What is Rate-and-Term Refinance?

A Rate-and Term Refinance refers to a kind of mortgage refinancing that allows the borrowers to change the terms and rate of their present loan and can replace the current terms and rates with new which are more beneficial for them. A borrower gets a new loan, pays off its old mortgage and then pays for new loan when he or she refinances. A rate-and-term refinance offers a borrower more or less time to settle its loan, low interest rate or different monthly payments.

Understanding Rate-and-Term Refinance

A rate and term refinance is a financing where the terms and rate of interest will change of a current mortgage without advancing new funds. There are some lenders who considered the rate and term refinances as a regular refinance, it is also popularly known as no cash-out refinance. A rate and term refinancing is mainly determined by the change in the interest rates of market to lower the monthly payments of mortgage. It is opposite of cash-out refinance which is determined by the change in home values by homeowner in order to seek to tap into its home equity. The possible advantages of a rate and term refinance is that it secures a lower interest rate and mortgage’s more beneficial term as the principal amount do not change.

Such refinancing may lower the monthly payments of a borrower or can set new plan to settle the mortgage quickly. As rate-and-term financing has advantages and disadvantages related with it a borrower needs to weigh merits and demerits of using rate-and-term financing as both advantages and disadvantages are associated with it.

Source: Copyright © 2021 Kalkine Media

Frequently Asked Questions (FAQs)

What are the requirements for Rate-and-Term Refinancing?

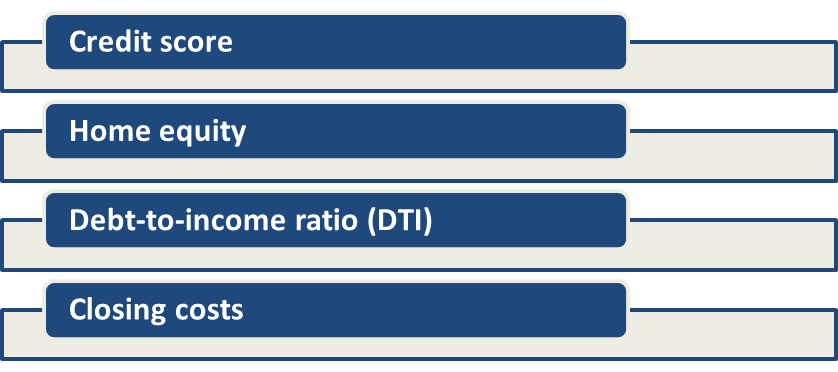

There are various requirements that a person has to fulfill for rate and term financing to work. The requirements for rate and term refinancing are just similar when a borrower applied for an initial loan, a borrower requires meeting its lender’s standards prior to qualify for a refinancing. Here are some of the requirements:

Source: Copyright © 2021 Kalkine Media

- Credit score: In order to refinance a borrower has to meet the minimum credit requirement that is depending on type of loan. For most of the types of loan, a borrower needs a minimum credit score of 620 to qualify for a refinancing.

- Home equity: Home equity of a person is referring to the percentage of a principle of loan that is paid by the borrower. A borrower should wait to refinance until he or she has minimum twenty percent equity in his or her home. A borrower can also with a lower equity percentage (less than 20 percent) but in that case the borrower does not access the most beneficial interest rates.

- Debt-to-income ratio (DTI): For refinancing a loan lenders also count debt-to-income (DTI) ratio of a borrower while evaluating his or her refinance application. A borrower aim of a debt-to-income ratio (DTI) has to 50% or lower prior to apply.

- Closing costs: A borrower requires accounting for closing costs when he or she refinancing its loan. Generally, closing costs for a refinance is ranging between 2 percent to 5 percent of the principal amount on its loan.

What are the reasons for doing Rate-and-Term Refinancing?

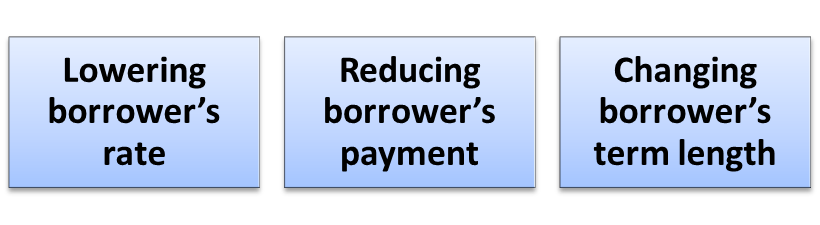

There are various reasons for choosing rate and term refinancing. Some of them are:

Source: Copyright © 2021 Kalkine Media

- Lowering borrower’s rate: Refinancing of a loan helps a borrower to get lower rates of interest in the comparison of current interest rates. A borrower is also qualified lower interest rate requirement of credit score now than the borrower took the initial (original) mortgage loan. That means refinancing is favorable for a borrower whenever he or she can get a lower rate of interest compared to what a borrower is paying presently.

- Reducing borrower’s payment: A borrower can reduce its monthly payment when he or she refinances a mortgage loan for a long term because it provides more time to borrower to settle (pay off) a loan. It is helpful when a borrower is facing problem to make monthly payments, but a borrower also has to pay more interest at the end of the course of loan.

- Changing borrower’s term length: A borrower can also refinance its mortgage loan for a shorter period. It increases the monthly payments of a borrower, but a borrower has to pay more interest at the end of the course of loan.

Please wait processing your request...

Please wait processing your request...