

Subprime lending is the exercise of lending to borrowers with meagre take-home pay and are lacking any credit histories. A subprime mortgage loan is the most common type of subprime lending, featuring greater interest rates and sterner requirements to reward lenders for the intensified credit risk.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Perhaps, these lenders choose borrowers who have difficulty in getting small interest rates and their ability to get capital for investment or to grow their businesses, or buy homes is scanty. Purpose of Subprime loans is to assist people with constrained credit history to be eligible for loans. Subprime loans have a relatively higher interest rate and fees. It means a subprime loan is usually given to you if you can't qualify for a loan with better borrowing terms. These loans help in providing liquidity in the market and in rotation of money in the economy.

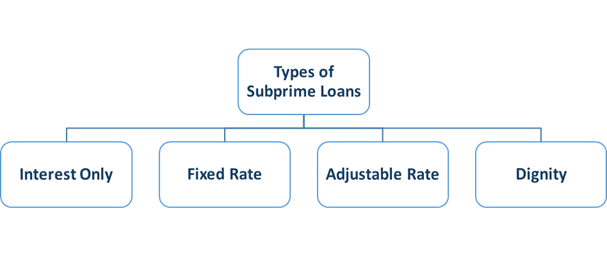

What are the types of Subprime Loan?

Source: Copyright © 2021 Kalkine Media Pty Ltd

The most common categories of subprime loans are:

- Interest-Only Subprime Loan- here, loan is structured in a manner that borrowers only pay the interest portion during early intervals of the loan. Thus, the initial monthly installments become reasonable to borrowers. But, in later periods, the payments are increased, making the difference quite steep.

- Fixed-Rate Subprime Loan- In this category, rate of interest remains persistent for the whole period of the loan. However, the loan period is generally lengthier than any conventional loan. If a loan’s timespan is usually 30 years, the period of fixed-rate subprime loan can range up to 50 years or more, making the collective interest paid on a fixed-rate credit higher.

- Adjustable-rate Subprime Loan- Here, the rate of interest remains constant for an initial period of the credit and changes later to a flexible rate. The interest rate for the later period of the loan will vary as per the market rate.

- Dignity Subprime Loan- In this category loan, debtors are obligated to record a down payment amounting to 10% of the loan and accept a higher rate of interest for starting period, commonly a time frame of five years. If the borrowers payback on time and increase their credit worthiness, their interest rate ultimately shrinks to the prime rate.

What are the advantages & disadvantages of Subprime Loan –

Source: Copyright © 2021 Kalkine Media Pty Ltd

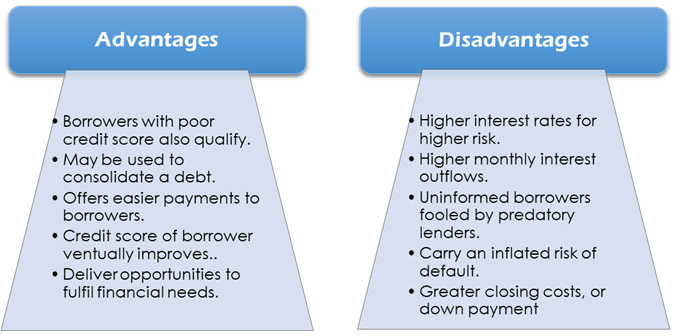

Advantages of a Subprime Loan are-

- Borrowers having low or poor credit score also qualify for subprime lending, which includes many types of loans, like mortgages or personal loans.

- A subprime loan may be used to consolidate a debt.

- Subprime loan offers easier and manageable payments to borrowers.

- Credit score of borrower can eventually improve, if he/ she makes timely payments on subprime loans.

- These loans deliver opportunities for borrowers to fulfil their financial needs, which were otherwise impossible.

Disadvantages of Subprime Loans are:-

- They charge higher interest rates to reward a lender’s higher credit risk.

- Higher rates of interest as compared to conventional loans resulting in higher monthly interest payments/ outflows.

- Uninformed borrowers may often be charged higher interest rates or fees by predatory lenders.

- Such loans carry an inflated risk of default. This is why Banks charge higher fees to compensate for the additional risk assumed.

- Subprime loans may have greater closing costs, or require higher down payment.

Few examples

Instances of the most standard subprime mortgages:

A 5/1 Adjustable Rate Mortgage may provide a fixed rate for five years. After which, the rate automatically adjusts to a financial index. In another instance, an interest-only loan may not require any principal repayment for the first few years of the loan. This may make it easier and affordable than any other loan. For example, many debtors think they will either refinance or sell their house before the principal repayment is needed. This is very hazardous since this is when monthly outflow increases. If the value of the house falls, they are unable to qualify for a refinance and can’t even sell the house. In such a case, they compulsorily default as they can't higher payments.

In another form, Option adjustable rate mortgage loans permit borrowers to choose repayment amount each month. If borrower makes a small payment once, it means the rest will get added to the remaining principal. After few years, this option disappears and the loan costs even higher than perceived in the beginning.

US

US  AU

AU UK

UK CA

CA NZ

NZ Please wait processing your request...

Please wait processing your request...