What is wealth management?

Wealth management is an approach to wealth creation and sustaining wealth. Wealth management professionals evaluate customers financially and recommend avenues for wealth creation and sustainability.

The emphasis is on financial sustainability alongside capital appreciation. It also includes adequate risk management and managing retirement. Wealth management professionals provide advice to clients for tailored wealth management solutions.

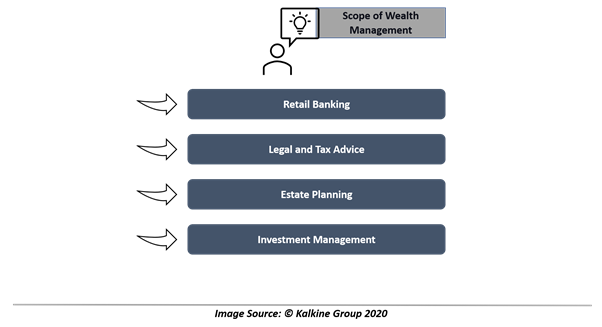

They engage in discussions with clients and recommend a variety of financial products to manage wealth and effectively achieve financial goals and freedom. The scope of wealth management spans across financial products, including retail banking, legal and tax advice, estate planning, investment management.

Wealth management seeks to deliver growth and long term wealth appreciation. Most of the banks run separate wealth management services under businesses like private banking, private wealth or wealth management.

Traditionally wealth managers had been engulfed with managing affluent class of people or High Net worth Individuals (HNIs) with large and complex asset base. Wealth management industry is also undergoing a change in investor expectations, digitisation, technological advancements, intensive competition etc.

Retail investor expectations are also evolving as they are inclined to access asset classes, which are traditionally privy to HNIs or institutional clients. Also, the wealth management process continues to evolve with the changes in the industry and customer preference.

Simply put, it is a standard practice for investors, especially household investors, to maximise money and investment along with adequate risk management and sustainability. Increasingly wealth management solutions are embracing a tailored approach because of broadening and rising clients expectations.

Advisors attempt to understand the financial situation of the clients and optimise future outcomes of financial decisions, thus improving the future financial situation of clients. It becomes vital for advisors to deliver advice that is in the best interest of customers.

Moreover, wealth management is essentially a consultative process of interacting with clients to understand financial situation, evaluate goals, develop strategic plans to achieve goals, recommend necessary products to implement strategic plans, and monitor risk and sustainability of solutions.

Not all people seeking to manage wealth afford wealth management services. Given that services are traditionally used by affluent people, the wealth management industry has been accessible to a small section of people who can afford.

What is the wealth management process?

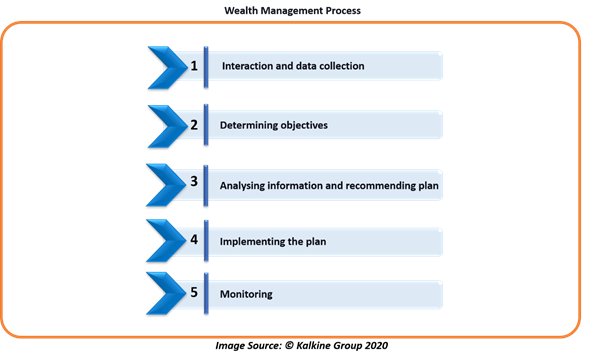

Wealth management process is an end to end management of the financial situation of a client and continues to evolve along with changing financial situation of the client. Below is a basic wealth management process.

Interaction and data collection: Wealth management professional interacts with prospective clients and enumerate the basic financial situation and financial goals. They also examine the assets, liabilities, retirement planning, insurance costs, income tax situation, cash expenses.

All the data is required to assess the financial situation of the client. With data and specified financial goals, wealth management professionals devise a plan for the clients.

Determining objectives: In this stage, the emphasis is on the financial objectives of the clients. It becomes important to assess the objectives of wealth management because financial goals vary from person to person. Wealth managers review clients expectations and engage in discussions.

They along with clients devise objectives for investments, retirement planning, insurance, income tax, business and also analyse the cash flow of the clients. After considering the expectations of the clients, objectives are defined for the clients.

Analysing information and recommending plan: Now wealth managers have expectations of the clients and objectives for the financial goals. The information is analysed and to develop an appropriate strategy. The strategy is developed considering objectives that are of most importance to the clients.

All inputs by the clients are considered duly for an effective strategy. After completing the analysis, the strategy is communicated with the clients to achieve stated financial goals and deliver on expectations.

Clients also come up with suggestions, improvement in the strategy, and evaluate the strategy. Wealth managers ensure that clients understand the aspects of strategy, and nothing is missed with respect to financial planning and goals.

Implementing the plan

Implementation is a crucial part of the wealth management process, and devised strategy is executed by wealth managers. This process usually includes implementing recommended changes by wealth managers like buying a specific insurance policy, retirement plan or investments.

Monitoring: It becomes imperative for wealth managers to monitor the process and recommend necessary changes to the process. Wealth managers attempt to ensure the strategy is aligned to achieve its goals considering the changes in the economic environment as well as the financial situation of the clients.

What are wealth management products?

Some basic wealth management products include:

Insurance: As a risk management product, insurance helps to minimise financial risk arising out of expected events. Under this, a wealth manager evaluates the insurance policies with the clients such as health insurance, life insurance, property insurance, motor insurance.

They also evaluate insurance policies and recommend a suitable policy when required or when the existing policies are not aligned with the strategy.

Retirement Planning: Retirement planning is one of the objectives of wealth management. Investment in retirement products helps people to achieve retirement goals. Wealth managers evaluate existing retirement products and recommend appropriate products.

Under this, the investments are directed towards pension plans, annuities and fixed income investment with relatively minimal risk.

Investment: Wealth creation is also an important part of wealth management. It is achieved through managing investments of the clients. With changing economic environment, investment management strategy also evolves continuously along with investment recommendations.

Clients are recommended to invest in asset classes such as equity, fixed income but not limited to ETFs, mutual funds, commodities and currency. Wealth managers usually have internal capabilities to recommend appropriate investment avenues for clients.

Taxation and loans: Wealth managers seek to avail all possible taxation benefits for the clients to manage wealth efficiently. They may recommend clients to invest in a product that delivers taxation benefits while recommending an effective tax plan by managing assets.

Debt is one of the liabilities for the clients, and repayment of debt also impacts the financial situation of the client. Wealth managers recommend efficient loan options available for the clients. They also evaluate existing loans of clients and advice to refinance wherever possible and beneficial.

Please wait processing your request...

Please wait processing your request...