What is QQQ

QQQ, also known as Invesco QQQ ETF, is a widely held exchange-traded fund (ETF) that tracks the Nasdaq 100 index. Nasdaq 100 index consists of 100 largest domestic and international financial companies, and it is based on market capitalization. The QQQ stocks prices go up and down imitating the tech-heavy Nasdaq 100 and there are distinct advantage and disadvantage to investing in it.

QQQ ETF offers investors with big rewards during bullish Nasdaq 100 index, but if the Nasdaq 100 index is bearish investors may face huge losses and has high sector risk, holds no small-cap stocks, and often appears overvalued. The passive management keeps fees low, offers potential for long-term growth and lots of liquidity. It allows investors to invest in largest 100 non-financial companies listed on the Nasdaq 100 Index.

Invesco QQQ ETF, formerly known as the PowerShares QQQ Trust ETF, reflects the performance of technology sector as it is heavily weighted towards large-cap technology companies.

The Nasdaq 100 index is constructed on a modified capitalization methodology that uses individual weights of included items according to their market capitalization. Weighting enables constraints to restrict the impact of the largest companies and valance the index with all members and to achieve this. The index reviews the composition of the index each quarter and adjusts weightings if the distribution requirements are not fulfilled.

QQQ ETF Sectors

The Invesco QQQ ETF tracks various sectors such as information technology, consumer staples, consumer discretionary, industrials, health care and utility sectors. QQQ ETF is rebalanced quarterly and reconstituted annually.

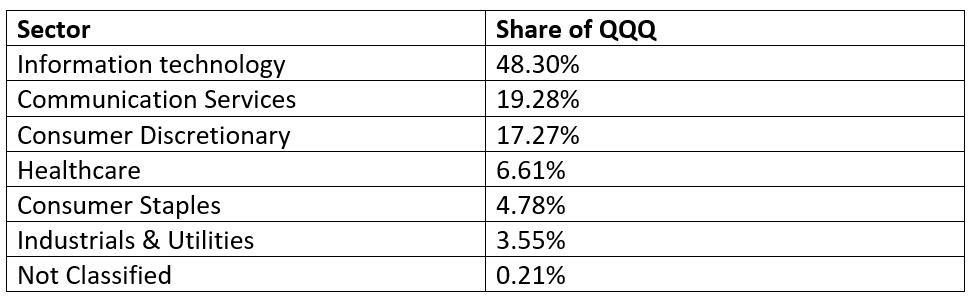

The sector breakdown of the Invesco QQQ ETF as of 18 November 2021 is given in the table below.

Invesco QQQ ETF Sector Breakdown

QQQ ETF Top Holdings

The QQQ ETF delivers exposure to companies that are at forefront of transformative, long term themes such as Cloud Computing, Mobile Payments, Augmented reality, Electric Vehicles, Big Data, Streaming Services and more.

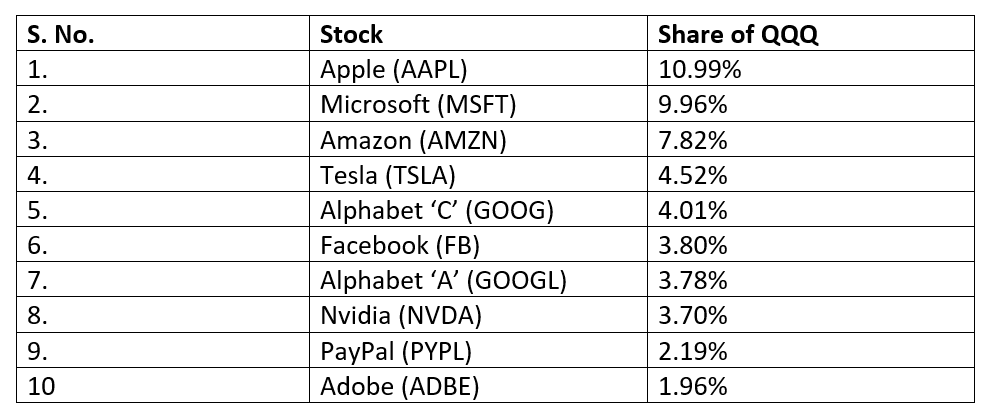

Apple is the most important company in QQQ ETF, and it became the first US Company to hit the market capitalization of US $2 trillion in August 2020. It strategized well and got its consumers into its ecosystem without letting them go. This is achieved by releasing and upselling new versions of old products to achieve growing revenue.

Invesco QQQ ETF top 10 Holdings

QQQ Pros and Cons

Pros

- Big Bull Market Rewards: if you want a bullish investment or feeling bullish right now investing in QQQ ETF is the best option to invest. As prices of QQQ stocks goes up more than S&P 500 bull markets, making it useful for sector rotation strategies.

- Liquidity: Investors may able to trade QQQ stocks faster at low cost and offers liquidity. Asset under management (AUM) for QQQ hit over $100 billion in 2020, providing a large market for traders.

- Long-term growth potential: QQQ stocks comprises of various large companies that are engaged in developing new technologies, including computers and zero-emission vehicles that offers QQQ ETF more potential for long-term growth. QQQ ETF is well diversified that makes it safer in long run.

- Low Expenses: low expense ratio of QQQ ETF increases returns and expenses add up over time.

Cons

- Sector Risk: As QQQ ETF places more weight on volatile technology-related sectors that the S&P 500 its risk and reward potential increases. Sector risk in Nasdaq 100 index stocks eventually becomes less important, same as the railroad companies that were the constituent of the Dow Jones Transportation Average (DJTA).

- High bear market risk: As QQQ ETF offers huge rewards and outperforms the S&P 500 during bull markets similarly it underperforms and investors may lose huge amount during bear market. The QQQ stock price declines when the dotcom bubble collapsed.

- High valuation levels: QQQ stocks are usually expensive by most of the standards used by value investors.

- No small-cap stocks: It excludes small-cap stocks as it imitates Nasdaq 100 largest companies. Small companies outperform large companies in long term and usually have more growth potential.

US

US  AU

AU UK

UK CA

CA NZ

NZ Please wait processing your request...

Please wait processing your request...