What is a zero balance account?

As the name implies, a zero balance account (ZBA) maintains a zero balance. This can be accomplished by having the account's balance "swept" into another account at the end of each business day. As a result, the zero balance account is often known as a "sweeping" account.

Furthermore, the zero balance account’s balance is transferred to a master account, and several zero balance accounts may feed into the same master account. If the ZBA requires any funds, the exact amount can be transferred, which is then wired onwards, keeping the account at zero. The only aim of a zero balance account is to handle payments. They can't be used to invest in the long run or earn interest.

Companies often prefer zero balance accounts to ensure that funds are widely available throughout various departments, keep more control over cash allocation, and minimise surplus amounts in separate accounts. Petty cash, payroll, and other related needs are handled via these accounts.

Highlights

- A zero balance account (ZBA) maintains a zero balance.

- A zero balance account’s balance is transferred to a master account.

- Multiple zero balance subaccounts can exist in a company.

Frequently Asked Questions (FAQs)

What is the function of zero balance accounts?

Source: © Goodstocker | Megapixl.com

A master account is a central place where an organisation's funds can be managed. For example, when cash is needed in the ZBA checking account to pay a charge or transaction, they are transferred in exact amounts from the master account because it is automated, so there is no need for a worker to conduct it manually.

Instead of having small dollar amounts idle in several subaccounts, more funds are available for investing by concentrating funds in the master account. Moreover, the master account has several additional perks when contrasted to the subaccounts, such as a greater interest rate on balances.

The master account isn't a checking account; it's a different, more profitable bank account. As a result, ZBAs increase the amount of money accessible for investment while lowering the danger of overdraft penalties.

When a ZBA is used to finance the organisation's debit cards, all the activities on the cards is pre-approved. Because there is no idle cash in the ZBA, a debit card transaction cannot be completed unless money is added to the account. This can aid in the management of corporate expenditure by reducing the chance of unauthorised activities occurring.

Moreover, managing incidental expenditures across a big corporation using a ZBA as a spending control tool is extremely useful. It is more probable that necessary approval procedures will be followed before completing the purchase if instant access to funds via debit cards is limited. This makes it simple to track transfers and reconcile accounts.

What are the benefits of having a zero balance account?

The following are some of the benefits of having a zero balance account.

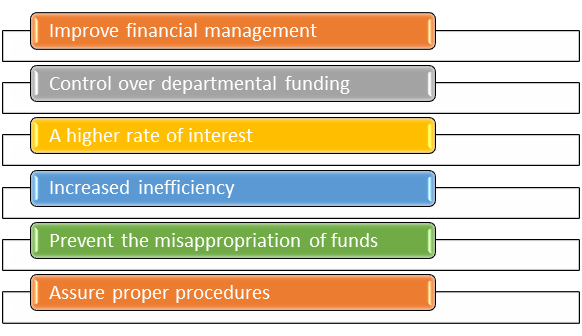

Improve financial management

To enhance financial management and facilitate transferring cash more effectively, an organisation may have many zero balance accounts. This could involve developing a separate ZBA for each department or function to keep track of charges daily, monthly, or annual.

Separate ZBAs may be involved in the financial management of specific short-term projects or those at high risk of unforeseen overages. The use of zero balance accounts aids in the prevention of excessive charges that occur without sufficient authorisation and notification.

Control over departmental funding

Instead of having different accounts for each department where money can be allocated, a zero balance account allows the precise money needed to be moved precisely when required, eliminating surplus funds from being kept in the account, resulting in inefficient spending.

A higher rate of interest

Because the master account typically earns a higher interest rate than the sub-account (zero balance accounts aren't designed for use as checking accounts), having funds in this central place pays well.

Increased inefficiency

Because zero balance accounts are automated, there is no need for employees to empty the account at the end of each day, and they also don't have to worry about time zones if their offices are in different locations.

The bank has processes to ensure that the account is swept to zero at EOB, regardless of where the office is located. In addition, if a cheque is drawn for the account, the ZBA automatically deducts the exact amount required to clear the cheque, eliminating the need for employee intervention.

Prevent the misappropriation of funds

Companies must confirm the transfer of funds from the master account into any sub-accounts, ensuring that no unauthorised expenditure occurs. If a business card is used for a cost that has not been permitted, the payment will not be processed, which is excellent for fraud protection.

Assure proper procedures

Departments that require funds will have to submit a request because zero balance accounts have no funds. Individuals may guarantee that protocols are always maintained by insisting on official requests for funding, which also helps avoid overpaying on projects.

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...