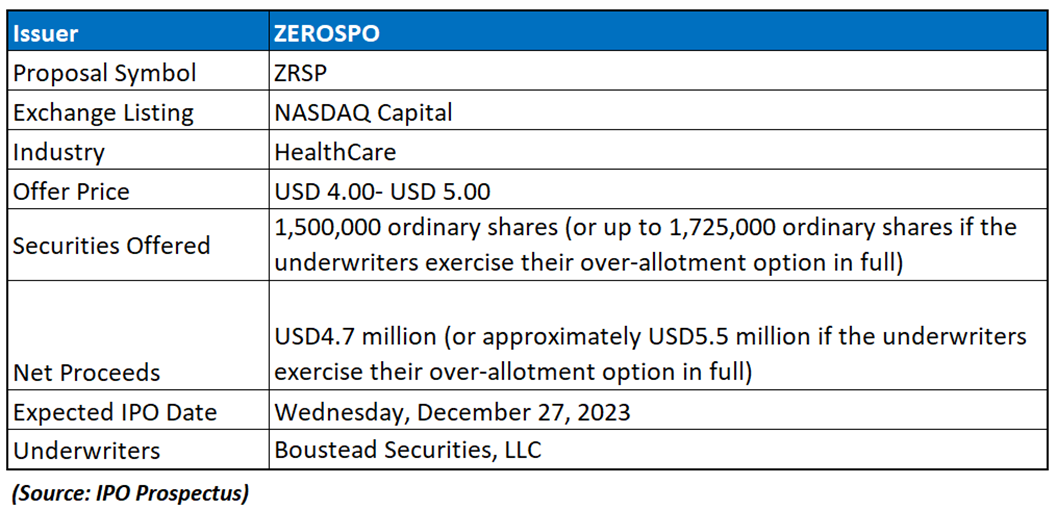

The Offer

Company Overview

ZEROSPO positions itself as a leading medical relaxation service provider in Japan, emphasizing its competitive standing among five key entities, including Medirom, Genki-Dou, HoneGori, and K’s Group. With a growing footprint and revenue comparable to key competitors, the company operates salons across Japan, leveraging judo therapists and acupuncture and moxibustion therapists to treat clients, primarily consisting of athletes. The company has expanded operations beyond the Tokyo metropolitan area, with 12 salons in non-Tokyo regions. It focuses on personalized treatment solutions under multiple brands, utilizing licensed therapists and accumulated customer data for effective and bespoke treatments. ZEROSPO aims to lead in medical relaxation services, becoming a recognized brand through the expansion of salons in key Japanese markets and potentially internationally.

Key Highlights

Primary Offering: The anticipated initial public offering (IPO) price is expected to range between USD4.00 and USD5.00 per share, with an assumed price of USD4.00 per share for the purpose of this prospectus, representing the lower end of the expected range. The actual offering price will be determined by market conditions at the time of pricing in consultation with the representative. Additionally, the company has granted the underwriters a 45-day option to purchase up to an additional 15% of the shares offered at the IPO price, excluding underwriting discounts and commissions. Before the offering, there are 12,689,592 ordinary shares issued and outstanding, and after the offering, it is expected to be 14,189,592 ordinary shares (or 14,414,592 if the over-allotment option is fully exercised).

Use of proceeds:

The company anticipates net proceeds of approximately USD4.7 million (or approximately USD5.5 million if the underwriters exercise their option in full) from the assumed sale of 1,500,000 ordinary shares at a presumed offering price of USD4.00 per share. After deducting estimated underwriting discounts, commissions, and offering expenses, the net proceeds will be utilized for various purposes. Approximately USD740,000 is allocated to repay the principal and accrued interest of a bridge loan extended by an investor to MoveAction, a subsidiary.

The intended allocation of net proceeds from the offering is as follows: 16% will be utilized for repaying the aggregate principal and accrued interest of the Bridge Loan, reflecting a commitment to debt reduction; 20% is earmarked for capital expenditures, focusing on the opening of new salons to support expansion efforts; 25% is allocated for acquisitions of existing salons or assets to further broaden the company's footprint; 15% is dedicated to training expenditures, encompassing the development of training facilities, teams, and recruitment initiatives; 4% is designated for recruiting expenditures; and finally, 20% is allocated for working capital and general corporate purposes, providing flexibility for ongoing operations and strategic initiatives. This detailed breakdown demonstrates a comprehensive approach to utilizing the funds for a balanced mix of debt management, expansion, and operational enhancements.

Dividend policy: The company has never declared or disbursed cash dividends on its ordinary shares, and there are no plans to do so in the immediate future. The current intention is to retain all available funds and future earnings for operational needs, without anticipation of cash dividends for ordinary shares. Possible credit agreements or borrowing arrangements in the future might impose restrictions on declaring dividends. Decisions regarding dividends will be discretionary and subject to factors such as financial condition, operating results, capital requirements, contractual constraints, overall business conditions, and other relevant considerations, to be determined by the board of directors.

Market analysis

The company's medical salons are predominantly located in the Kanto region, recognized as the economic and political center of Japan. With a population of 44.34 million, constituting 36.0% of Japan's total population, the company ranks among the top 8 in the Kanto region and the top 12 nationwide based on the number of salons, according to the Imperial Databank survey. The midterm goal is to expand to 100 salons nationwide within the next five years, becoming the largest salon network in Japan. To achieve this, the company outlines strategic steps such as location planning, human resource planning, marketing, management system infrastructure development, corporate finance, capital budgeting, and M&A/integration. Expansion plans include regions beyond Kanto, such as Chugoku, Kanto Koshinetsu, Kyushu, and Tohoku, particularly focusing on Fukuoka prefecture to diversify from the current concentration in Tokyo and its neighboring prefectures. The company notes seasonality trends, with revenue peaking from July to September, a slowdown in November, and weaker sales in January and February due to shorter days and colder weather, with March and April serving as transition months and featuring a spring sales promotion in April to boost May sales.

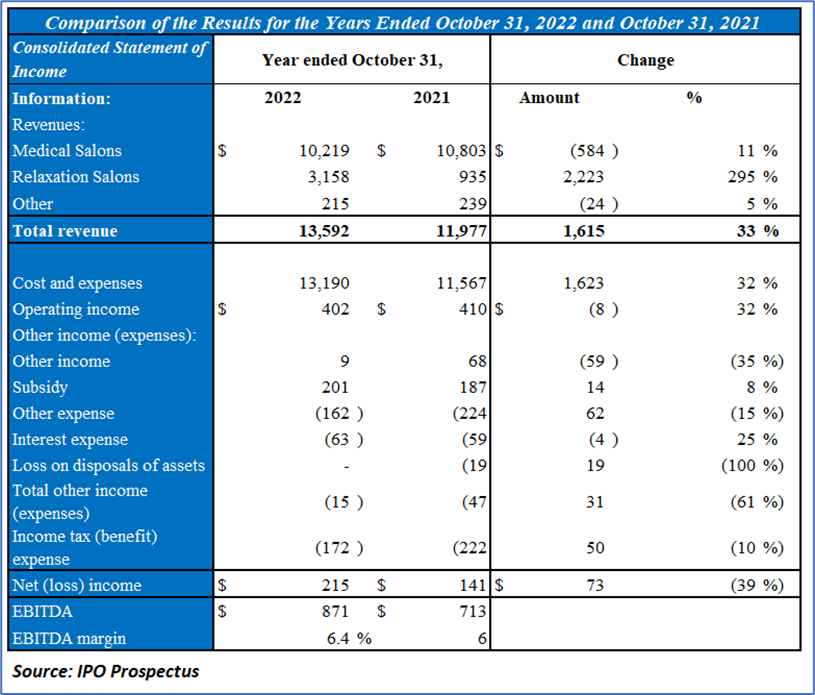

Financial Highlights (Expressed in USD):

Revenue Composition: The revenue structure of the company's medical salon services encompasses income from both directly operated salons and franchise salons. Similarly, the revenue from relaxation salon services includes income from both directly operated and franchise salons.

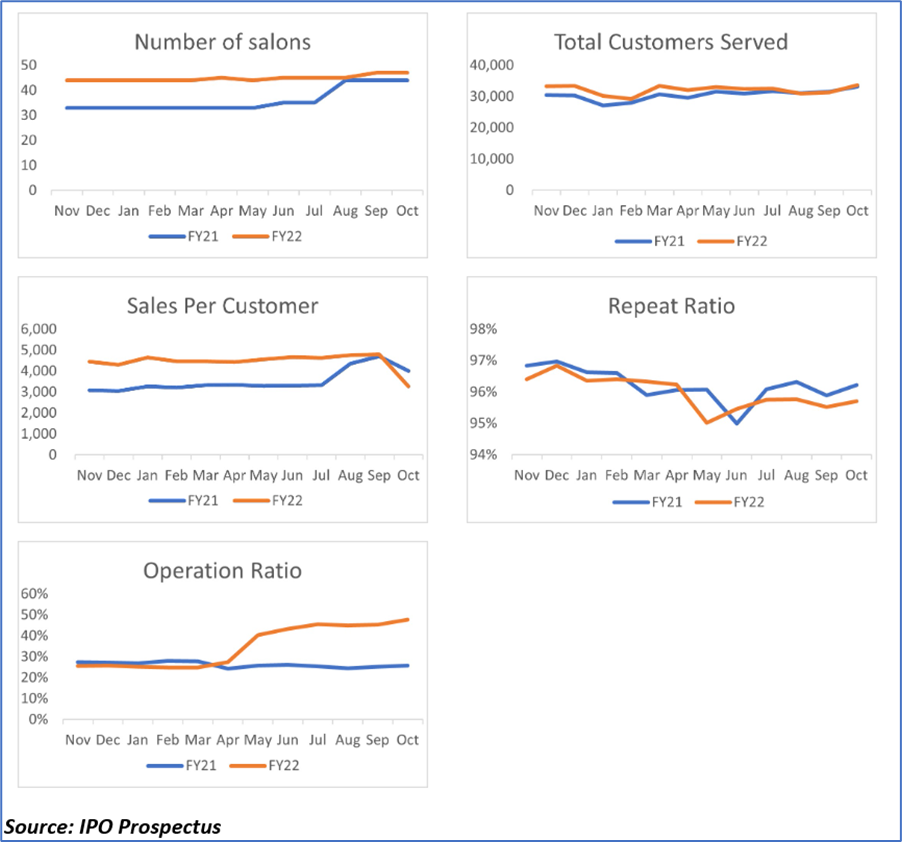

Factors Driving Revenue Growth: Key factors contributing to the increase in revenue in the Medical and Relaxation Salon business involve a surge in the number of salons, sales per customer, and operation ratio. Notably, the decline in medical salon revenue in USD is attributed to currency translation, with revenue in Japanese yen experiencing a modest 2% increase, offset by a 13% drop in the average foreign exchange rate in 2023 compared to 2022.

Operational Efficiency and Demand Surge: Operational efficiency and increased demand play pivotal roles in the company's financial dynamics. The Operation Ratio witnessed a significant 19% increase in the six months ending April 30, 2023, attributed to a surge in demand for treatment services and efficiency improvements facilitated by new electric treatment machines. These machines enable seasoned therapists to attend to multiple patients simultaneously and allow less-experienced therapists to contribute to the service.

Financial Performance Metrics: In terms of financial performance, after accounting for the cost of revenue, the gross margin for the six months ending April 30, 2023, stood at USD 2.4 million (49%), contrasting with USD 3.1 million (58%) for the same period in 2022. The consolidated net loss for the six months ending April 30, 2023, amounted to USD 1.0 million (16.8% of consolidated revenue), deviating from the consolidated net income of USD 0.5 million (7.4% of consolidated revenue) during the comparable period in 2022. Furthermore, the EBITDA demonstrated a decline from USD 0.9 million in the six months ending April 30, 2022, to (USD 0.7 million) for the equivalent period in 2023, resulting in an EBITDA margin (loss) of (11.5%) and 12.2% for the six months ending April 30, 2023, and 2022, respectively. The primary contributors to the improved EBITDA are largely associated with increased operating leverage.

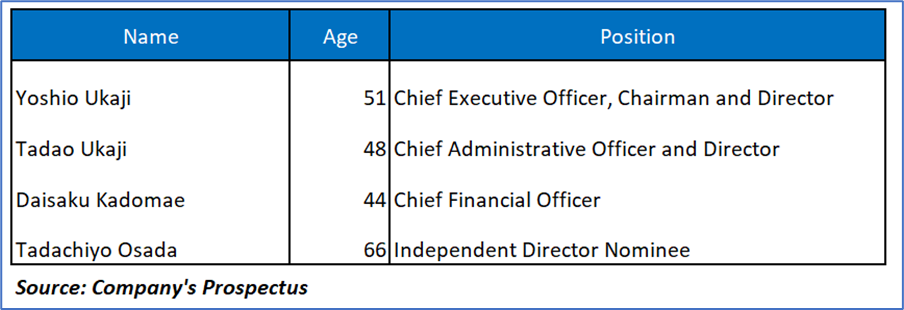

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “ZRSP” is exposed to a variety of risks such as:

Conclusion

ZEROSPO, a prominent medical relaxation service provider in Japan, positions itself as a key player in the industry, competing with major entities such as Medirom, Genki-Dou, HoneGori, and K’s Group. With a growing footprint and revenue comparable to competitors, the company operates salons across Japan, utilizing judo therapists and acupuncture and moxibustion therapists to primarily serve athletes. The anticipated initial public offering (IPO) price ranges between USD4.00 and USD5.00 per share, with an assumed price of USD4.00, representing a comprehensive valuation strategy. The company plans to utilize the net proceeds, estimated at approximately USD4.7 million, for various purposes, including debt reduction, expansion through new salons, acquisitions, training initiatives, recruiting efforts, and general corporate purposes. The strategic breakdown reflects a balanced approach to managing funds. Although the company has never paid cash dividends, its focus on retaining funds for operational needs aligns with expansion plans. Positioned in the Kanto region, the economic hub of Japan, ZEROSPO aims to achieve a nationwide presence with a mid-term goal of 100 salons within five years. Despite some financial metrics showing a decrease, such as gross margin and EBITDA, operational efficiency and increased demand contribute positively to the company's financial dynamics.

Overall, while there are growth prospects, ZRSP's performance shows a mix of positive and negative financial trends. Hence, given the financial performance of the company, consistent revenue, decreased net income, industry analysis, use of proceeds, and associated risks “ZEROSPO” IPO seems “Attractive" at the IPO price.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.