What is a regressive tax?

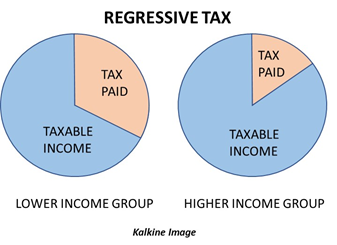

It is the type of tax in which that tax rate decreases as the taxable income increases. Thus, higher incomes are charged less, while the burden of taxation falls majorly on the lower income groups. This type of tax is the opposite of a progressive tax.

Under a regressive tax, the amount of tax imposed on the higher income group and lower income group stays the same. However, the difference arises when the wealthier population pays a lesser proportion in taxes, while the lower income groups pay a higher proportion of their income as taxes.

Therefore, a regressive tax includes those taxes for which the tax rate decreases as the taxable amount increases and, in such cases, basically the tax rate is the same for all income groups but affects each group differently.

How is a tax determined to be regressive?

Based on comparisons between the average and marginal tax, taxes can be categorised as regressive, progressive, and proportional.

Average tax refers to the sum of total amount paid in taxes divided by the tax base, which is the taxable income or amount, whole multiplied by 100. If a consumer pays a 10% tax on the first $10,000 and 20% on the next $10,000, then

Average Tax = [(1000 + 2000)/20000] * 100 = 15%

Thus,

The marginal tax refers to the tax paid on an additional unit of income. Under the marginal tax, taxpayers are divided into tax slabs or tax brackets which help in determining the rate to be applied for taxing their earning.

A tax is said to be regressive when the average tax is higher than the marginal tax. On the contrary, a tax is progressive when the marginal tax is higher than the average tax. Whereas a proportionate tax is the tax where the tax rate remains the same irrespective of any changes to the taxable income.

Why are regressive taxes adopted?

- Easier computation: Tax rates that are equal for all income groups are easier to compute and provide ease of access. Certain goods or items may be taxed at an equal rate so that it is easier to keep track of daily transactions

- Discouraging demerit goods: Certain goods might cause harm rather than increasing productivity in the economy. These may include cigarettes which are harmful to consume. The idea here is to discourage the lower income group from spending a larger proportion of their income on a demerit good. But for the higher income group, the income available to spend is not as limited as it is for the lower income group. Thus, even a higher tax may not disincentivise demerit goods for the higher income groups. Therefore, even a progressive tax might not work here.

What are different types of regressive taxes levied on goods?

- Sales Tax: Sales taxes, which are implemented as a percentage of sales prices, are regressive. They are levied on various goods and are charged as a percentage of total sales. Thus, they end up hurting the lower income group more than, the higher income group.

- Consumption Taxes: By the same ideology as the sales taxes, consumption taxes are imposed on the value of the goods produced and are not based on the income group that the buyer belongs to.

- Excise Tax: These taxes are imposed on certain specific goods and are levied at the same rate irrespective of the income group that the taxpayer belongs to. An example of this can be a tax on tobacco. It is likely to impact lower income groups more because it is reported that people below poverty like are more likely to be addicted to smoking.

- Fuel Taxes: Lower income groups pay as much as the higher income groups in fuel taxes. Thus, they are regressive in nature.

- Lumpsum Taxes/Poll Taxes: Any tax that levied as a fixed sum on all group is a lumpsum tax. This is a regressive tax in nature as it does not increase as the income of the taxpayer increases, instead stays the same.

Kalkine Image

Why is the Value Added Tax an important topic of discussion?

VAT is a type of special excise duty levied on certain select goods. It is implemented in European countries and certain other parts of the world. It is highly debatable whether VAT is a regressive tax or not.

The severity of its implementation is affected by the goods on which VAT is levied. For instance, VAT should be ideally implemented on luxury items. This would not make it regressive as lower income groups are less likely to purchase luxury goods.

However, the argument arises when VAT is implemented on other essential goods that are not luxury items. Implementing VAT on these goods can make it a regressive tax.

The marginal propensity to consume declines with increased income. Individuals are less like to spend more than they are to save as their income rises. Because of this reason, higher income groups would pay a lesser proportion of their income as VAT, when compared to the lower income groups. This makes VAT a regressive tax.

But it can also be argued that lower income groups would spend more on essential commodities that do not have VAT levied on them. Thus, it would not hurt them as much as it would hurt the higher income groups.

Therefore, the goods on which VAT is levied affect how regressive the VAT truly is.

Please wait processing your request...

Please wait processing your request...