What is a secondary market?

An investor has two options to buy any asset, particularly a financial asset. Either they can buy it directly from the originator or the issuer, like corporations, governments, banks etc.- this is known as the primary market in the context of a financial market. Since the asset sold is for the very first time, it is called the primary market. On the other hand, investors also can buy an existing financial asset from another investor who already owns it- this is known as the secondary market. Stock exchanges like the National Association of Securities Dealers Automated Quotations (NASDAQ) and the New York Stock Exchange are some of the well-known examples of a secondary market.

Summary

- The platform wherein an investor buys an existing financial asset from another investor, who already owns it, is called the secondary market.

- There is higher liquidity for the stocks being traded in the secondary market, better pricing, and a more comprehensive market range.

- Secondary markets can be further classified as auction markets and dealer markets.

Frequently Asked Questions (FAQs)

What do we know about the nature of Secondary Markets?

Given the popularity of stocks amongst traded securities, stock exchanges are some of the most commonly known secondary markets. However, there are many other kinds of secondary markets. For example, asset managers, fund houses also act as secondary markets through buying and selling mutual funds, which is a portfolio of stocks and bonds. Similarly, investment banks also buy and sell loans to other investors, acting as a secondary market. Another typical example of a secondary market is government agencies like Fannie Mae and Freddie Mac which engage in the purchase of mortgages.

Australian Stock Exchange (ASX) Electronic Display © Sadeq68 | Megapixl.com

As can be seen from the above examples, any transaction that happens after the initial creation of securities can be termed secondary. Let's take the example of an automobile finance company A which is primarily engaged in giving automobile loans to consumers who buy vehicles. An investment bank can buy the automobile loans from Company A, which will be termed a secondary market transaction.

Given the popularity of equities among the common public, "stock exchange" has become a synonym to the secondary market and is often used interchangeably. While NASDAQ and NYSE are some of the well-known stock exchanges, there are many large and small exchanges engaged in the buying and selling securities across the globe.

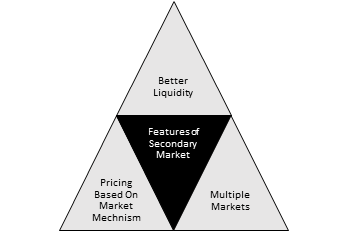

What are the key features of the secondary market?

There is higher liquidity, better pricing and a more comprehensive market range for the stocks traded in the secondary market.

Copyright © 2021 Kalkine Media

Better liquidity

One of the most significant advantages of a secondary market is higher liquidity vis-à-vis the primary market. In other words, investors can easily buy or sell an asset in the secondary market. Issuers are rarely engaged in the buying of securities, especially stocks and bonds. Even in share buybacks, companies do it directly from the secondary market, rather than dealing with individual investors. In addition, the timing of the buybacks will be fixed by the issuer and not by the investor. As a result, the secondary market offers a platform to investors to transact in securities with minimal loss of value.

For instance, if an investor wants to buy Microsoft shares (MSFT), they can deal directly with any of many other shareholders in the secondary market. The company is not involved in the process.

Even in a bond market, investors can transact directly with the millions of other bondholders in the market. While the issuing company will repay the principal amount at maturity to the bondholder, often five to ten years later, investors can continue to trade in bonds to make profits in a changing interest environment.

Pricing

In a primary market, the prices of securities are often fixed by the companies, in consultation with other parties like investment bankers, institutional investors etc. On the other hand, given the multitude of investors in the market, prices in the secondary market are driven by the supply and demand factors. As a result, a variety of reasons could have an impact on the prices in a secondary market. These include company performance, industry performance, country’s economic performance, global economic performance, management actions, competitor actions etc. For example, the anticipated growth in earnings from a vaccine introduction could drive investors to buy stocks of pharma companies, boosting their share prices.

Multiple Markets

In a primary transaction, there is only a single market, i.e. the issuer. On the other hand, the secondary market offers multiple markets. For instance, a company could be listed on two exchanges, potentially in different geographies as well- this offers increased liquidity and efficient pricing to investors. Moreover, as new products are introduced in the financial markets, the number of security markets are also expected to grow.

© Djbobus | Megapixl.com

How can secondary markets be classified?

The secondary market can be broadly classified into two types:

Auction Markets

The key differentiator in an auction market is that the traders trade directly with each other. As the name suggests, prices are derived through a traditional auction process. All traders who want to trade gather at a place and quote the bid and ask prices. The bid or the ask prices are the prices at which a trader is willing to buy or sell an asset respectively. As the prices are quoted in the midst of all parties, the bidding process is expected to converge at a mutually agreeable price through an efficient market mechanism. New York Stock Exchange (NYSE) and the Australian Stock Exchange (ASX) are well-known markets operating on an auction basis.

Dealer Markets

Unlike the auction markets, dealer markets have an intermediary in between the buyer and the seller. The middle man holds the inventory for securities and deals with the market participants who want to buy or sell the security. In other words, the dealer creates liquidity for security in the market. Proponents of the dealer market argue that the competition amongst the informed dealers will lead to efficient markets and, in turn, better prices for the investors. In return, the dealers profit through the spread between the prices at which they buy and sell the securities. For example, the dealer would quote an ask price of US$9 and a bid price of US$10, the dealer would profit from the bid-ask spread of US$1 (US$10 – US$9). US’ NASDAQ and London’s SEAQ are examples of dealer markets.

Please wait processing your request...

Please wait processing your request...