What is a takeover?

Usually, a takeover happens when a firm makes a bid to acquire or take control of another firm. Generally, the takeover is conducted by purchasing a majority stake in the firm targeted. In the acquisition process, the company that makes the bidding is known as the acquirer. The organisation that aims to take ownership is known as the aim.

Smaller firms are generally taken over by large corporations. The takeover can be voluntary, that is, both the firms enter in a joint venture. It also can be forced, that, the company goes after the target after the rejection.

When two firms merge into one, it can leverage organisational performance and bring numerous advantages for the shareholders.

Summary

- Takeover happens when a firm makes a bid to acquire or take control of another firm.

- The takeover is conducted by purchasing a majority stake in the firm targeted.

- In the acquisition process, the company that makes the bidding is known as the acquirer.

- The organisation that aims to take ownership is known as the aim

Frequently Asked Questions (FAQs)

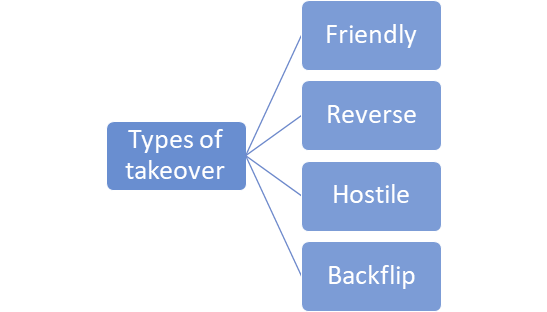

What are the types of takeovers?

There are four types of takeovers

Source: Copyright © 2021 Kalkine Media

- Friendly – In a friendly takeover, the targeted firm is informed about the takeover before the bid is offered. Both companies have sufficient time to assess the takeover terms. When an organisation determines that the takeover will result in shareholders’ wealth maximisation and will be in the best interest of the organisation, then the management will show positive support towards the takeover. Generally, the takeover is friendly in private companies because the difference between the shareholders and the board of directors is minimal. The reason for the same is that, in private companies, the management holds the majority of the stake of the company and therefore the bid takes place with the consent of the management only.

- Hostile – When the management is not consulted during the takeover bid and contact is directly established with the shareholders with no information to management, it is called a hostile takeover. Additionally, a hostile takeover can be conducted when the when rejects the bids and the company pursues the company stakeholders with the bid.

- Reverse – When a listed company is taken over by an unlisted private company, then it is known as a reverse takeover. This takeover might occur with the intention to achieve listing status with ease. Reverse takeover can be conducted by both hostile or friendly method. This method can save a tremendous amount for the small companies to gain listing status, and which can add significant value to the small firms. SPACs are one such companies which take place after a reverse takeover.

- Backflip – In the backflip takeover, the bidding company becomes the subsidiary of the targeted company. This takeover extends the benefit of brand value which is attached with the targeted company. Such a takeover generally happens when companies with a strong value presence are short of resources and the bidding company is equipped with resources such as cash and is looking for an investment For example, XYZ takes over ABC Ltd, but the name of ABC Ltd continues as it is a reputed and well – recognised brand.

How to avoid a hostile takeover?

A hostile takeover is a well-known takeover, and, in many cases, the terms ‘hostile takeover’ and ‘takeover’ are used interchangeably. A hostile takeover is usually achieved through a tender offer or proxy fight. The targeted company can undertake these two steps to avoid a hostile takeover –

Selling their company to the hostile bidder or a third party.

In case the company decides to stay independent, then they can resist the takeover by utilising numerous defensive measures.

When the hostile takeover is forced by the acquirer then the targeted firm can employ the following strategies to avoid the same –

- Poison pill

- Poison put

- Restrictive takeover laws

- Staggered board

- Restricted voting rights

- Supermajority voting provisions

- Fair price amendments

- Golden parachutes

- ‘Just say no’ defence

- Litigation

- Greenmail

- Share repurchases

- Leveraged recapitalization

- ‘Crown jewel’ defence

- ‘Pac-man’ defence

- White knight defence

- White squire defence

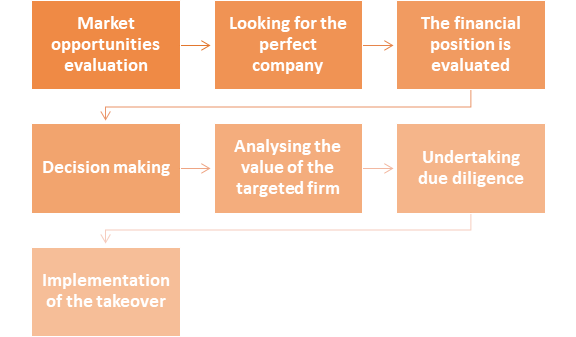

What steps are followed by a company while conducting take over?

- Market opportunities evaluation – A firm that is looking for an investment, evaluates the market and identifies the growing opportunities which align with the firm’s vision and then ranking is done based on the business feasibility.

- Looking for the perfect company – A company aims to identify a company that meets the strategic and financial objective of the acquiring company. An acquirer might restrict themselves while locating the potential company or may search beyond it.

- The financial position of the potential companies is evaluated – The financial statements of the potential targets are evaluated comprehensively to assess the business viability in the future.

- Decision making – After assessing the limitations and benefits associated with the takeover, the acquirer has to make a decision based on the value-added after the takeover.

- Analysing the value of the targeted firm – In this stage, the price of the takeover is decided and other financial alternatives are also assessed. This stage also includes the final financial assessment of the targeted company.

- Undertaking due diligence – After the acceptance of the offer by the targeted firm, the acquirer conducts due diligence. The due diligence involves thoroughly investigating the financial, operational and legal position of the firm targeted.

- Implementation of the takeover – This is the final stage in which a definitive agreement is prepared by the acquirer and the deal is closed between the firms.

Source: Copyright © 2021 Kalkine Media

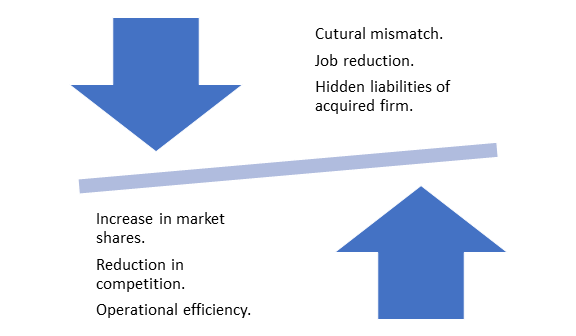

What are the advantages of a takeover?

- The market share of the firms increases as the sales of the firm increased accompanied with covering a larger customer base.

- The competition in the market is reduced to some extent.

- With the synergy, the firms may be able to achieve operational efficiency after the acquisition or takeover.

What are the disadvantages of a takeover?

- When the culture of the participating firms does not match, it results in a decline in the operational efficiency of both firms.

- Sometimes, the takeover also results in job cuts due to a reduction in the workforce requirements.

- After a takeover, the acquirer might be exposed to new hidden liabilities of the acquired firm.

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...