What is vertical integration?

Vertical integration is an arrangement of an enterprises’ supply chain in a way that helps to fit in different stages of the production process and supply chain into its business. A company may seek to create a competitive advantage by in housing every outsourced operation.

The intention of vertical integration is not only to gain market superiority but also for securing distribution channels and optimising cost structure. In nutshell, it is used to have control over the Industry’s Value Chain.

Management tries to show shareholders that a potential business transaction will enable a vertical integration, which will lead to synergies and better earnings. But there always remains risks of underachievement and transaction benefits may not yield the anticipated benefits.

Companies aggressively look to grow inorganically through mergers and acquisitions. Oftentimes, a potential vertical integration is the main driver behind such transaction.

There are two types of vertical integration: forward integration and backward integration.

Forward integration is when a business controls retailers and distributors of its products. An example of this could be an oil and gas company with gas stations.

Backward integration is a vertical integration strategy where a business seeks to control suppliers, and therefore the inputs used in the production of goods or services. An example of backward integration could be a restaurant owning a farm to source its groceries.

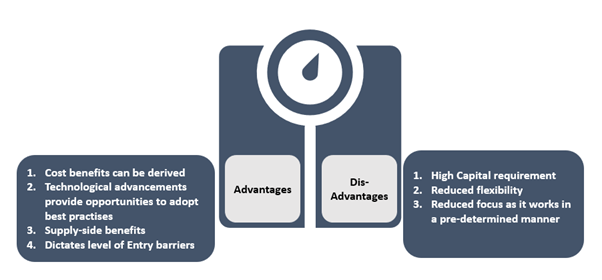

What are the advantages and dis-advantages of vertical integration?

Image Source ©Kalkine Group 2020

Advantages

Cost benefits

In the majority of the cases, the primary intent of vertical integration is to eliminate or at significantly save costs, especially buying and selling costs.

A combined entity is able to run integrated operations across the organisational structure, including manufacturing, purchase, sales, promotion, market research etc. In this way, companies gain competitive advantages over other companies. An organisation goes in for vertical integration when the cost of making the product in the house is cheaper than buying from the market.

Technological advancements

When two businesses combine for vertical integration, there are opportunities to adopt best practices of the two entities.

In a backward integration, the opportunities to exploit technological capabilities are higher because of the integrated production and distribution activities. Research and development function of the combined entity is provided with the enhanced synergy benefits.

However, the potential new innovations by the combined entity are dependent on effective coordination of marketing and technical functions.

Supply-side benefits

Sometimes companies that are seeking to acquire other company are mainly driven by the intention to assure the supply of their inputs. For example, a cell phone maker may prefer to acquire a business that is producing chips, batteries, processors.

Businesses with high fixed costs are vulnerable, especially in times of supply-side disruptions, which can lead to severe damage in their operational performance, therefore need for higher capital might come about.

Entry barriers

Incorporating stringent entry barriers is perhaps the motive of many potential transactions in the M&A space. Competition regulators also scrutinise M&A deals to promote a business environment that does not suppress competition.

The intensity of vertically integrated business dictates the level of barriers to entry as well as competition. When two players combine in an already concentrated, it would eventually discourage smaller new entrants in the market.

But entry barriers could only be incorporated effectively when the vertical integration of two companies is successful.

Disadvantages

Capital requirement

An acquisition is already a costly affair for most transactions, given that the bidder is paying a premium for potential future cash flows or earnings. After completing the acquisition, the entities engage in integration of not an only business process but cultural and values as well.

The integration process also incurs additional costs of the combined entity. For companies seeking vertical integration, it becomes imperative to chart out operational efficiencies and potential cost savings to deliver better returns.

Since investments and capital intensity is already at a high end in an M&A deal, the companies with vertical integration should focus on delivering expected synergy benefits. Otherwise, the chances of a successful deal are relatively lower.

Reduced flexibility

A combined, vertically integrated entity has less independent decision-making point of control. The objective of a vertically integrated business is to operate in a certain way. Businesses with relatively reduced flexibility may fail to adapt to ongoing changes in the industry.

For instance, the rapid emergence of e-vehicles has posed an existential crisis for ICT engine businesses. Similarly, automobile parts manufacturers, especially engine part supplier, are facing an existential crisis. If a business has acquired engine part supplier, it may write off the acquisition in future.

Reduced focus

A vertically integrated is expected to operate in a predetermined manner. This could derail the existing focus and specialisation of the entity or its business units. Effective vertical integration will likely require distinct approaches to managing business verticals.

Please wait processing your request...

Please wait processing your request...