What is variable overhead spending variance?

Expenditure or spending variance depicts the difference between the actual amount associated with a specific expense and the expected value associated with the same expense. Variable overhead expenditure variations are the costs related to running an organisation, but these vary according to job fluctuations or activity rates. As product release rates increase or decrease, different overheads also vary, usually in direct proportion.

At a given production level over a given period, variance is basically the difference between what was supposed to cost and how much it ended up costing. Therefore, it can be an important indicator when comparing different accounting methods, asset management, outsourcing of certain business features or new suppliers.

Summary

- Spending variance depicts the difference between the actual amount associated with a specific expense and the expected value associated with the same expense.

- Spending overhead variance can change due to price fluctuations, consumption, and efficiency of performance.

- Increased efficiency helps reduce variable overhead spending variance and, as a result, total overhead variance rate.

Frequently Asked Questions (FAQ)

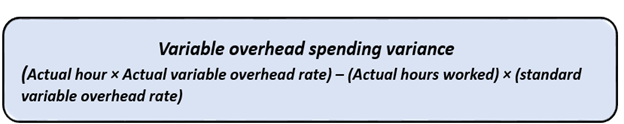

How is variable overhead spending variance calculated?

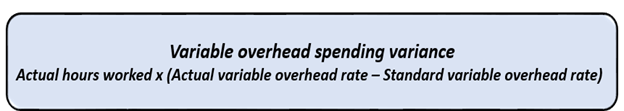

Variable Overhead (OH) Spending Variance is the difference between Actual Variable OH Expenditure and the Standard Variable OH Rate per hour multiplied by actual hours worked. The actual hours are the number of machine hours or hours of work in a period.

It is the difference between the variable production costs and how much it costs if given the level of activity over time.

The average level of variability can be expressed in terms of machine number or working hours. So, for example, in the case of a very strong manufacturing business, a high degree of variability can be expressed in terms of the number of working hours and the case of automatic production processes, a standard rate based on the number of hours put in by a machine.

Usually, companies have a mixture or a customised mix of automated business processes that may require both the basis of absorbing the variable OH.

Source: Copyright © 2021 Kalkine Media Pty. Ltd

or

Source: Copyright © 2021 Kalkine Media Pty. Ltd

Spending overhead variance can change due to price fluctuations, consumption, and efficiency of performance. Price and volume changes are in line with performance variables. However, wastage of working hours is ineffective and can cause further financial disparities or increasing spending overhead variance.

Similarly, Increased efficiency helps reduce variable overhead spending variance and, as a result, total overhead variance rate. Variable overhead prices are often uncontrollable for performance managers; however, price changes also cause variability. Therefore, variable overhead expenditure variance can occur due to changes in the overhead components' price or effectiveness of the expenditure. One part of the spending overhead variance is manageable for operational administrators, which is efficiency.

Source: © Stokdrozdirina | Megapixl.com

What are the possible reasons for a favourable variance?

Favourable variable overhead spending variance shows that the company has incurred lower costs than the average cost.

Possible reasons for a positive variance include:

- Scale economics (e.g. increase in the order size of indirect items leading to more discounts on purchases).

- Decreased standard price for indirect supply.

- Effective cost control (e.g. energy efficiency through the installation of energy-efficient equipment).

- Scheduling error (e.g. failure to look at the expected curve of a learning curve that may properly lead to future misuse of the material).

- Extra work efficiency by eliminating waste and idle working hours.

- Bulk purchases or indirect depreciation.

- An unexpected decline in energy prices, e.g., electricity levels are declining.

- The adjustment to unfamiliar budgets can create a positive but inaccurate variance.

- Changes in the demand and supply of indirect inputs, not budgeted by the management.

- Due to technological changes within the company, which leads to lower fuel and energy costs.

What are the possible reasons for an adverse variance?

Possible causes of negative variance include:

- An increase in low national wage rates leading to higher costs of indirect labour.

- Ineffective cost control (e.g., not standardising batch production value resulting in higher set costs).

- Scheduling error (e.g., failure to check for an increase in levels of power units operating at the time allotted task time).

- Decreased efficiency, e.g., unskilled workers.

- Increased staffing costs or capacity building.

- A seasonal or sudden increase in indirect prices.

- Poor planning can lead to abnormal budget estimates that may result in inconsistent variability.

- Due to the demand for labour in the market, it increases the average working hours.

- The use of outdated and inefficient equipment also leads to higher production costs.

- The use of indirect non-skilled jobs also increases overall productivity.

Please wait processing your request...

Please wait processing your request...