What is a Treasury Yield?

Treasury yield represents the total amount of interest earned (in percentage terms) on US government's loan commitments like Treasury bills, notes, and bonds. In other words, treasury yield is the effective loan cost that the US government pays to acquire cash for various timeframes.

Image Source: Shutterstock

Understanding Treasury Yields

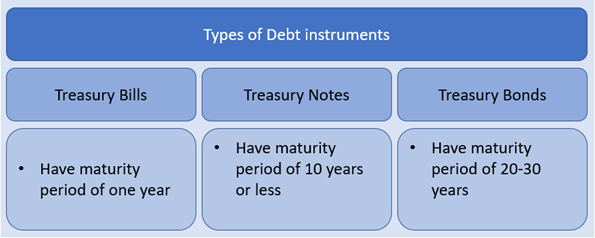

The US Department of Treasury issues various types of debt instruments to raise capital to fund multiple projects. The department sells those instruments to pay for US debt. The types of instruments issued by the government include:

- short term maturity instruments like Treasury bills (mature within a year).

- Treasury notes (issued with a maturity period of 10 years or less).

- Treasury bonds (issued for investors’ long term investment goals of 20-30 years).

Kalkine Image

How do they work?

Financial specialists that buy these Treasuries indirectly loan the government money. Treasuries are considered the safest way to invest the money as they come with the US government’s credit and good faith. Investors earn profits in the form of returns, commonly known as “Coupons” for investing their money. The amount of investment yield for lending money to the government depends on the market’s demand and supply trend.

The US Department of Treasury issue the bonds at an auction to all the successful bidders. The bonds come with a fixed interest rate and face value. Fixed interest rates are the maximum rates that an investor can earn. If the demand for bonds at auction is high, the bonds are issued to the highest bidders at a relatively higher price than its face value, lowering the yield. On the flip side, if demand is less, bonds are issued at a lower price than their face value to the bidders allowing them to earn more yield.

When the demand for bonds is less, investors can purchase them at a relatively lower price than their face value, earning more profit. On the other hand, when the demand is more, bonds are sold at higher prices than their face value, reducing the yield. However, investors can resell the bonds in a secondary market if they don't want to hold them for the full tenure.

Treasury Yield as an Economic Indicator

Yield curves can be used as an economic indicator. One can predict the future of the economy using Treasury yields. The more extended the period on a Treasury, the higher is the yield. Financial specialists require a better yield for keeping their money linked up with the government for longer periods. The higher yield on bonds provides extra confidence to the investors regarding the certainty of the economy. Investors keen to flow their money in these government schemes for a long term basis, keeping their money safe.

On the flip side, when the yield on long-term bonds is less than short-term notes, it creates a situation for economic recession and brings uncertainty in an investor’s mind. In such a case, investors aren’t keen to tie their money with the government for an extended period.

The yield on T-Bills, Notes, and Bonds

Image Source: Shutterstock

T-bills offer zero-coupon that has no interest payment. T-bills are issued at a lower price compared to their face value. Investors can buy the bills in the weekly-auctions. The difference in the face value and auction price is regarded as the return on investment and can be considered as Treasury Yield on Treasury Bills. Two methods, namely, Discount Yield and Investment Yield, are used by the US Treasury Department to calculate the yield on T-Bills.

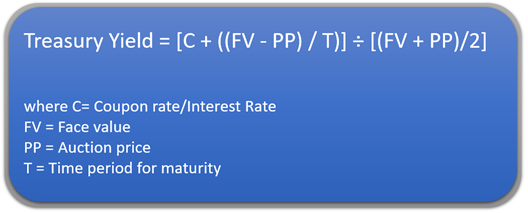

On the other hand, T-Bonds and T-Notes come with a coupon payment and a maturity value. Coupon payments are received by the investors on a six-month basis, whereas face value is received on its maturity. The bonds and notes can be purchased at discounted and hyped prices depending upon the demand-supply scenario, which decides the auction price to sell bonds and notes. A premium option to buy bonds and notes is also present but accounts for a lower yield.

The formula for calculating the yield on T-Bonds and T-Notes is as follows:

Please wait processing your request...

Please wait processing your request...