How do you define solvency?

The term solvency reflects a company's financial stability and tells us about a company’s ability to manage its outstanding loans. Solvency represents the financial health of a company or an entity. It is often used as a tool to demonstrate how well-equipped a company is to meet any future challenges. One can know about a company’s solvency by looking at the balance sheet and cash-flow statement. Shareholder’s equity is the difference between the total assets of a company and the liabilities.

Summary

- Solvency tells us about the financial stability of a company. It also reflects a company's ability to meet its financial obligations.

- Solvency also demonstrates a company’s preparedness to meet future challenges and risks.

- Shareholder’s equity is the difference between the total assets of a company and the liabilities. Thus, a company can become insolvent but still produce steady working capital.

Frequently Asked Questions

What is the relationship between insolvency and shareholders’ equity?

To know about a company's financial health, analysts compare the total value of assets of an entity with the total liabilities held. Negative shareholders’ equity indicates insolvency. On the other hand, positive shareholder’s equity suggests that a company has sufficient assets to manage its liabilities.

Negative shareholders' equity can result in huge personal losses for small business houses if limited liability terms protect it. This means that if a company is required to close its business, then it must liquidate its property or assets and payback for all its liabilities, except the shareholders’ equity as the remaining value.

Negative shareholders’ equity can mostly be found in the balance sheet of newly developed private companies or startups. A company’s solvency position shows signs of improvement as it moves towards maturity. The presence of negative shareholders’ equity is also common in the balance sheet of a recently offered public company.

Though, in certain circumstances, even well-established companies are at risk of solvency. Say, for example, a pharmaceutical company forgets to renew its patent. If the competitors come to know about the patent expiration, they will use this to their advantage by producing the same product. This ultimately results in reduced royalty payments. Besides, any change in a company's policies that are related to the continuation of its business operations can pose a risk for the said company. Additionally, business entities and individuals will face solvency if a judgement from a lawsuit is against them. This will negatively impact their image, reputation, and credibility, resulting in losses of all kinds.

Solvency, to an extent, depends on liquidity. It is therefore important to keep in consideration the methods that are used to manage liquidity. Though these are two different terms, it is essential to discuss them together, especially when there is an insolvent company. It should be remembered that an insolvent company can produce regular cash flow along with constant working capital.

Image Source: © Chrisdorney | Megapixl.com

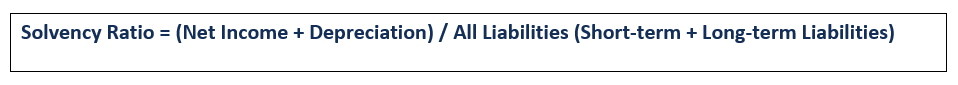

How do we calculate a company’s solvency and the solvency ratio?

The difference between total assets and liabilities tells us about a company’s solvency. Furthermore, solvency ratio is of immense help as it tells us about a company's financial condition. The solvency ratio helps us determine how long a company can remain financially stable in the foreseeable future.

The formula to calculate the solvency ratio is:

The other two ratios which help us analyse a company's solvency are the interest-coverage ratio and debt-asset ratio. The interest ratio is calculated by dividing the company’s profits (before subtracting any interests and taxes) by its interest expenses. Therefore, a higher interest coverage ratio is a sign of greater solvency.

The debt-asset ratio is calculated by dividing a company's debt by the value of its assets. Thus, the debt-asset ratio is also an important indicator of a company’s solvency.

It should be remembered if the ratios suggest lower solvency, then it would suggest that the company’s financial health need to be taken care of.

Image Source: © Rummess | Megapixl.com

Explain solvency with the help of an example?

Suppose XYZ wants to invest in a firm. One of his colleagues told him that an investment in that firm would provide him with high yields. However, XYZ is not sure if he has enough money to make this investment.

Thus, after hours of thinking, he decided to look at his own personal account’s insolvency.

So, to calculate his solvency, he first makes a list of all the assets he owns:

Assets –

- Cash – $90,000

- House – $600,000

- Car – $25,000

- Other Assets – $50,000

Liabilities –

- Educational loan for his elder son – $50,000

- Mortgage on the house – $300,000

- Credit card debt – $40,000

He then decides to calculate the total assets owned by him and the liabilities he needs to pay off. To get total assets, he adds the amount for all these assets mentioned above, and for total liabilities, he adds the value for all the liabilities.

Thus, he gets:

Total assets: $ 765,000

Total liabilities: $ 390,000

After the calculation, XYZ realises that he possesses a positive net worth after all the deductions. As such, he decides to go ahead with this investment plan.

Please wait processing your request...

Please wait processing your request...