What is meant by collateral?

Collateral refers to an asset that is offered by a borrower to a lender as a security against a loan taken. The lender has a risk associated while giving a loan - the risk of counterparty default. If the borrower takes the loan and disappears without repayment, then the lender would incur significant losses. Thus, obtaining collateral makes loans less risky for the lender.

Collateral can be a tangible or intangible asset. If the borrower fails to make the payment, then the lender can take possession of the collateral. This acts as the repayment for the loan. The loans given out without collateral are called ‘unsecured loans’ because they do not insure the lender against the risk of counterparty default.

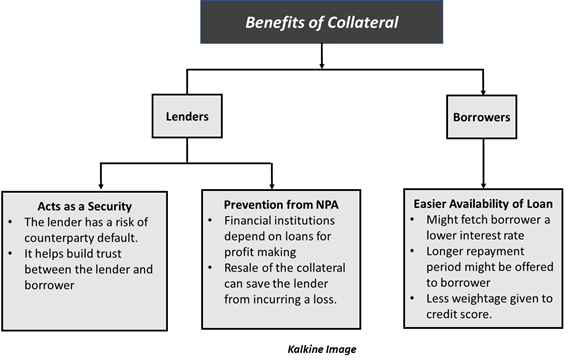

Providing collateral helps build trust between the lender and borrower. It may also benefit the borrower in the form of lower interest rate, as compared to unsecured loans. The value of the collateral may be higher, equal to, or lower than the amount of the loan taken. This depends on various factors like income of the borrower, credit score, liquidity of the asset, etc.

How is collateral beneficial to both the parties?

Any type of protection given against a loan to the lender would make him/her more secure about his/her position.

Most banks and financial institutions depend on loan repayments to earn profits. The difference between the income from loans and the interest payments given to depositors in a bank determines its profit.

If a borrower defaults on his loan, then the loan becomes a non-performing asset for the bank. It becomes a liability for the bank. Thus, collateral goes a long way in providing a sense of security to the lender.

From the perspective of a borrower, collateral can be beneficial as it might fetch him a lower interest rate and an extended repayment period. Also, secured loans are easier to qualify for. Lenders may deny unsecured loans to borrowers based on the level of creditworthiness. This is so because, for many financial institutions, the credit score is the sole coverage against which an unsecured loan is given. However, if an individual has never purchased a loan and is new to the market, then a secured loan can be of help. Thus, collateral-based loans are a way for debtors to increase their credit score.

How are different types of collateral categorised?

Collateral is categorised based on the loan taken against it. It can be any item, like a car, a house or even securities owned by the borrower like stocks, bonds, etc. In some cases, future payslips can also be used to insure loan repayments by a borrower.

Broadly, collaterals can be categorised as:

- Consumer Goods: This includes tangible items like cars, houses, or property that a consumer would want to invest in by taking a loan. The most common type of collateral is mortgage or housing. Many financial institutions offer loans against property documents.

- Inventory: This includes items that are kept as inventory by a firm. This type of collateral is given by businesses that take a loan from any financial institution. These businesses offer the unsold stock as a security so that in case of default, it can be used for repayment.

- Equipment: Businesses may also put their production equipment up as collateral. This immensely helps the businesses that are at an early stage of production. Most new businesses need liquid funds to expand. In case they have a lack of inventory, they can offer their primary equipment as a security against the loan.

- Invoices: Invoices promising future payments to a business, can be used as collateral. These can be used to insure against short-term loans. These are highly liquid, as they are checks promising future payments. Therefore, they are used collateral.

- Securities on paper: Any kind of investment that the borrower has in the form of stocks, bonds, can be used as a collateral.

- Savings account of the borrower: Savings account held by the borrower can be held as collateral. This can be useful in case the borrower does not have enough assets to offer as investment. In case of a bank, when the borrower defaults then the bank may liquidate his account for repayment.

How do banks perceive collateral?

Banks take a safer approach while valuing assets that are considered as collateral. They mostly accept collateral with a higher value or with a value equal to the amount of loan taken. While valuing the asset, banks take the fair market value of the asset rather than the value of the asset at the time the borrower purchased it.

Banks and most financial institutions prefer collateral for which the borrower has ownership, like mortgage, cars, etc. However, this may not be true for all types of banks. Some banks may offer higher leverage to their wealthy and influential borrowers by allowing them to offer securities as collateral. However, the banks may not consider the entire value of these securities as collateral because they have a market risk attached to them. Therefore, some banks may only consider 50% or sometimes 75% of the borrower’s portfolio.

Regardless of the market risk, most types of collateral are susceptible to the risk of depreciation attached to them. This is why most financial institutions consider the market value of the good(s).

US

US  AU

AU UK

UK CA

CA NZ

NZ Please wait processing your request...

Please wait processing your request...