What is meant by venture capital?

Venture capital is a form of financing for startup companies that have a potential to grow. Investors pick companies they think would grow in the long term and invest in them. The capital given to these companies is called venture capital and the investor providing the money is known as venture capitalist.

Investing in a new company is risky and has the possibility of the investment not coming to fruition. Thus, venture capitalists are generally wealthy set of people who have lots of capital to spare. The investors may be compensated by having decision making authority over the company, apart from the returns offered to them.

The term “venture” added in the front refers to the risky nature of the investment as it involves startup companies that do not have an established name yet.

Who is a venture capitalist?

Venture capitalists may be wealthy individuals who function separately, or they can also be institutional investors. These venture capitalists may choose to provide their inputs not just in the form of capital but also through their valuable expertise. Additionally, just the presence of a big venture capitalist with a company can add prestige to it and open many doors for it.

The return to these investors depends on the growth of the company. Many of the well-known businesses that started as a small venture have received a backing from venture capitalists and grown exponentially. Thus, if a venture capitalist has expressed an interest in a business, then it is highly likely that the business has ample amounts of potential which is why the investor took interest in it.

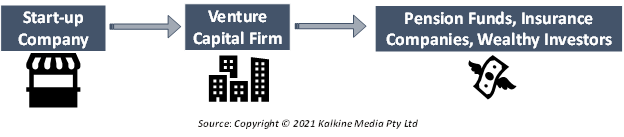

These venture capital firms in turn obtain their capital from pension funds, insurance companies and wealthy investors. These firms usually have analysts to decide which business is the best one to invest in. Other types of investors include angel investors who may not invest in new businesses and may not hold as much capital funds as venture capital firms. Thus, venture capitalists have a high appetite for risk.

How do venture capitalists work?

Venture capitalist often ask for stake in the company in exchange for the funds provided by them. This is known as equity financing, i.e., the investor takes an equity position for a particular level of funds provided by him.

However, not all types of businesses would be comfortable with equity financing. Usually, firms that are at a primitive stage accept the condition of giving away equity to the venture capitalist. Many entrepreneurs prefer to keep control of the business restricted to themselves. Thus, venture capital would be a poor choice for them.

Often venture capitalists also help by providing their expertise instead of only giving away funds to the company. Thus, a well-established fund going through a slowdown in business can gain from such expertise rather than through funds. Also, fresh businesses that do not have much knowledge of the market can use the knowledge of a VC to their advantage.

Venture capitalists may provide their services to a company for many years in exchange for voting rights and major decision-making rights. However, this comes to a stop when either the shares of a company gain in value or usually when the company goes public. This is the time when VCs exit the company after having made extensive profit off it.

What are the stages of venture capital funding?

Once a company receives the approval of a venture capital firm, there are the following stages of funding the follow:

- Seed capital: Usually the venture capital firm passes on the entrepreneurial idea to the various investors engaged with the firm. The venture firm convinces these investors to put their money int the company. After thorough research, investors decide to go ahead with the funding.

- Startup Capital: This is the stage wherein the business idea is brought to fruition. Such a process usually starts with a prototype or a sample model that is tested and developed more extensively. The entire development process is generally monitored by someone from the venture capitalist’s team. Things only move ahead if the investor is convinced at this stage too.

- Early-Stage Capital: This stage involves significant levels of funding as the investor funds further production process in the company. Additional costs like marketing and distribution are also covered under this stage.

- Expansion Stage: This is the stage wherein the company expands its business through the help of diversification and differentiation of products. For a company to reach this stage, it must be profitable in the first place. This step comes 2-3 years after the inception of the firm.

- Bridge/Pre-IPO Stage: This is the last leg of the VC funding wherein a company has established itself in the markets. However, the company may not necessarily decide to go public. The capital received from the IPO could be beneficial for the firm in case it decides to go ahead with merger, elimination of competitors, research, and development, etc.

What are the advantages of venture capital?

- No repayments: Business owners do not have the compulsion to repay the amount received as funding from the venture capitalist. This is true even in the case when the company is not able to be a successful venture.

- Connections: Often various venture capitalists come equipped with a solid background and a network of connections nationally as well as internationally.

- Latest technology: If a firm is unable to afford new technology, then the venture capital would invest in it as his own profit depends on the company. Thus, a firm gains access to resources that it otherwise would not have been able to afford.

What are the disadvantages of venture capital?

- Loss of ownership: Funding is done by way of equity financing which requires the business owner to give away some stake of his company to the investor.

- Time-consuming process: Venture capital process can be too slow for certain entrepreneurs as it requires certain time-related targets to be met before full funding is released to the business. It also requires a high level of market research which may take up time.

- Conflict of interest: As more and more people are added to the board, decision making is more likely to become a tedious process. Thus, the addition of investors to the board can be challenging.

Please wait processing your request...

Please wait processing your request...