The Offering

.png)

Company Overview

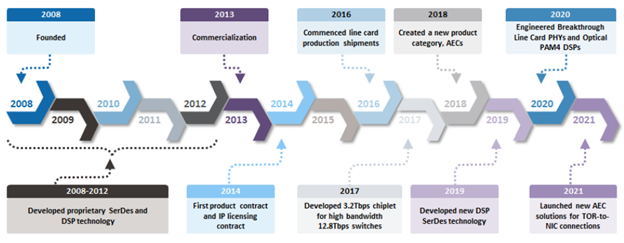

Credo Technology Group is a pioneer in providing secure, high-speed connectivity solutions, enhancing power and cost efficiency as data rates and associated bandwidth requirements rise rapidly across the data infrastructure sector. The company's technologies alleviate bandwidth bottlenecks besides augmenting power, security, and credibility. Its connectivity solutions are designed for optical and electrical Ethernet applications, including the emerging 100G (Gigabits per second), 200G, 400G, and 800G port markets.

Source: IPO Prospectus

Key Highlights

Uses of Fund: The company plans to use the net proceeds from this offering for working capital and other general corporate purposes. The company may also use a portion of the net proceeds for acquisitions or strategic transactions.

Dividend Policy: The company has never declared or paid cash dividends on its common stock. Furthermore, it does not intend to declare or pay cash dividends on its shares shortly. The company's current strategy is to keep all available money and any future earnings to support operations and finance the expansion of its core business.

Extensive Innovative Solutions Supplier: Credo’s solutions portfolio includes HiWire AECs, Optical DSPs, Line Card PHYs, SerDes Chiplets for Multi-Chip Module (MCM) package integration and SerDes IP licensing. These products and innovative technologies enable customers with numerous bandwidths, power, cost, security, reliability, and end-to-end signal integrity requirements.

Industry Tailwinds: The rapid growth in data and related data traffic across the network is creating bandwidth barriers and bottlenecks, creating the need for solutions that can enable faster connectivity speeds. Credo is in the early stage of penetrating an ample opportunity and is also set to benefit from strong secular tailwinds in the data infrastructure market.

Strong Competitive Strengths: The company's key competitive strengths include a strong SerDes Intellectual Property (IP) portfolio, proven demand from Tier 1 customers - engaged with five of the top seven hyperscalers, and customer base includes more than 20 blue-chip clients, best-in-class technology, a culture of continuous innovation, an innovative team, and an experienced leadership team.

Strategic Growth Strategy: To support its mission of providing secure, high-speed connectivity solutions, the company intends to focus on the following strategic areas: extending its leadership in SerDes technologies, expanding its portfolio of products and IP solutions, attracting and acquiring new customers, and extending and deepening relationships with existing clients.

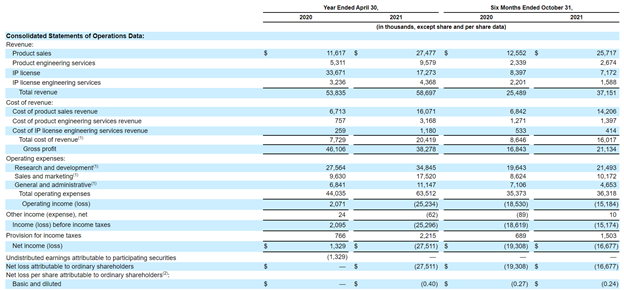

Financial Highlights (Figures are in US Dollar)

Source: IPO prospectus

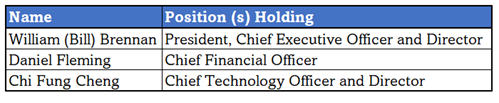

Key Management Highlights

Source: IPO Prospectus

Risk Associated (High)

Investment in the IPO of "CRDO" is exposed to a variety of risks such as:

Higher dependency on limited customers: A considerable amount of the company's revenue is dependent on a small number of customers, and the loss of, or significant drop in sales to, one or more of its considerable customers could have a detrimental impact on the company's topline and operating results.

Short term purchase agreements: Credo does not have long-term purchasing commitments from its clients, and if they cancel or amend their purchase orders, the company's operating results may suffer.

Intense competition: The company faces tough competition and anticipates that competition will rise in the future. If it fails to compete effectively, it could adversely impact its business and operating results.

Conclusion

The company is an innovator in offering secure, high-speed connectivity solutions that assist its customers in improving power and cost efficiency as data rates and corresponding bandwidth requirements expand exponentially throughout the data infrastructure market. Furthermore, the company could profit from the data infrastructure market's secular solid tailwinds. Similarly, Credo believes that it has a significant opportunity to increase its client base and intends to accelerate new customer acquisition throughout the geographies it serves and enter new market segments by scaling its sales and marketing capabilities.

However, the company has a history of net losses and has an accumulated deficit, and it may also incur net losses in the future. Further, Credo's future success will largely depend on its ability to execute its strategies successfully.

Therefore, based on the above rationales, we have assigned the IPO of Credo Technology Group Holding Ltd with a “Neutral” rating, which implies that the attractiveness of this IPO appears to be low given the associated risks and the current market scenario and this might be suitable for investors with a high-risk appetite [basis further evaluation].

*Please note that an IPO can be postponed or put on Hold at the discretion of the company or regulatory authority.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.