SEC is the abbreviation for US Securities and Exchange Commission. It was set up in 1934, to enforce US laws on securities (financial assets) trading. The SEC is run by a five-person commission, with each member serving for a five-year period. It is a regulatory agency set up by the US Government to control securities market operations and protect investors.

Financial services providers—like as brokers, investment advisory firms and wealth managers, as well as their expert representatives—need to be registered with the SEC to conduct any business. It offers investors right to read registration declarations, periodical reports, and other statements related to securities via electronic data-gathering, scrutiny of reports and a recovery database which it has set-up.

Summary

- The Securities and Exchange Commission (SEC) is a U.S. federal government agency set up to regulate the securities markets and to protect investors.

- The SEC has power to bring civil actions against lawbreakers through fines imposed by its various divisions.

- It was established to help restore investor confidence and to prevent stock market crashes in the US.

Frequently Asked Questions (FAQs)

What are the responsibilities of SEC?

- SEC is responsible to maintain unbiased and well-organized markets.

- It ensures that investors don’t fall for any frauds or any sort of abuse.

- SEC administers periodical publication of earnings reports by public & listed companies.

- An individual holding more than 5% of a company’s shares, is also required by SEC to declare holdings publically.

- SEC puts those on trial who break securities laws in the US and can impose hefty penalties.

- It also has a duty to oversee any mergers and acquisitions taking place in the US.

- It has the power to approve registration statements of underwriting firms who are book-runners.

- SEC in addition to all of the above, also helps government maintain an efficient economy.

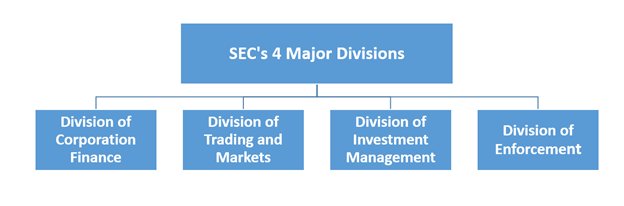

How is SEC structured?

The SEC is run by five commissioners who serve for a period of five-years. The SEC commissioners are appointed by the president, and one of them becomes the as chairperson. Each commissioner's may serve for an additional 18-month period, until a replacement is found. To promote nonpartisanship, the law allows only three of the five commissioners to belong to the same political party.

Copyright © 2021 Kalkine Media

These divisions have following responsibilities-

- Division of Corporation Finance - ensures corporate releases and for making available important information to investors and stakeholders.

- The Division of Trading and Markets- has to ensure justice, order and productivity in market activities.

- The Division of Investment Management- helps SEC protect investing public and boosts capital formation by regulating the investment management

- The Division of Enforcement – is responsible for investigating securities law abuses and initiates civil and criminal action against guilty.

Other than this, the SEC has other functional offices namely: The General Counsel, Chief Accountant’s Office, Office for Economic Analysis, Compliance Office, Office of International Affairs, Investor Education department, Investor Advocacy department and The Policy and Investor Outreach office.

Any Self-regulatory body set up by any industry like the Stock Exchanges, can also appeal for action with the SEC. The SEC Office of Whistleblower stands out as one of the most powerful tools for enforcing the securities law. It was created as a reform measure.

Which two sanctions does SEC seek in case of civil suits?

Typically, SEC prosecutes offenses which include any accounting fraud, or broadcasting of misleading or deceitful information and insider dealing. It uses the following to ways-

- Injunctions- these are orders to disallow future violations. Any person or corporation that disregards an injunction passed by SEC is liable to pay fines or can be taken into custody for disrespect.

- Legal proceedings- SEC can also seek a judicial order barring or suspending persons from acting as legally authorized officers or directors of a company. It may impose a range of executive proceedings, to be heard by in-house officers of the commission. These orders can be cease and desist orders, order to revoke or suspend registration, and others like imposing a suspensions of employment.

- Monetary Sanctions- The SEC's whistleblower policy is very well known to reward individuals who share authentic information that can lead to successful law enforcement. Actions under this policy come with monetary sanctions above of USD 1 million. The individual is eligible to receive 10 to 30% of total sanctions' proceeds.

Overall, the SEC has charged more than 200 entities or individuals. It has collected close to USD 4 billion from penalties, sanctions and other financial respites. Till now, not many corporation or wall street executives have been jailed. Most cases are either settled for a monetary punishment or accepted Injunctions and proceedings.

Which other laws aid the SEC in its mission?

The US federal government has passed following other laws which majorly support the SEC’s objective of law enforcement and Securities market regulation-

- Trust Indenture Act of 1939

- Investment Company Act of 1940

- Investment Advisers Act of 1940

- Sarbanes-Oxley Act of 2002

- Consumer Protection Act of 2010

In addition to the above, now SEC also brings frequent civil prosecution actions against corporations and individuals who violate the securities laws. SEC also involves itself in every major financial fraud or financial crime case, either directly or indirectly.

Please wait processing your request...

Please wait processing your request...