What is Special Dividend?

A special dividend is known as an extra dividend, or a one-time distribution not falling under the regular dividend distribution calendar. It is often an unusually larger amount paid over and above its usual dividend payments. It is generally declared when a corporation’s earnings are exceptionally strong. Few examples of such situations are a sale of a subsidiary, business spin-off or an exceptional turnover year.

Summary

- Special dividends are unusual, with extra dividends distributed by companies out of exceptional revenues or unexpected excess cash.

- Special dividends do not affect regular dividends. They are over the regular dividend payments.

- More often, special dividends are paid one time by corporations; such occasion doesn’t occur often.

- Special dividends do reflect on the utility of the funds utilized to pay it. It sometimes depicts a positive picture while others believe it to be paid on its stagnation stage.

Frequently Asked Questions (FAQ)

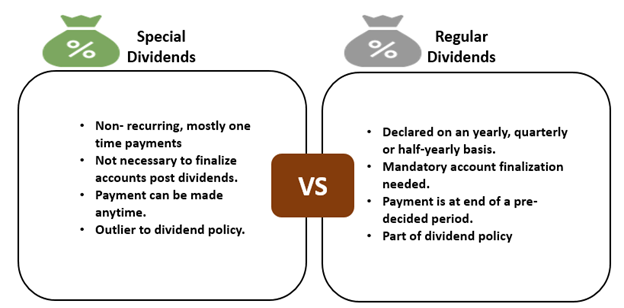

How do special dividends differ from regular dividends?

Source: Copyright © 2021 Kalkine Media

Special dividends are not usual and are paid over and above regular dividends. It is often a topic of interest for stock valuers and investors.

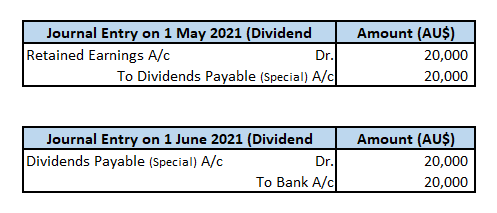

How are special dividends recorded in books of account?

Take the example of a company, Zelta Ltd., which proposes to declare a special dividend of AU$2 per share. Its’ books currently reflect 10,000 issued shares. Total special dividends payable is AU$20,00 (AU$2 x 10,000 shares).

Zelta ltd. declares dividends on 1 May 2021 and pays out of bank balances on 1 June 2021. To record these events relating to special dividends, the following journal entries are passed in the books of account-

Source: Copyright © 2021 Kalkine Media

Why is a special dividend paid?

The most common situations where a company may go for paying special dividends are-

- Excess cash availability in the balance sheet- Often, if a company has spare excess cash available on its balance sheet, it opts to declare a special dividend. Company’s do this when there is no opportunity cost of reinvesting the cash. Take, for example, Microsoft, which declared a special dividend of US$3 per share in 2004. It was a total cash payout of US$32 billion.

- Alteration to the asset, liability balances- In case a company wants to alter its debt-equity balance or cash available to loans balance, it may go for special dividends. It basically alters the balance of assets and liabilities. Using up cash to pay special dividends alters the percentage of assets available for financing loans or other purchases.

- Boosting investor confidence- Special dividends are also sometimes paid to boost investor. It is a tool used for long-term value generation by building up shareholder confidence. When equity-holders receive unexpected, excess cash as a special dividend, they feel good about the company’s operational and cash efficiencies. It helps in making investors stick with the company for a longer-term.

- If companies have a mixed dividend policy – Cyclical companies - Companies that do not have any fixed payment method may use special dividends alongside interim or final dividends. It is often done by businesses of a cyclical nature to improve the economic outlook of the company. These companies may declare a special dividend when revenues outperform normal periods. They often increase the dividend rate during booms and reduce it during the recession.

Examples of special dividends paid-

Old Republic International, an insurance underwriter in the US & Canada, had declared US$1 per share special dividends in 2021. It was the 3rd special dividend paid since 2018. The special dividend help boosts its valuations in FY’21.

In 2018, the BHP group listed on ASX declared a special dividend of AU$1.02 per share. The entire payment was worth AU$5.2 billion. The Australian mining company got the funds from the sale of its US shale oil business.

American Financial Group, an insurance company, had declared a special dividend in 2009. It was 11% more than the company’s regular dividend payments at US$2 per share. The company had generated significantly high revenues that year.

How does a special dividend impact stock price?

Special dividends often have a similar effect as a cash dividend on stock prices. For example, company Exceptional Ltd., which is currently trading on ASX at a share price of AU$ 200. It plans to declare a special dividend based on its outstanding performance in H1- FY21. Once the special dividend of AU$50 per share is declared and stocks become ex-dividend, the share price will decrease.

Often, the decrease is around AU$50, and theoretically, if everything else remains constant, the stock should trade post dividend at AU$150. But practically, stock trades up or below AU$150 after the dividend may be paid. Other factors may also have some influence on the share price.

What are the pros and cons of paying special dividends?

Benefits of paying special dividends-

- With special dividends, often the market valuation of a share rises.

- This results in proving its market standing.

- It is often an indication that a company is doing exceptionally well.

- It also boosts investor’s confidence for a long term journey with the company.

- It makes the company attractive to institutional and portfolio investors as well.

Disadvantages of paying special dividends-

- It may attract a few investors interested only in accruing benefits of the dividend.

- It may drain out the company of funds for short term contingencies.

- Special dividends, if paid to improve outlook, may have high opportunity costs.

- It requires extra documentation and reporting efforts.

- Special dividends are often an indicator of stagnation in a company’s lifecycle.

- It reflects that companies don’t have better investment options.

Please wait processing your request...

Please wait processing your request...