When it comes to doing business, there are various business models that have been discovered by numerous entrepreneurs throughout the centuries. The business model is a specific fundamental framework upon which various business activities are carried out. Different businesses have different business models depending upon the industry, size of the company, capital structure etc.

Sharing economy is one of the most popular and fastest-growing business models that we have seen in the last few decades. Many of the startups nowadays are also preferring the sharing economy business models over the conventional models.

What is a Sharing Economy business model?

Sharing economy in its purest essence is not just a business model but also an economic principle that is continually evolving and thriving in the economy. It means to facilitate the exchange of goods and services between the parties by using means like technology. The underlying principle is that these parties can mutually share value from an underutilized asset.

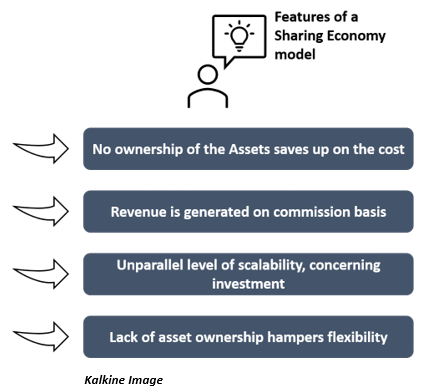

The businesses which rely on the sharing economy model, do the same job. These businesses do not provide a product or service of their own but help to facilitate the transaction between buyers and sellers and charge a commission on that transaction. This model is also referred to as an asset-light model, peer to peer economy or Collaborative economy.

In today’s world of technology, this business model has become simpler than ever, and some companies are even going one step further to create their own marketplace for these buyers and sellers. The penetration of internet in various parts of the world is further helping the companies to thrive on this model.

What are the pros and cons of a Conventional Business Model?

Let's assume there is a businessman willing to open a transport company offering cab services. He buys 100 cabs for his company for which he takes up a humongous loan. After buying those 100 cabs, he then hires 100 cab drivers for which he needs to shell out a hefty amount every month to fund their salaries.

Advantages

- The biggest advantage of this model is the ownership of the asset lies with the businessman. The asset can be sold off in the future in times of cash crunch. Higher number or value of assets adds more weightage to the balance sheet of the business.

- As the cabs are owned by the company, they can be used whichever way the company likes, without the interference of another party. Ownership of the cabs would give the company flexibility to use it the way it wants to.

- The revenue generated by the core operations is relatively higher, and the business keeps all of it. Like a cab fare generating $10 revenue would all be kept by the company, not a specific percentage of it.

Disadvantages

- However, there are relatively many disadvantages, as well. The initial financing of the assets is a big task which requires some guarantees or high creditworthiness. Financing also leads to interest cost, which may add a burden on the company’s cash flows.

- Another disadvantage lies in the operational cost of the business. It includes the rent of a safe parking facility, the maintenance cost of the cabs along with the monthly salary of the drivers, irrespective of whether they sit idle or work throughout the month.

- Scalability of the business becomes questionable when there is a lot of investment needed to scale up. In this example, in order to increase the scale of the business, additional cabs would need to be purchased, requiring substantial additional investment.

What are the pros and cons of a Sharing Economy Business Model?

Let's see how the same businessman can run the same company but on another business model. Instead of taking up a hefty loan to go straight to the cab showroom, he decides to contact the existing independent drivers who possess their own cabs.

The businessman would help the driver find new customers and in return would charge a nominal commission for every ride. If they both agree to the agreement, then the same business could take place as seen in the conventional model but with different economics.

Advantages

- The biggest advantage of this model which is attracting a lot of startups is that the business does not need to own the asset. In the above example, the businessman does not have the ownership of the cab. Therefore, there is no cost of ownership being incurred by the company.

- As you might have noticed, even the cab driver is also an independent driver and not the company’s employee, saving up additional costs towards the monthly salary.

- As there is no ownership of assets required, the business can be scaled up with unparallel ease. In our example, all a businessman needs to do is contact more cab drivers and convince them to work with you (not for you).

Disadvantages

- However, there are some disadvantages to this model too. There is no ownership of the asset, which takes away the flexibility to use it the way the company wants. If the cab driver refuses to take a fare, the company cannot do much about it as the cab driver is not an employee of the company.

- Lower asset base might not be much of help in the time of cash needs as selling assets are one of the quickest ways to fund the capital needs.

- Due to the revenue model, the company only earns a percentage of the actual revenue generated by the driver, called commission. If the driver generates $10, the company might get only $4 (as per the agreement). This kind of revenue model generally does not work well with the low volume of transactions.

Please wait processing your request...

Please wait processing your request...