Revaluation Reserve

What is a revaluation reserve?

A revaluation reserve is an account used to reflect the actual market value of a company’s assets. It is a non-cash reserve created due to changes in the value of assets. It is excluded from the free reserves of a company, as funds are not available against it for dividend distribution to shareholders. It is, in nature, a reclassification of capital. Increased asset value is credited to the Revaluation reserve A/c. Similarly, any decrease is debited to the Revaluation reserve A/c.

Not all upwards movements in asset value are added to the revaluation reserve. It all depends on the historical treatment of the asset, especially if it has been impaired. Rather all material differences between current market value and the book value of assets are considered.

Highlights

- Revaluation reserve is created in the books of account to represent an account tied to changes caused by the revaluation of the carrying value of its asset

- Revaluation reserves often represent volatility in an asset’s market value caused majorly due to currency fluctuations or other long-term changes in valuation principles.

- Revaluation is created with the aim of fair presentation of the value of an asset; it is a part of the balance sheet of a company’s financial statements

Frequently Asked Questions (FAQ)

How is revaluation reserve created?

It is created to reflect the changes in the value of certain assets. An upward revision in the asset's value is recorded in books to increase reserve balance and vice-versa. The recording of such changes also depends on the methods of valuing assets and the accounting policy adopted. The number of times revaluation happens on fluctuations in the fair value of assets. If it changes materially, then revaluation is essential and appropriate. It is then recorded using a proper method based on the asset class.

Image Source: © Adodonov | Megapixl.com

Businesses usually establish a revaluation reserve if an asset’s carrying value is often monitored based on the market circumstances. There is no need to wait for scheduled adjustment dates to record changes in the revaluation reserve. Firms can use reserve in place of asset impairments if it doesn’t affect the fair representation. The revaluation reserve will increase the liability side or reduces asset value depending on accounting presentation.

What is the accounting treatment for revaluation?

A revaluation reserve is credited on the rise in the asset’s market value compared to its’ recorded book value and vice-versa. Thus, depending on the accounting policy, the revaluation of assets differs.

Usually, accounting practices around the globe allow companies to show fixed assets at historical cost or after revaluation.

- According to the historical cost method, a firm shows the asset in its books at the historical cost or purchase value after deducting any accumulated depreciationamount and impairment loss. There is no scope for reflecting upside or downside changes in the value of assets.

- But, as per the revaluation model allowed under IFRS, an asset is originally stated in the books at cost. Later, the carrying value is adjusted for any fluctuations in the asset’s value. Under this method, both upward and downward adjustment for revaluation is allowed.

Example

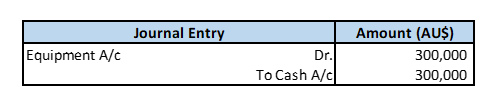

Heavy Ltd bought drilling equipment of AU$300,000 on January 1, 2008. Company will record the value of the building using the journal entry given below.

Source: Copyright © 2021 Kalkine Media

The drilling equipment's useful life is 15 years, and as per the accounting policy, the company depreciates it on a straight-line basis. Yearly depreciation is hence AU$300,000/15 or AU$20,000. As of 31 December 2010, the accumulated depreciation in books is AU$20,000×3 or AU$60,000, and the carrying amount is AU$300,000 minus AU$60,000, which equals AU$270,000.

So, equipment is shown in the books at its historical cost; however, it is periodically depreciated. There is no other entry for upward adjustments to its value. A Surplus in the revaluation reserve is credited on the increase in the asset's market value compared to its' recorded book value and vice versa.

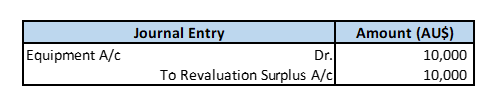

Heavy Ltd wants to switch to a revaluation model and estimates the fair value of drilling equipment as AU$280,000 as of December 31, 2010. The carrying amount is AU$270,000, and the revalued amount is AU$280,000, so an upward adjustment of AU$10,000 is required to the equipment account. It is booked using the journal entry given below:

Source: Copyright © 2021 Kalkine Media

Depreciation after revaluation will be on the revalued amount. So, depreciation value for Heavy Ltd will be remaining useful life or AU$280,000/12, which equals AU$28,333.33.

Do all revaluation profits get booked as revaluation surplus?

The gain on the revaluation of an asset is termed as surplus. It is not a profit and therefore is not booked in the profit and loss statement. Not all surplus on a revaluation is added to the revaluation reserve. Especially in the case of previous impairment, there is an impairment reversal instead. Any remaining surplus above impairment reversal is recorded in the revaluation reserve. Therefore, revaluation reserves are not distributable.

How is revaluation reserve different from a capital reserve?

Revaluation reserve is used to reflect an increase/decrease in the value of assets. Whereas capital reserves are made from non-operational activities from a sale of investments or on the issue of shares at a premium, etc. Some types of gains are mandated by accounting principles or law to be reflected as a capital reserve, for example, the premium on shares. Some profits might get recorded as a capital reserve by choice of management. It is created for funding future projects or business expansion or to meet unforeseen business circumstances. Capital reserves are shown in the balance sheet until they are utilised, but revaluation reserves are not possible. It is carried in the balance sheet till the asset is available with the firm.

Please wait processing your request...

Please wait processing your request...