Return on investment (ROI) is a term used to gauge the performance of an investment. It is often expressed in % term and is determined by dividing the investment's net profit or loss by its initial expense. A high return on investment (ROI) indicates that the investment's benefits exceed its cost.

Source: © Melpomenem | Megapixl.com

How do we calculate ROI?

A Company’s expense can be assessed in ROI terms. However, there are exceptions like buying staples that contribute to an investment even though they do not have a direct ROI.

ROI also helps explain opportunity cost, the return an investor forgoes to invest in a business. If an investor decides to invest in a company instead of the stock market, he expects a return higher than or equal to what he would have made by investing in securities.

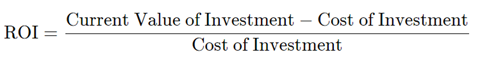

ROI can be calculated by dividing a company's profit made on an investment by the investment cost.

Here, the current value indicates the money earned from the sale of the investment of interest. The cost refers to the total amount invested.

What is the significance of ROI?

The ROI metric is used in business to calculate the rates of return on capital invested in an economic enterprise over time to determine whether or not to invest. It's also used as a metric to measure the performance of various investments in a portfolio. Even though the distribution of ROI over time is crucial, the investment with the highest ROI is typically prioritised.

Of late, the ROI metric has been used for scientific funding agencies’ investments in open-source hardware research and the resulting returns for direct digital replication.

Recent Developments in ROI

A new type of ROI metric known as "social return on investment," or SROI, has recently piqued some investors and businesses’ interest. SROI was created in the late 1990s and recognises the wider effects of ventures with extra-financial significance (i.e., social and environmental metrics not currently reflected in conventional financial accounts).

The value proposition of such ESG (Environmental, Social, and Governance) parameters used in socially responsible investing (SRI) activities is best understood with SROI.

Different versions of ROI have been created for specific purposes. For example, the effectiveness of social media campaigns is measured by the number of clicks or likes produced per unit of effort (Social media statistics ROI). Similarly, marketing statistics ROI seeks to determine the amount of return that can be attributed to advertisements or marketing campaigns.

What is a good ROI?

ROI depends on the risk taken by an investor. If an investor is risk-tolerant, he is likely to generate positive returns in the long-term, though there might be short-term risks. On the other hand, risk-averse investors might accept lower returns as they are unwilling to take additional risk.

As every investor/business has different expectations based on the risk taken, there is no specific range that can be termed as a good ROI. In general, for start-ups, a robust double-digit ROI is considered good.

A Profitable Investment (Source: © Ivelinr| Megapixl.com)

Which industries generate the highest ROI?

Different industries have different ROIs, and thus the metric should be compared between players within the same industry for an apple-to-apple comparison.

The returns of an industry might change over time, and thus, over a period there might be no clear-cut winner. In 2020, tech companies like Apple, Microsoft, and Amazon generated significant returns, although utilities and the energy industry posted lower ROIs or even losses.

What are the challenges with the performance metric?

Everyone believes they can predict returns on an investment, but no one can see the future. Big data can provide averages, but for most of us, only a well-planned investment can yield meaningful results. Investing without doing thorough research is never a good idea.

Before investing in any business, one should conduct detailed research, understand the business, and engage with people already involved in similar businesses.

For instance, an individual who invested in bitcoin in 2010 and sold it in 2018 beginning, and one who bought the cryptocurrency and is still holding it, might not have the same level of satisfaction. Thus, investments can vary from person to person, based on their experience, views, risk-taking ability, and most importantly, timing.

What are the benefits and limitations of ROI?

While the broadly used performance metric has several advantages, it has its fair share of limitations. Let’s look at them in detail.

Benefits

- ROI is simple to measure, and even non-accounting managers can understand the results. ROI can be calculated using percentages and can be compared between projects and investments of various sizes.

- ROI helps evaluate the financial success of your business. Knowing your ROI keeps your company on track by showing whether you are making more or less money than the industry average.

Limitations/Disadvantages of ROI

- Since your company's cash flow is not directly mirrored in your ROI, your financial health cannot always be correctly calculated using ROI alone.

- You'll need a solid grasp of your potential business expenses to determine an effective ROI. ROI may be unreliable if you don't have reliable figures for future expenses or if the numbers used in your estimate are unpredictable, such as interest rates fluctuation.

- ROI only looks at the financial success of a project/investment. Investing in new computers and technologies for your workers may have a negative ROI but may make your employees happy and increase retention. The nonfinancial benefits of an investment are not considered when calculating the ROI of a project or company.

- The underlying data that shapes the inputs should be included with the ROI, usually in the form of a business case. The need for a Net Present Value adjustment is critical for long-term investments, and without it, the ROI could be misleading. Instead of using discounted cash flow, a Discounted ROI could be used.

- Since it does not account for the environmental, social, and governance success of an entity, the conventional ROI calculation does not completely capture the short-term or long-term significance, benefit, or risks associated with natural and social capital.

Please wait processing your request...

Please wait processing your request...