What is a Waiver?

A waiver is a lawfully binding provision in which any party in a contract agrees to forfeit their claims voluntarily in the contract and the other party is not liable.

When two or more parties enter a contract, parties often decide to forfeit part of their respective claims or rights. The parties might use a waiver that is expressed either in a written form or through a specific action. Through these actions, either party officially gives up a right, claim or privilege.

For instance, two parties enter a contract and one of the parties might sign a waiver which states that they will not take any kind of legal action if there is unintentional wrongdoing by the other party.

Summary

- A waiver is a lawfully binding provision in which either party agrees to forfeit their claims voluntarily in the contract and the other party is not liable.

- When two or more parties enter a contract, parties may decide to forfeit part of their respective claims or rights.

- The parties might use a waiver that is expressed either in written form or by performing a specific action.

Frequently Asked Questions (FAQs)

What is the significance of a waiver?

The party, person or organisations who is signing a waiver is surrendering their rights to take any course of action or claim in case something goes wrong. In most of the cases, a party will only sign a waiver when they are receiving any kind of benefit in exchange for forgoing their rights or claims.

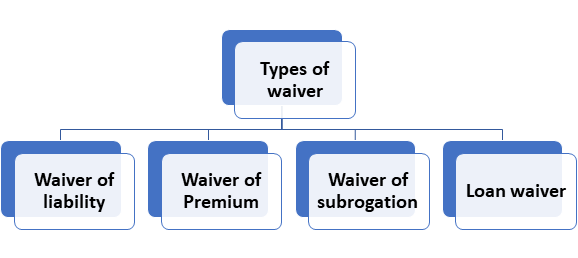

What are the types of waivers?

There are four types of waivers –

- Waiver of liability – There is a provision in the waiver of liability contract which states that the participating parties do not have the rights to sue the organisations in case of injuries faced by the parties. When an individual signs a waiver of liability contract, the individual acknowledges and accepts the risk associated with the events which will be performed.

Furthermore, the individual relieves the other party from all the liabilities in case an incident occurs in the future. For example, in the time of pandemic (like COVID -19) airlines industry are asking the passengers to sign a contract before taking the journey. The contract states that the airlines will not be responsible in case the passengers get infected during their journey.

- Waiver of Premium - This waiver is generally used by the insurance companies, in which the insured are relieved from paying the premium payment under specified conditions (mentioned in the contract). For example, in the case of some life insurance, the clause states that the insured is not liable to pay the premium if the person is suffering from a disability or is dead.

As mentioned earlier, the parties enter a waiver only when both parties are benefiting from the contract. Similarly, the insurer might charge a higher premium if the insured parties opt for non-payment of premium under a specified situation. For example, the insured house owner is not liable to pay the house insurance premium amount when they suffer from a disability. However, during the lifetime of the insurance, the company might charge a higher premium.

- Waiver of subrogation - In few cases, the property or insured person might be affected because of the activities of a third party, after which the guarantor must reimburse for the damage. The right to subrogation permits the insurer to compensate the loss by asking for a claim from the third party. After entering or signing a waiver of subrogation contract, the insurer’s right to ask for a claim is taken away and they are exposed to a higher level of risk.

For instance, a contract is established between the factory workers and the owner of the factor which includes the waiver of subrogation, that is, in case the work suffers can cause of damage then he/she cannot contact the factory owner. In such cases, the insurance companies might charge a higher premium as they are exposed to the risk worker is suffering while working at the factory.

- Loan waiver – A loan waiver takes place when the lender relieves the borrower from the obligation to repay the loan voluntarily. Either the loan is waived off partially or fully, that is, the borrower must pay part of the loan amount or no amount. For instance, the loans are waived off in the educational institutes, when the borrower fulfils a certain criterion.

Image source: Copyright © 2021 Kalkine Media

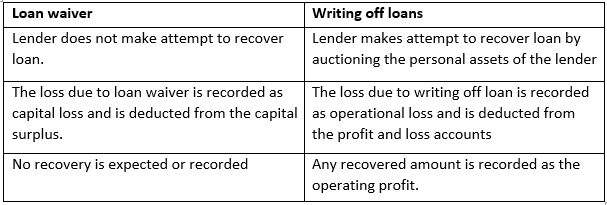

What is the difference between writing off loans and waiving?

Waiving off the loan states that the borrower does not have the obligation to repay the loan, partially or fully. The unpaid amount of the loan will be borne by the lender and no actions can be taken against the borrowers. Generally, the waived off loan amount is deducted from the capital reserves, resulting in a reduction in the capital surplus amount. A capital reserve is created through non-operational activities, such as selling off the factory waste product or interest income. Thus, a loan waiver is a capital loss.

Whereas, writing off the loan is an operational loss for the lender and is deducted from the profit and loss accounts. The loan is written off when the borrower is not in a situation to repay the loan either he/she is declared bankrupt or in another situation. So, the lender must clear their balance sheets and write off the loan. However, the lender can make attempts to recover the amount by either auctioning the personal belongings of the borrower or other means. Any recovery made is recorded as organizational profit.

Writing off loan VS loan waiver

Image source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...