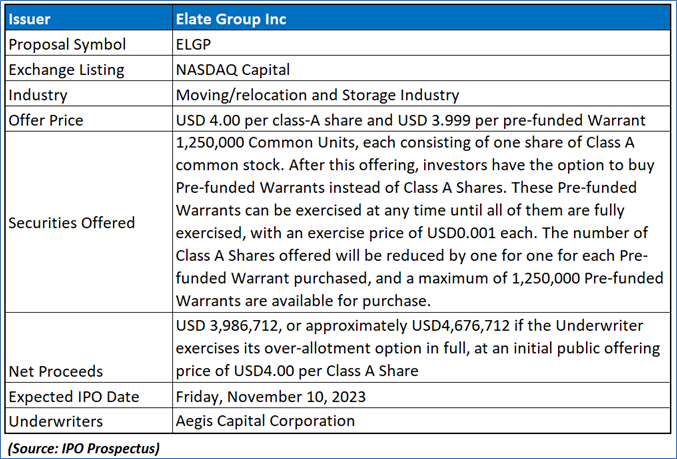

The Offer

Company Overview

ELGP, a high-touch, best-in-class moving, and storage firm, was established in 2013 to provide domestic concierge services and international relocation solutions for private, public, and business clients in the US and Canada. Seven metro areas on the U.S. east coast are the current focus of ELGP. The company's present operating base in Brooklyn, New York, largely serves the seven metro regions that it now services. With a growing fleet of trucks and competent relocation, the staff made up of 27 full-time and 5 part-time personnel, ELGP now serves these markets. Disassembly, packing, unpacking, re-setup, and short-term storage are all included in ELGP's full moving services.

Key Highlights

Primary Offering: 1,250,000 Common Units, each consisting of one share of Class A common stock. After this offering, investors have the option to buy Pre-funded Warrants instead of Class A Shares. These Pre-funded Warrants can be exercised at any time until all of them are fully exercised, with an exercise price of USD0.001 each. The number of Class A Shares offered will be reduced by one for one for each Pre-funded Warrant purchased, and a maximum of 1,250,000 Pre-funded Warrants are available for purchase. The offer will have a net proceeds of USD 3,986,712, or approximately USD4,676,712 if the Underwriter exercises its over-allotment option in full, at an initial public offering price of USD4.00 per Class A Share.

Use of proceeds:

ELGP estimates that, assuming the exercise of any Pre-funded Warrants and without the Underwriter's over-allotment option exercise, the net proceeds from this offering will be approximately 3,986,712 USD. If the Underwriter exercises its over-allotment option in full, this figure would be approximately 4,676,712 USD, based on an initial public offering price of 4.00 USD per Class A Share. These estimates are after deducting anticipated underwriting discounts, commissions, and estimated offering expenses of 613,288 USD, which ELGP is expected to bear.

The intended allocation of the net proceeds (assuming Pre-funded Warrant exercise and no over-allotment option exercise by the Underwriter) is as follows: approximately 27% or 1.1 million USD for general corporate purposes, including working capital; approximately 22% or 0.9 million USD for expanding service lines into additional states and extending cross-border services to Canada; approximately 33% or 1.3 million USD for entry into and development of the storage facility segment, including potential acquisitions; approximately 4% or 0.2 million USD for debt repayment; and approximately 14% or 0.6 million USD for capital expenditures to increase the vehicle fleet and other tooling. ELGP plans to secure additional capital for vehicle fleet expansion and storage facility segment capital requirements through bank financing. Debt repayment relates to trade payables with no specific payment terms.

It's important to note that each 1.00 USD increase (decrease) in the initial public offering price of 4.00 USD per Class A Share would result in a corresponding increase (decrease) of ELGP's net proceeds by approximately 1.15 million USD, assuming the number of Class A Shares and/or Pre-funded Warrants offered remains constant. Additionally, an increase (decrease) of 500,000 in the number of Class A Shares and/or Pre-funded Warrants offered, with no change in the 4.00 USD initial offering price, would result in net proceeds increase (decrease) of 1.84 million USD from this offering.

Dividend policy: All dividends to holders of common stock will be declared and paid at the Board of Directors' discretion and will be based on a variety of factors, including the company's financial situation, earnings, compliance with applicable laws, and any debt agreements to which it is then a party, as well as other factors that the Board of Directors deems relevant.

Industry and competitive analysis

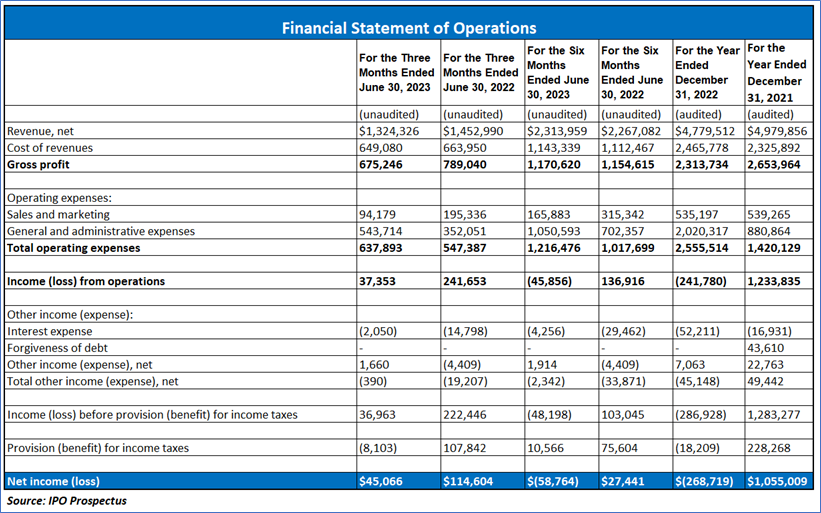

Financial Highlights (Expressed in USD):

Three Months Ended June 30, 2023, Compared to Three Months Ended June 30, 2022

Six Months Ended June 30, 2023, Compared to Six Months Ended June 30, 2022

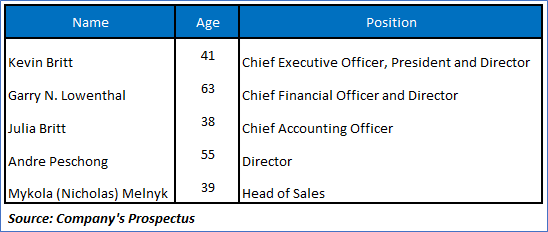

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “ELGP” is exposed to a variety of risks such as:

Conclusion

ELGP's recent financial performance reflects a mix of positive and negative factors. While the company reported a net income of USD 45,066 in the three months ending June 30, 2023, demonstrating profitability, this represents a significant 61% decrease from the same period in 2022, which could be viewed as a downside. The decrease in net income is attributed to higher professional fees and increased stock-based compensation expenses. Similarly, the 9% decrease in operating revenue, amounting to USD 1,324,326, is a concerning trend, primarily due to the shift of moving projects from the second quarter of 2023 to the first quarter. On the positive side, the cost of revenue decreased by 2%, reflecting some cost management. However, operating expenses surged by 16%, driven by various factors, including salaries and advertising fees, which is a notable negative aspect. The substantial 85% decrease in income from operations in the same period further raises concerns. A positive point is the decrease in interest expenses and the income tax benefit in this period, reflecting cost savings and improved tax efficiency.

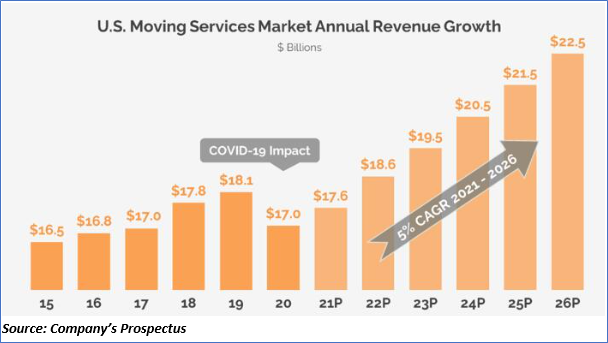

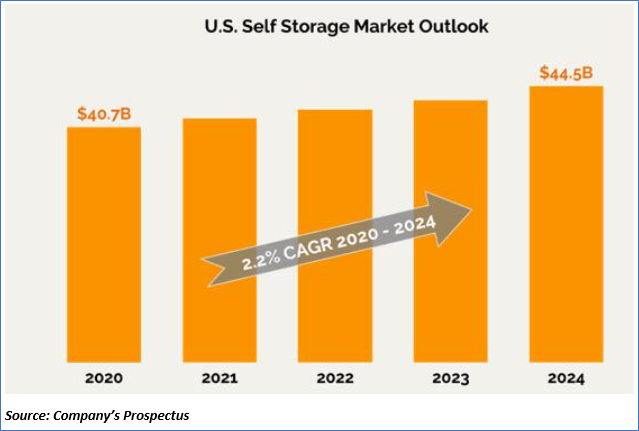

Looking ahead, ELGP's growth prospects appear promising, with plans to expand service lines, enter the storage facility segment, and increase the vehicle fleet. The company is operating in a growing moving services market with a projected USD 22.5 billion valuation by 2026. Additionally, the impact of the COVID-19 pandemic on the transportation sector had a milder effect on movers, as they were considered essential. Changing societal priorities and trends, with more people moving for family reasons rather than jobs, indicates evolving opportunities. In addition, the self-storage industry, a segment ELGP is considering entering, is forecasted to grow, presenting potential for diversification. However, stiff competition in the industry is a notable risk, and the cyclical nature of the market and fluctuating fuel prices pose additional challenges. Furthermore, ELGP faces potential risks related to capital investments and debt repayment.

Overall, while there are growth prospects, ELGP's performance shows a mix of positive and negative financial trends. Hence, given the financial performance of the company, consistent revenue, decreased net income, industry analysis, use of proceeds, and associated risks “Elate Group Inc (ELGP)” IPO seems “Neutral" at the IPO price.

** ELGP has already been covered as on 23rd January 2023, but as the company postponed the IPO, an updated report (latest financials) has been released by Kalkine Group.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.