Trailing Twelve Months

What is TTM?

Trailing 12 months (TTM) is an expression used to show the financial data related to the previous 12 months back-to-back. It may or may not be the 12 months of a single financial year. As on any date, if an investor wants to know financial data for the past successive 12 months, they will take out the trailing 12-month data. The phrase is popularly abbreviated as 'TTM'. So, if investors want to know the net profit margin of the last 12 months, they will have to get the TTM net margin as of date. However, since financial data is periodic, the TTM data is computed using quarterly or monthly data, as it may be available. Therefore, TTM data for various financial results may not be comparable.

Summary

- TTM shows the previous 12 months' financial data, which may or may not be from a single financial year.

- TTM is used because it is a useful time frame to state financial metrics.

- It allows for more up-to-date financial metrics.

Frequently Asked Questions (FAQ)

Where to find TTM data?

The trailing 12-month or TTM data is often taken from the available reported balance sheet numbers and regularly updated quarterly data. Some analysts also tend to take an average of the first and last quarter to compute TTM data; it is usually done to comply with generally accepted accounting principles (GAAP). For items reflected on a company's cash flow statement like capital expenditures, dividend payments, etc., analysts take the last four quarters of reported available data from the income statement.

The TTM revenue data is useful to understand and estimate the top-line growth of a company. It can also precisely show the source of this growth. However, utility of TTM revenue is overshadowed by other commonly use profitability metrics like, earnings before interest, tax, depreciation, and amortisation (EBITDA), operating income, etc.

In case of financial instruments, TTM yield shows the percentage of income an investor could earn from their portfolio over last 12 months. For this a weighted average of the yields on all portfolio assets is taken into consideration. Similarly for a fund, TTM yield is computed from the yields of stock, bonds, or other securities where the fund has invested money.

Image showing acronym TTM, Source: © Dizain777 | Megapixl.com

How to compute TTM financial data?

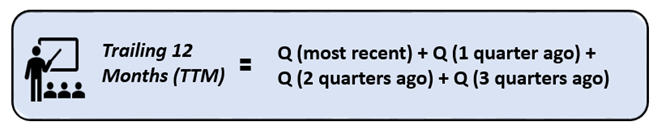

The easiest method of getting TTM data is to add data from the previous quarter to the three quarterly periods previous to it. The fiscal year in which they fall doesn’t matter much. Just start with the most recent quarter–so say for TTM computation in July 2020, one should take Q2 data of 2020, ending in June 2020 and go back and add preceding three quarters data to it.

The formula for TTM -

Image showing TTM formula, Source: Copyright © 2021 Kalkine Media

Example

To compute the trailing 12 months revenue for Aramanda company, we will take data and compute revenue as below-

If the latest completed quarter of Aramanda company is Q3 of 2021:

- Q4 of 2020: $15 billion

- Q1 of 2021: $18 billion

- Q2 of 2021: $20 billion

- Q3 of 2021: $19 billion

The trailing 12 months revenue for Aramanda company will be $72 billion.

There is another more complicated formula for computing TTM data. However, analysts use it more frequently as it is better adapted to tools and datasets most used by them. The calculation begins with taking the company's annual financial report and then adding the reports for any quarters following the reported period. From this, then analysts subtract the corresponding quarters given in the annual report.

The alternative formula is -

Trailing 12 Months = Most Recent Quarter(s) + Most Recent Year – The Corresponding Quarter(s) 12 Months Before the Most Recent Quarter(s)

Annualised TTM numbers are extremely useful for analysts because they reflect a more current picture of the financial than the last fiscal year's numbers. Such annualised TTM numbers are also less volatile than quarterly numbers. TTM numbers also smoothen the effects of seasonality.

Why companies use TTM?

Companies use TTM data for internal assessments. These evaluations include calculating key performance indicators like net profit margin or EPS. Companies can also use TTM financials to assess year-over-year trends like revenue growth. Consider TTM revenue not just shows the amount a company has earned during the trailing twelve months but also determines growth experienced and the reason for growth is coming from.

What are some limitations of TTM data?

Source: © Wavebreakmediamicro | Megapixl.com

TTM financial data also have some limitations, like any other data computation method. For example, it cannot determine the profitability of a company or its capability to generate revenues. This issue in the TTM method makes analysts ignore it when they are focused more on profitability. However, it can still be vital in determining strengths and weaknesses of a business's revenue-generating practices.

Some businesses have complicated accounting entries used by accountants to determine quarterly or annual financial data. Therefore, conducting a trailing 12-month analysis without considering the effect of these entries can result in making inaccurate assumptions for determining a company's financial position.

In addition, manually generating TTM data may also be prone to manual errors as not all businesses will have datasets that can automatically determine TTM financials.

Please wait processing your request...

Please wait processing your request...