What are fringe benefits?

Fringe benefits refer to the additional perks offered to employees alongside their salary. Any kind of compensation that is offered to the employee for his/her work other than salary can be counted as a fringe benefit. This may include health insurance, a company car, or a company phone, etc.

Fringe benefits make a job more attractive even when the salary offered is at par with what other companies are offering. Employees are more likely to take a job with additional benefits as it makes the position more lucrative.

Different companies may offer different fringe benefits, and these benefits may vary across different designations in a single organisation. Fringe benefits can help employees save money in the long run.

Who can receive fringe benefits?

Fringe benefits are offered to employees and to various other members of an organisation who may be categorised as non-employees. These include:

- independent contractors

- Employees having a stake in the company’s shares

- Highly compensated employees

- Relatives of employees

Other additions can be made to the list based specifically on the national revenue agency’s guidelines. Companies may not always give fringe benefits to all the people falling in the above categories.

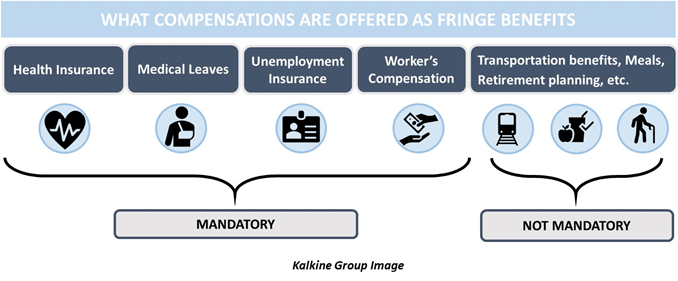

What is offered as compensation under fringe benefits?

Fringe benefits may be optional or necessary depending on the classifications made by the revenue services of a country. The following fringe benefits are made compulsory by most revenue agencies:

- Health Insurance: Companies are mandated to provide health cover to their employees. Companies can offer to pay for the cost of an accident as well as a full health insurance cover for their employees. Sometimes the insurance cover can extend to the families of employees as well.

- Medical Leaves: Organisations are mandated to provide sick leaves to their employees. The number of leaves permitted to employees may vary across organisations. Generally, the revenue agency places a lower boundary as the minimum number of medical leaves that must be offered by companies to their employees.

- Unemployment Insurance: Employers may be mandated to pay federal and state unemployment tax to the department of labour, which provides wages and training to the people who are unemployed for no fault of their own.

- Worker’s Compensation: Compensation may be offered to employees who are injured at work or suffer from an occupational disease.

There may be some benefits that are not mandated by the government but are additionally offered by companies to make the position lucrative. Some of these might be:

- Transportation benefits

- Meals

- Reduction in Tuition Fees

- Employee Stock Options

- Retirement planning services

- Working condition benefits

- Athletic facilities

- Dependent care assistance

Are fringe benefits taxable?

Just like wages, fringe benefits are also taxable. However, not all fringe benefits come under the taxable category. Unless specified otherwise, most fringe benefits are taxable.

The following sections of a fringe benefit may not be taxed:

- Any amount that is excluded by law from compensation like low-cost holiday gifts or achievement awards.

- Any amount that is paid by the recipient towards the benefit.

If the recipient of the benefit is counted as a non-employee, then any or all the benefit can be excluded from the taxable income. Thus, the classification as employee or non-employee is important for this reason. The benefit received by a non-employee may not be subjected to any income tax withholding; however, he/she may be asked to report that income elsewhere.

Why do employers offer fringe benefits?

Fringe benefits offer various advantages to employees, but employers may also seek to gain some benefits from them. These include:

- Beating the Competition: A company offering fringe benefits appears to be a cut above the rest as it may be perceived as a company that is considerate about the interests of its employees. It helps establish a brand image, making the company more desirable to employees, as well as to potential investors.

- Better Employee Integration: A company that focuses not only on the top-tier management but also on lower-level management and operative employees would earn a good public image. If a company puts extra concern into providing benefits to all its staff, then it is more likely to have a well-performing and satisfied staff.

- Medical Attention: Many fringe benefits allow workers to avail medical benefits or insurance cover during accidents. Such fringe benefits help ensure that employees are safe and secure and can contribute to the company with full potential.

US

US  AU

AU UK

UK CA

CA NZ

NZ Please wait processing your request...

Please wait processing your request...