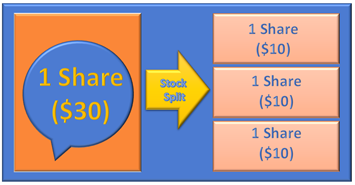

Stock Split happens when a company increases the number of shares without changing its market cap. As the quantity of shares increases, the cost per share goes down. Companies split their stocks to infuse liquidity and reduce the price of each share in the market to attract more investors.

A 3-for-1 stock split, Kalkine Constructed Image

How Stock Split Works?

Blue-chip stocks, along with publicly traded companies, use Stock Split more frequently as the share prices of these firms usually grow positively. The spurt in their share prices is attributed to events like acquisitions, mergers, product launches and technology innovations. Due to a gradual increase in the share prices, the market value of the stocks becomes too expensive for the investors, subsequently lowering their market liquidity.

Kalkine Constructed Image

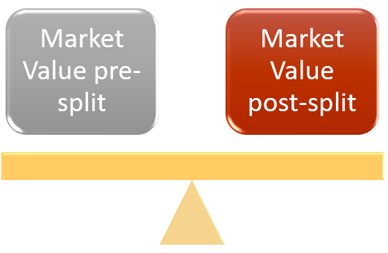

Suppose a publicly traded company ABC declares a 2-for-1 stock split. Preceding the split, the company's 100 shares are estimated at $50 each, for a complete estimation of $5,000. After the split, the number of shares will increase to 200 as it was a 2-for-1 stock split, but the total market value of those 200 shares will remain the same, that is, $5,000. However, the price per share will get reduced to $25. So, if a trader has 50 shares costing $50 each, before the stock-split, the number of shares in his possession will increase to 100 after the stock-split; and now the price of each share will be $25. The total market value will remain the same before and after the stock-split.

Types of Stock Split

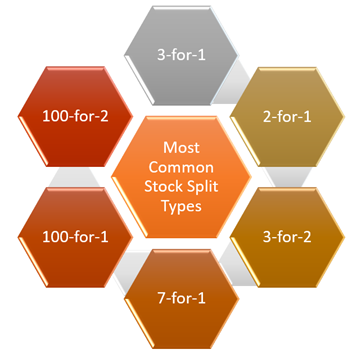

When a stock split is applied, the price of shares gets regulated automatically in the markets. A company's management can choose to split the stock into any number of ways. For example, a stock split may be 3-for-1, 2-for-1, 7-for-1, 9-for-1, 100-for-2, etc.

The most widely recognised kinds of stock splits are 2-for-1, 3-for-1, and 3-for-2. In a 2-for-1 stock split, an investor gets two shares for each share they possessed before the split. In a 3-for-1 split, they get three shares for each share, and in a 3-for-2, they get three shares for each of the two held before the split.

Kalkine Constructed Image

Why were stock splits more popular in the past?

Organisations were bound to split their shares in the past to some extent in light of the mechanics of trading. Previously, trading wasn't controlled by quick-moving advanced technology and was costlier for investors. Traders use to get better prices if they were willing to purchase in bunches of 100 shares or so, which also carried more extreme commissions. A stock split helped in keeping a check on stock prices for traders who were willing to buy in lots. However, nowadays, commissions generally don't exist as most of the traders have been shifted to a do-it-yourself brokerage module.

Benefits of Stock Split

The most important benefits of Stock Split are enlisted below:

Kalkine Constructed Image

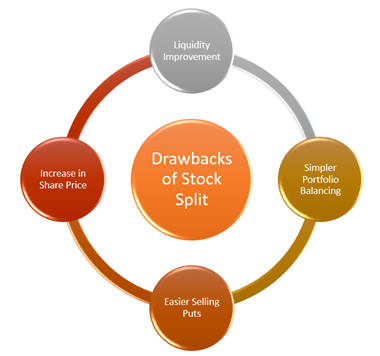

Liquidity Improvement:

In case, the stock price of a company rises, it will lead to a reduction in the volume of stock trading, thereby decreasing the liquidity in the market. Increasing the number of shares at lower prices will increase the liquidity, and more buyers will now be able to purchase the shares, increasing stock trade.

Simpler Portfolio Balancing:

It is easier to trade with lower valued shares. The convenience to sell or buy the shares becomes easy.

Easier Selling Puts:

If investors are trading in bulk, sometimes it becomes costly to sell in a "put option". A put option gives an owner the right to sell a specified amount of underlying-security at a predetermined price in a stipulated period. If the price of each share is high, it may lead to a higher level of losses for a trader.

Increase in Share Price:

At the point when a stock splits, it can bring an increase in share price even though there might be an immediate decrease after the stock split. This is because the stock becomes affordable for a larger number of investors who make the purchase.

Drawback of Stock Split

Increased Market Instability:

Stock splits could add to the unpredictability in the market, given the new offer cost. More investors may choose to buy the stock since it is more moderate, and that could build the instability of the stock.

Please wait processing your request...

Please wait processing your request...