What is a variable annuity?

A variable annuity is a contract sold by an insurance company that guarantees future payments to the holder based on the performance of the underlying securities listed in the contract. The issuer provides the holder with a minimum payment, but the rate of return on the underlying assets may chance. One can either make a single purchase payment or make multiple purchase payments to buy an annuity.

Buying a variable annuity gives individuals multiple investment options as well, such as mutual funds that invest in stocks, bonds, money market instruments or even all three of them.

Summary

- A variable annuity is a contract sold by an insurance company that guarantees future payments to the holder based on the performance of the underlying securities listed in the contract.

- A variable annuity works in two phases, namely the accumulation phase and the annuitisation phase.

- The income generated from a variable annuity is tax-deferred. However, tax deductions are made during the time of withdrawal of the money.

Frequently Asked Questions (FAQ)

How does variable annuity work?

A variable annuity works mainly in two phases:

Accumulation phase

The variable annuity holder makes purchase payments during the accumulation phase. The amount credited in your annuity account will be slightly lesser than the amount you have paid because charges will be deducted. The annuity holder then gets a wide range of options as to where he would want to invest. One can easily switch from one investment to another form of investment during the accumulation phase.

Payout or annuitisation phase

The second and final phase of a variable annuity is the payout or annuitisation phase. In this phase, the annuity holder receives payment in a regular interval as a steady cash flow once you decide to annuitise your contract. The annuity holders also have the choice to decide the period of receiving payments. In most contracts, the period stretches up to either 20 years or for the entire lifetime. The annuity holder may also choose to receive a fixed amount of money every month or receive income based on the performance of the assets.

Image source: © Rummess | Megapixl.com

What are the features of a variable annuity?

Although every variable annuity is unique, some of the common features in every variable annuity are stated down. However, all the features mentioned below are chargeable, and one needs to pay extra to receive these perks.

Insurance benefits

Every variable annuity offers insurance benefits to its holders. For example, let us assume a situation in which the annuity holder dies before the insurance company pays the income payments. In the case of a variable annuity, several contracts assure the beneficiary to get paid at least some specified amount. There are other benefits, such as the power to withdraw money up to a certain limit every year throughout his/her life, given to the beneficiary after the annuity holder's death.

A variable annuity is tax-deferred

One does not need to pay federal tax on the income earned through the investments involved with a variable annuity until a withdrawal is made or payments are received, or death benefits are paid. However, one can quickly transfer money from one variable annuity to another without paying any federal tax. This is because taxes are only deducted during withdrawal at a regular federal income tax rate only.

Periodic income payments

Another wonderful feature of a variable annuity is that it lets the annuity holder receive periodic income payments for a specific period or a lifetime. The process of converting your investments into regular income payments is known as annuitisation.

What are the other types of the annuity?

There are, in total, three other types of annuities, excluding variable annuity. They are:

- Fixed annuity

A fixed annuity offers a fixed income to the annuity holders at a fixed, regular interval.

- Immediate annuity

An immediate annuity offers a lump-sum amount of premium at once to the annuity holder instead of paying him in multiple intervals. One of the benefits of an immediate annuity is that it will offer a good amount of money at periodic intervals. Therefore, it is ideal for people who are almost about to retire and need a lump-sum amount of money at fixed intervals.

- Deferred annuity

A deferred annuity can be referred to as the one in which the annuity holder needs to develop a corpus to purchase the annuity during the retirement period. This type of annuity contract can be purchased with the accumulated by an individual from his pension plan.

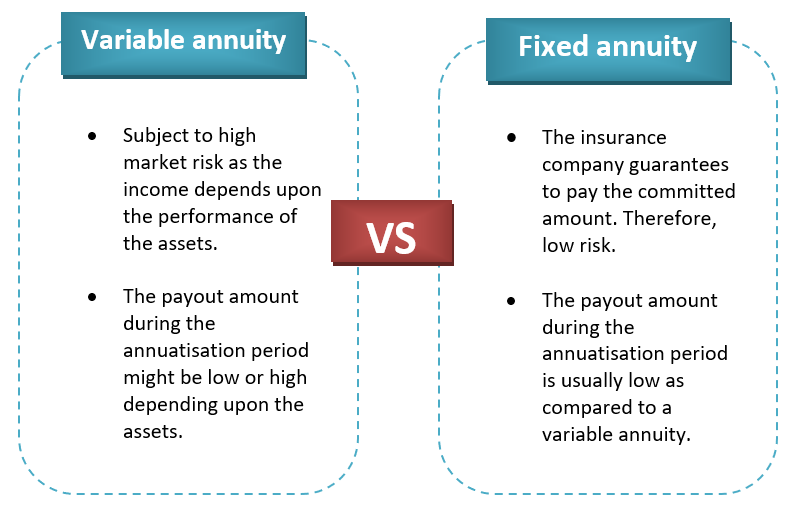

How does a variable annuity differ from a fixed annuity?

Image source: Copyright © 2021 Kalkine Media

What are the advantages and disadvantages of the variable annuity?

How does a variable annuity differ from a fixed annuity?

- The income from the variable annuity is tax-deferred. Thus, there is no need to pay tax on the income generated from a variable annuity contract unless one wants to withdraw the money.

- One can easily modify the flow of the income when it comes to the variable annuity contract.

- You don't have to worry about death before payout, as your beneficiary will receive guaranteed death benefits.

- The variable annuity fund is mostly out of reach for the debtors and creditors.

Image source: © Designer491 | Megapixl.com

The following are the disadvantages of the variable annuity:

- The variable annuity contracts are subjected to higher market risk as it depends on the performance of the underlying assets.

- Withdrawal of money from the account in times of emergency may result in tax deductions and surrender fees.

- Hefty fees involved with the variable annuity.

Please wait processing your request...

Please wait processing your request...