Section 1: Company Overview and Fundamentals

1.1 Company Overview:

Opera Ltd (NASDAQ: OPRA) is a Norway-based technology company that is engaged in the web browser development. The Company operates as a provider of browser and integrated artificial intelligence (AI)-driven digital content discovery and recommendation platforms. The Company’s operations are comprised of search, advertising, technology licensing and other.

Kalkine’s American Tech Report covers the Company Overview, Key positives & negatives, Investment summary, Key investment metrics, Top 10 shareholding, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

Stock Performance:

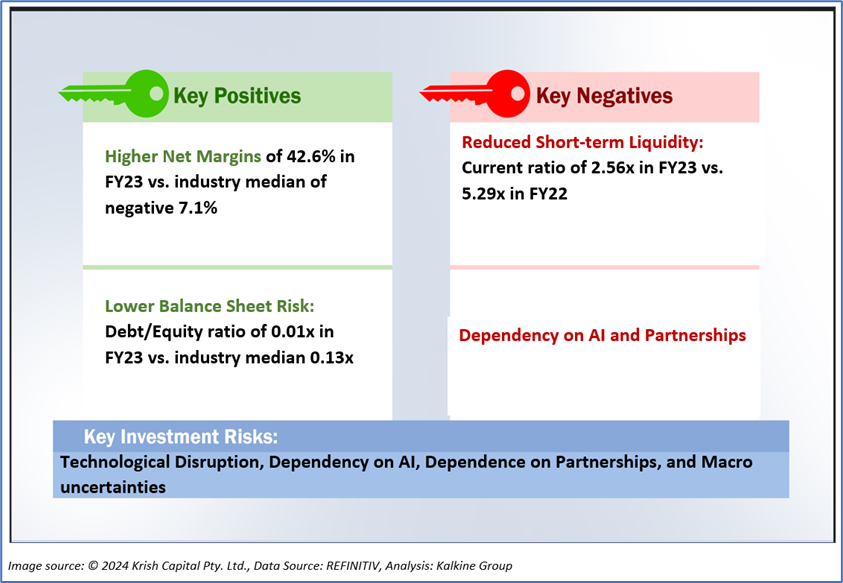

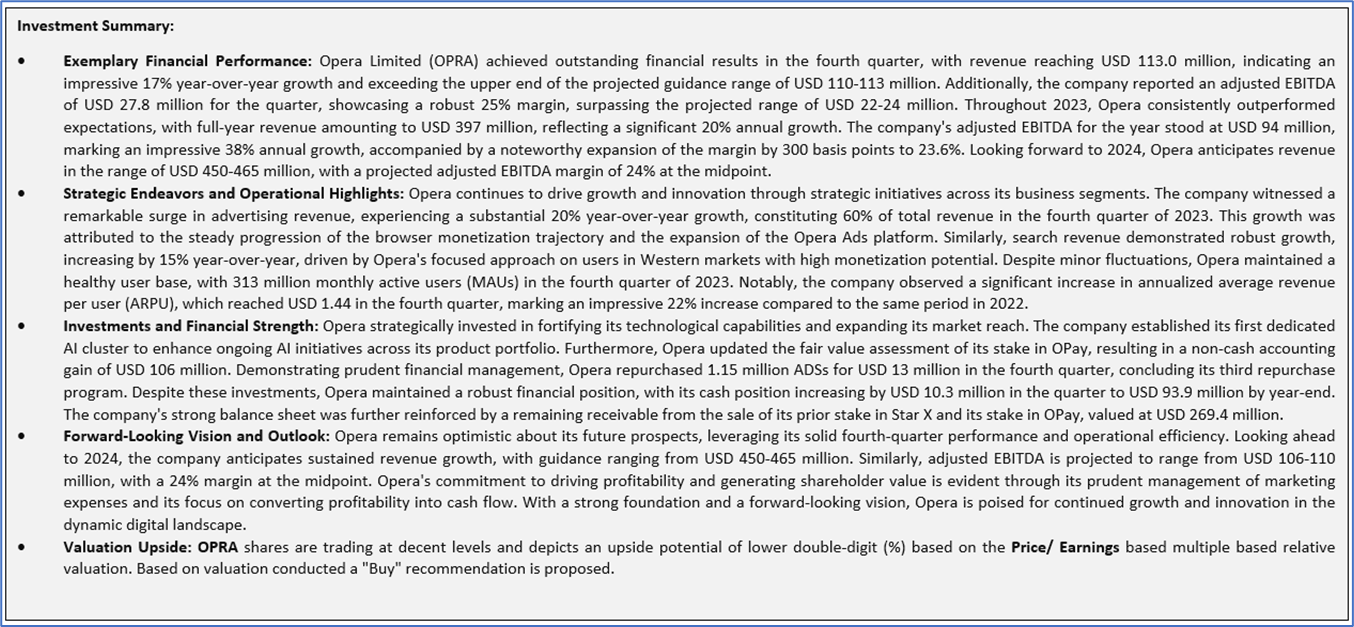

1.2 The Key Positives, Negatives, and Investment summary

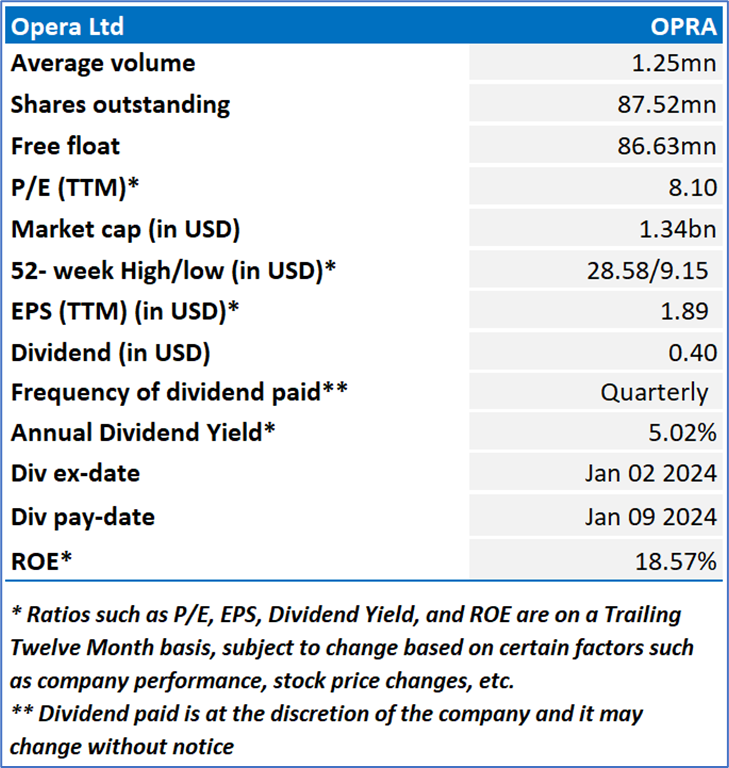

1.3 Key Metrics:

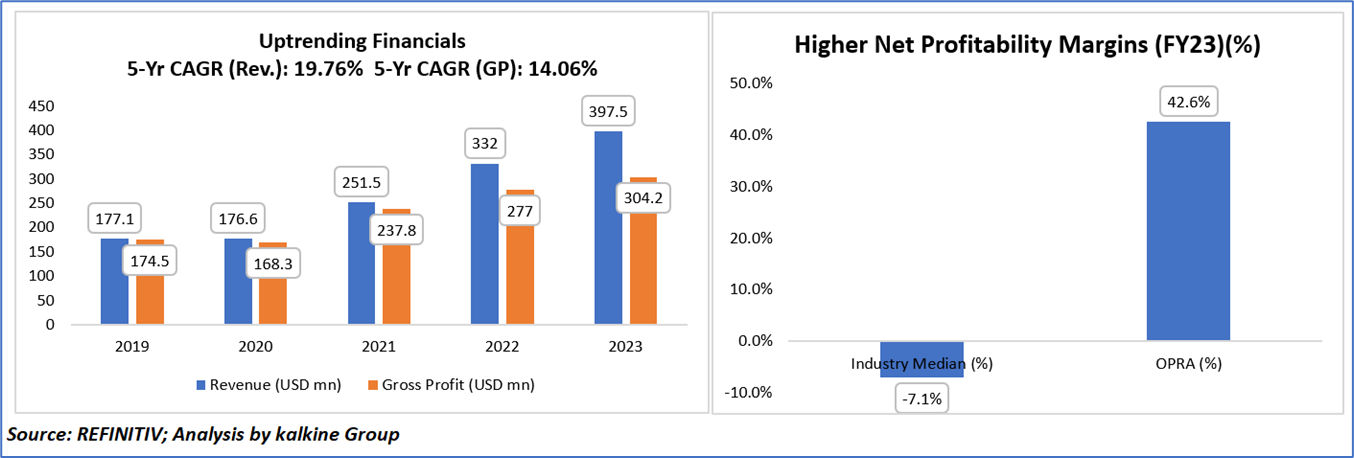

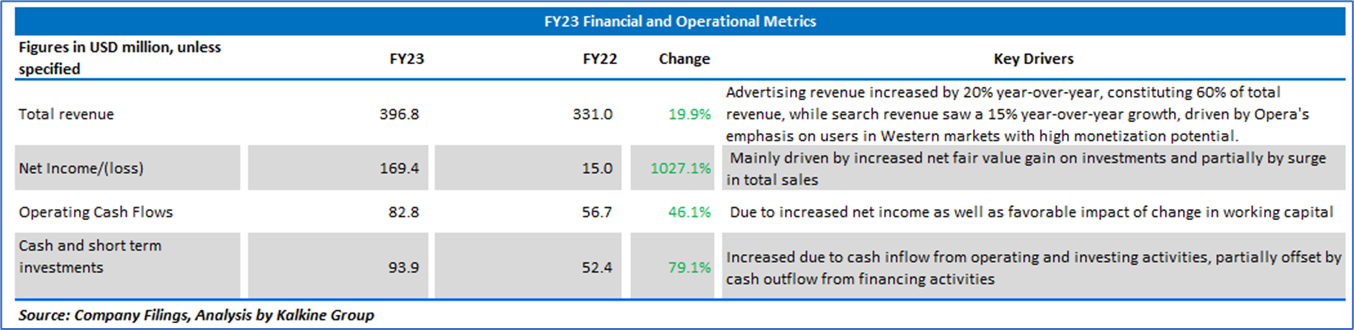

Opera Limited has shown consistent growth in revenue from 2019 to 2023, with figures rising from USD 177.1 million to USD 397.5 million. The gross profit also witnessed a steady increase over the same period, progressing from USD 174.5 million to USD 304.2 million. In terms of net margin, Opera Ltd has exhibited resilience in net margins, outperforming the industry median of -7.1% to a robust 42.6% in 2023. This positive trend underscores Opera's financial strength and efficiency, positioning the company favorably within its industry.

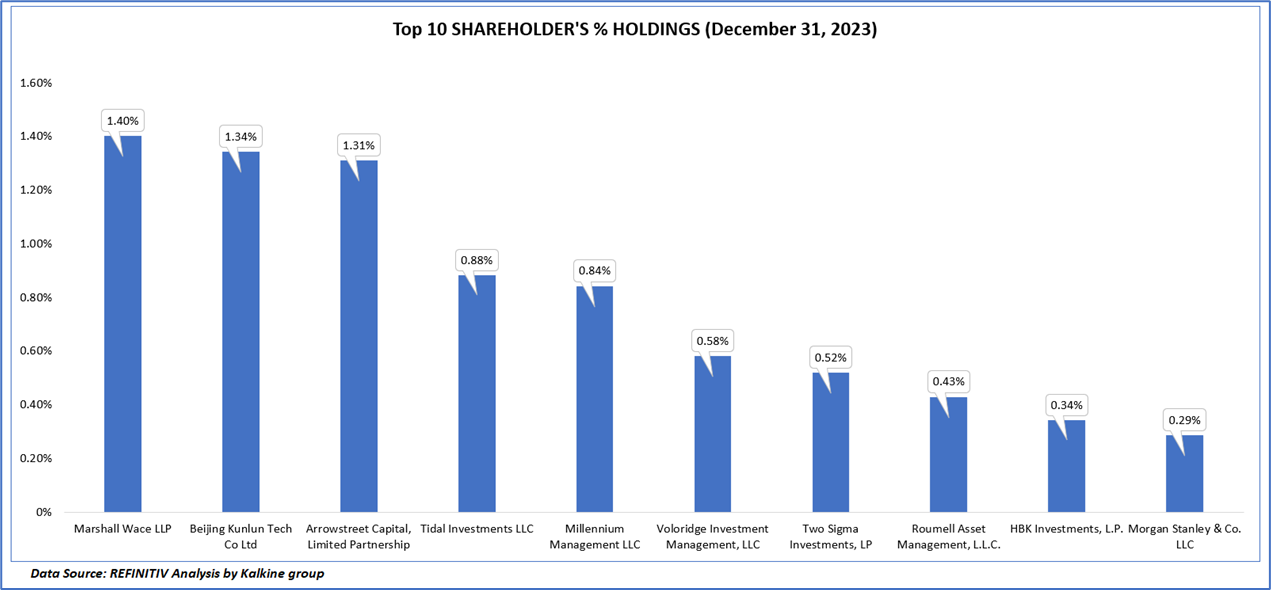

1.4 Top 10 shareholders:

The top 10 shareholders together form ~7.95% of the total shareholding, signifying diverse shareholding. Marshall Wace LLP and Beijing Kunlun Tech Co Ltd are the biggest shareholders, holding the maximum stake in the company at ~1.40% and ~1.34%, respectively.

Section 2: Business Updates and Corporate Business Highlights

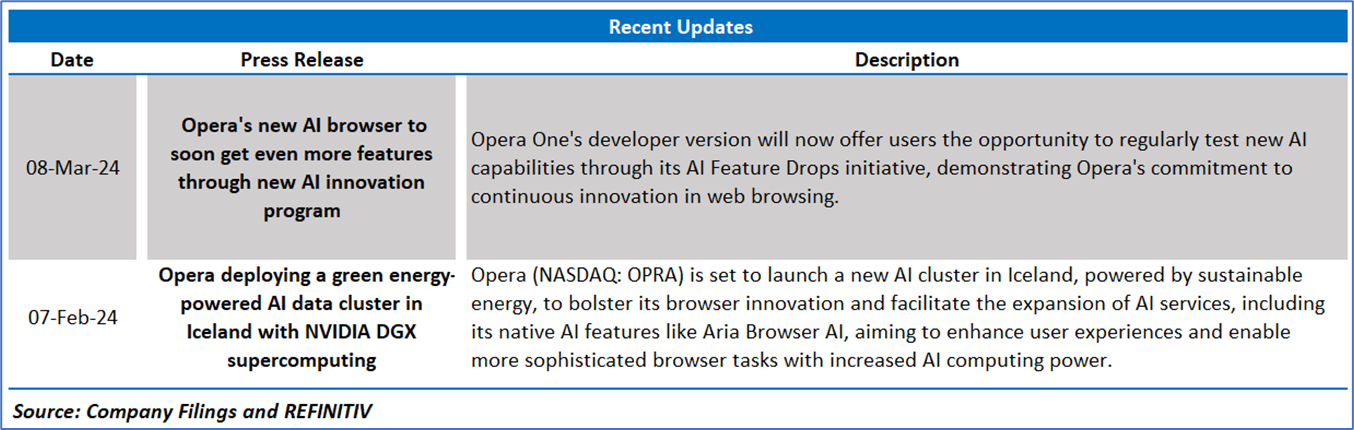

2.1 Recent Updates:

The below picture gives an overview of the recent updates:

2.2 Insights of FY23:

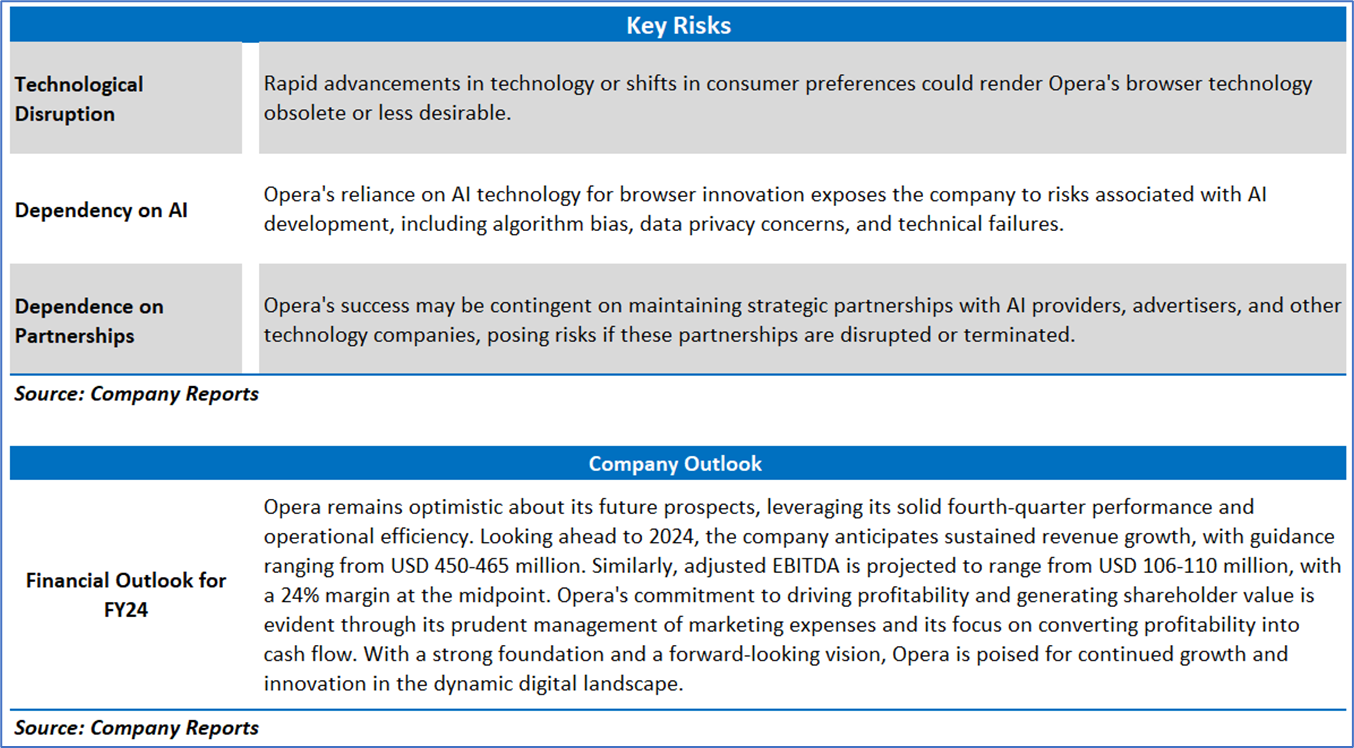

Section 3: Key Risks and Outlook

Section 4: Stock Recommendation Summary:

4.1 Price Performance and Technical Summary:

Stock Performance:

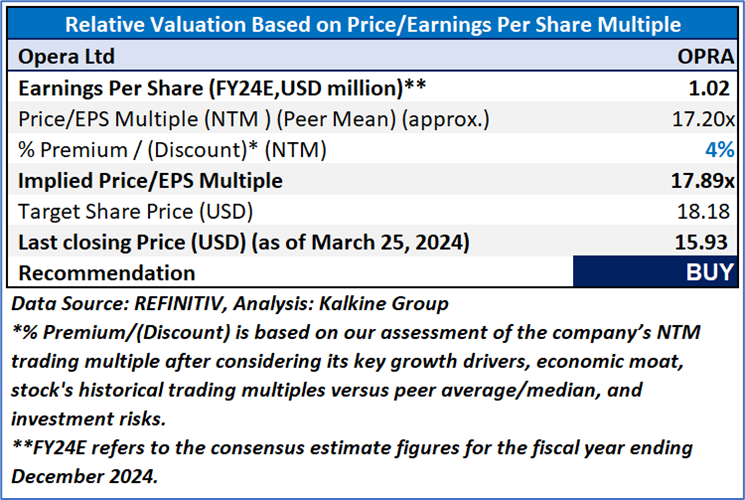

4.2 Fundamental Valuation

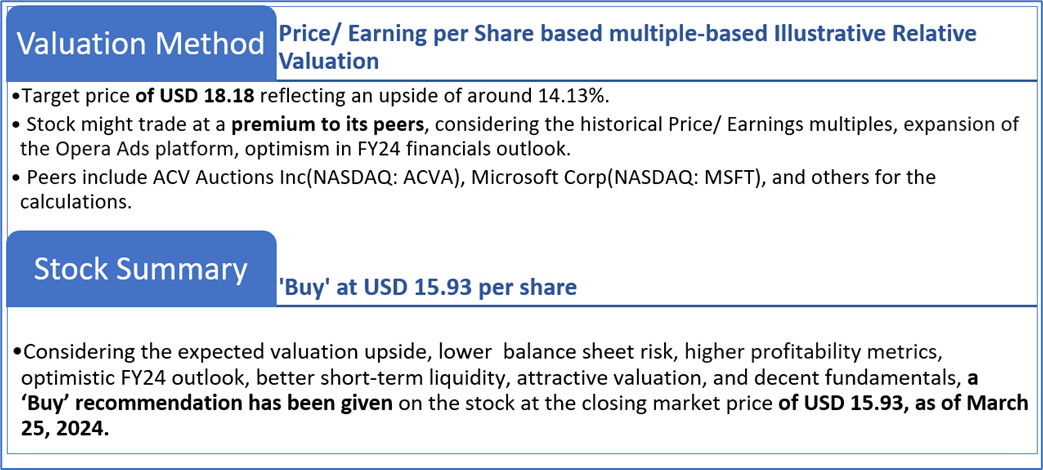

Valuation Methodology: Price/Earnings per share Multiple Based Relative Valuation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is March 25, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

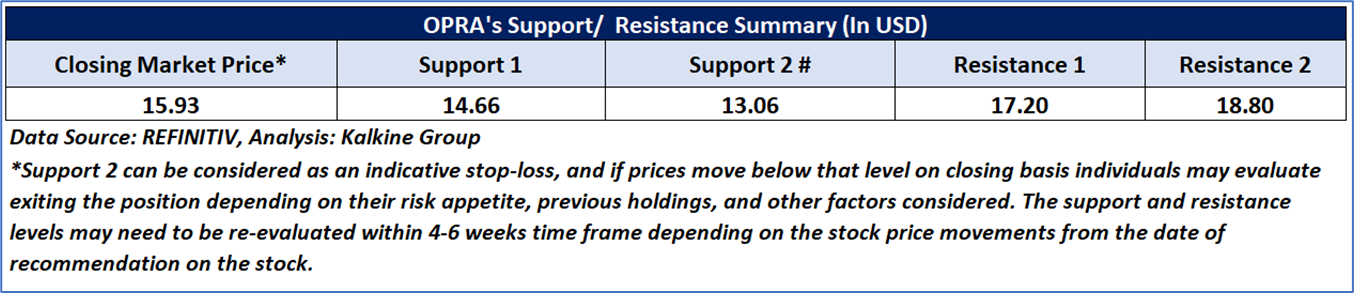

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

Kalkine Equities LLC provides general information about companies and their securities. The information contained in the reports, including any recommendations regarding the value of or transactions in any securities, does not take into account any of your investment objectives, financial situation or needs. Kalkine Equities LLC is not registered as an investment adviser in the U.S. with either the federal or state government. Before you make a decision about whether to invest in any securities, you should take into account your own objectives, financial situation and needs and seek independent financial advice. All information in our reports represents our views as at the date of publication and may change without notice.

Kalkine Media LLC, an affiliate of Kalkine Equities LLC, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.