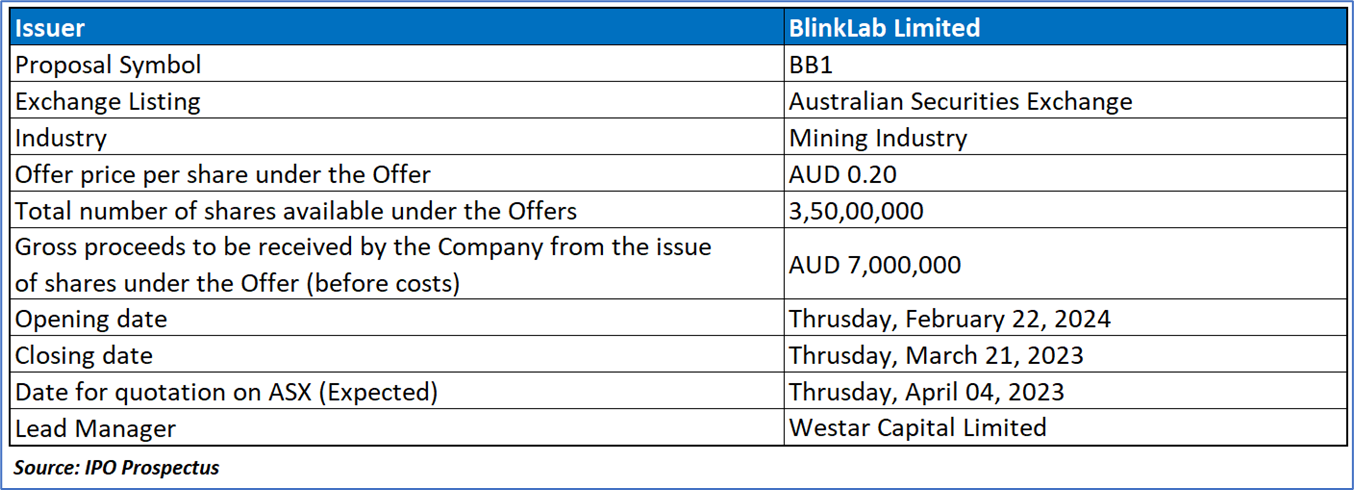

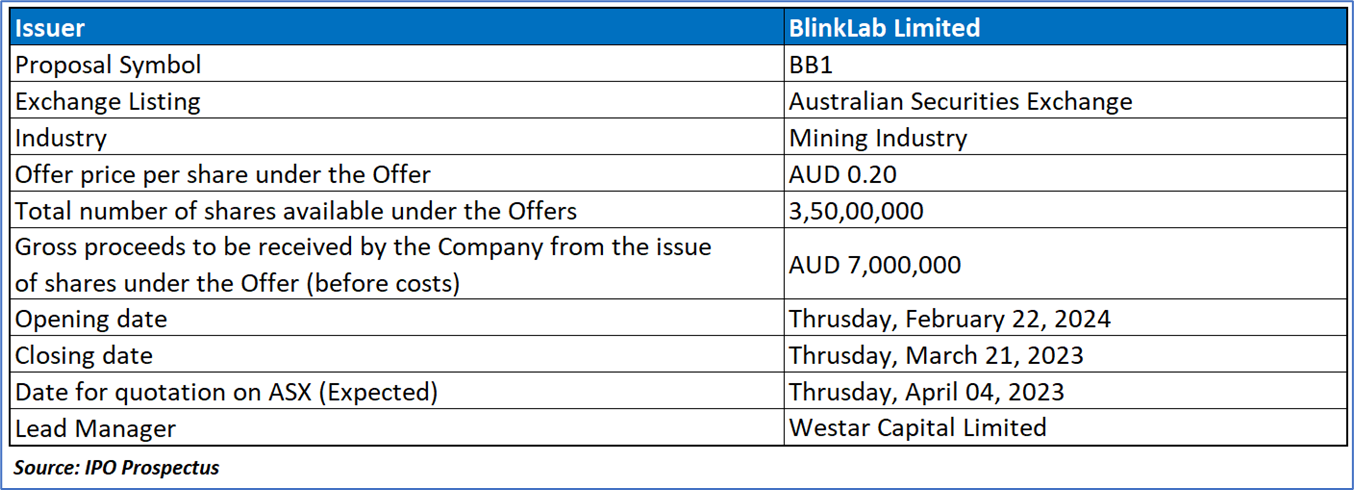

The Offer

Company Overview

BlinkLab, established on August 17, 2021, aims to expedite the development and commercialization of intellectual property (Licenced IP) from Princeton University. The company holds an exclusive global license for the Licenced IP, focusing on smartphone-neurobehavioral testing. BlinkLab has created a medical device, the BlinkLab Device, in the form of a smartphone application with an e-platform. This device conducts neurometric tests aiding in the diagnosis of conditions like autism spectrum disorder (ASD), attention deficit hyperactivity disorder (ADHD), schizophrenia, and other neurodevelopmental disorders. The BlinkLab Tests, including eyeblink conditioning, prepulse inhibition of acoustic startle, and habituation of eye blink response, serve as biomarkers for neurological and psychiatric disorders. Results from these tests are recorded on smartphones and analyzed using machine learning on BlinkLab's confidential and secure online platform. BlinkLab's immediate focus is to complete regulatory clinical studies and secure FDA approval in the US and CE Mark in Europe. The ultimate goal is to introduce the BlinkLab Device to the market initially as a diagnostic tool for ASD.

Key Highlights

Primary Offering:

The Public Offer entails the offering of 35,000,000 Shares at a price of AUD0.20 per Share, with the objective of generating AUD7,000,000 in funds (pre-expenses).

Use of proceeds:

Industry Overview:

- Introduction: BlinkLab is dedicated to advancing smartphone-neurobehavioral testing for the diagnosis of neurodevelopmental conditions such as autism spectrum disorder (ASD), Attention Deficit Hyperactivity Disorder (ADHD), schizophrenia, and other related disorders. The company's focus is on developing innovative solutions that leverage smartphone technology for efficient neurobehavioral assessments.

- Overview of Neurodevelopmental and Neuropsychiatric Disorders: Market Size and Growth

- Autism Spectrum Disorder Globally: ASD, characterized by social and communication challenges, affects over five million Americans, with an estimated prevalence of approximately 1 in 36 eight-year-olds. The significant impact on individuals and families results in substantial community resources being dedicated to care. The ASD treatment market is valued at USD 29.8 billion in 2021, projected to reach USD 45.9 billion in 2032. The diagnostic market is also growing, expected to surpass USD 5.4 billion by 2036, driven by increased awareness and the importance of early diagnosis for successful interventions.

- Autism Spectrum Disorder in Australia: Australia exhibits a high prevalence of autism in children, approximately 4.5%, surpassing rates in other countries. The National Disability Insurance Scheme (NDIS) contributes to this prevalence, raising concerns about potential overdiagnosis. The NDIS system's financial incentives have led to an increased number of diagnoses, impacting diagnostic waitlists and delaying support for affected children.

- Attention Deficit Hyperactivity Disorder Globally: ADHD, a heritable neurobehavioral condition primarily affecting children and adolescents, presents challenges in academic and social settings. With a global prevalence of around 5% in this age group, ADHD incurs substantial economic costs, encompassing direct medical and non-medical costs, indirect costs, and impacts on the education and justice systems. The economic burden ranges from USD 831.38 to USD 20,538 per person, highlighting the considerable implications of ADHD.

- Implications of Market Dynamics: The growing prevalence of neurodevelopmental and neuropsychiatric disorders, coupled with increased awareness and government initiatives, propels market growth for diagnostic and treatment solutions. BlinkLab's innovative approach aligns with the evolving needs of the healthcare industry, offering potential contributions to early diagnosis, intervention, and improved outcomes for individuals affected by these conditions.

- Challenges and Opportunities in the Industry: While opportunities for growth exist in addressing the unmet needs in neurodevelopmental and neuropsychiatric disorder diagnostics and treatments, challenges include potential overdiagnosis, diagnostic waitlists, and the economic burden associated with these conditions. BlinkLab's commitment to developing smartphone-based solutions provides a promising avenue for addressing these challenges and contributing positively to the industry landscape.

- Platforms on which IPO will be available: eToro, I G, Plus500, AvaTrade, CommSec, Admirals, Nabtrade, GO Markets, Saxo Bank and XTB and many more.

Dividend policy:

The Company foresees substantial expenditures for the assessment and advancement of its business, with a predominant focus expected over the next two years from the date of this Prospectus. Consequently, the Company does not anticipate declaring any dividends during this period. The decision to pay dividends in the future rests with the discretion of the Directors and will hinge on factors such as the availability of distributable earnings, operating results, the financial condition of the Company, future capital requirements, and other relevant business considerations. The Company cannot provide assurance regarding the payment of dividends or the availability of franking credits, as these decisions will depend on various factors as evaluated by the Directors.

Financial Highlights (Expressed in AUD):

- Pre-revenue company: The Company does not currently have any operational revenue and is not expected to until the approval of FDA for its product.

Key Management Highlights

Risk Associated (High)

- Licence Agreement: Under the Princeton Licence Agreement, the Company holds an exclusive worldwide license for the discovery, development, manufacturing, and commercialization of products or services covered by Princeton University's patents. The Company also has the authority to grant sub-licenses, subject to the agreement's terms. Termination by Princeton University due to a material breach, if not remedied within 30 days after notice, could significantly impact the Company, affecting the development of the BlinkLab Device and its ASX listing.

- Government Interest and Rights: The Bayh-Doyle Act grants the U.S. Government irrevocable, non-exclusive, royalty-free rights to inventions arising from funded research. The Company acknowledges Government Interest in the Licensed IP resulting from a grant to Princeton University. While not expecting the U.S. Government to exercise its rights, the Company plans to commercialize the BlinkLab Device, subject to FDA approval.

- Jurisdictional Requirements and Protections for Patents: Varying laws across jurisdictions govern patents, impacting grant and maintenance requirements. The Company may need additional resources to meet diverse patent criteria, potentially redirecting attention and funds from other operations.

- Trade Secrets and Confidentiality: The Company heavily relies on trade secrets and confidentiality in research, development, and commercialization of the BlinkLab Device. Despite existing protective measures, there is inherent risk, as absolute certainty against breaches by employees, contractors, or third parties cannot be guaranteed.

Conclusion

BlinkLab Limited, an emerging player in smartphone-neurobehavioral testing, has proposed an initial public offering (IPO) to generate AUD7,000,000. Established in August 2021, the company holds exclusive global rights to intellectual property from Princeton University, focusing on neurobehavioral testing for conditions like ASD, ADHD, and schizophrenia. The BlinkLab Device, a smartphone application, conducts neurometric tests aiding diagnosis, with regulatory studies underway for FDA approval. The industry overview emphasizes the growing market for neurodevelopmental disorder diagnostics and BlinkLab's innovative contributions. However, financial highlights reveal a pre-revenue status, and potential investors should consider the high associated risks, including dependence on the Princeton Licence Agreement, government interest and rights, jurisdictional patent requirements, and trade secret vulnerabilities. The company anticipates significant expenses, postponing dividends for the next two years, with future decisions subject to various business factors.

Hence, given the financial performance of the company, incurred net losses, company’s product, and associated risks “BlinkLab (BB1)” IPO seems “Neutral" at the IPO price.

Disclaimer-

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.