Before jumping directly into the put option, it would be prudent to first get the basic understanding of the options in general. In today’s modern world financial markets, we have quite a lot of financial instruments to trade apart from the traditional equity shares. Options are one of these financial instruments, and probably the most complex in its structure and pricing.

What is an option?

Option is a financial derivative product which does not have a value of its own. Like any other derivative product, its value is derived from its underlying asset, which could be an index, stock, currency etc.

Option is primarily a contract between the buyer and the seller to buy or sell a specific quantity of underlying asset on or before a specified date (expiration date) at a pre-determined price (strike price). Options give the buyer of the contract the right to exercise his option on or before the expiration date but not the obligation. For the seller of the contract, he has an obligation to fulfil his side of the deal if the buyer chooses to exercise the right.

This might seem unfair for the seller that he has an obligation to fulfil the contract, but the buyer has only right and no such obligation. For this right, the buyer of the contract has to pay a premium to the seller to get this right, and the seller gets to pocket this premium irrespective of whether the buyer exercises his right or not.

What is the Risk to reward structure of an options contract?

The risk to reward structure is quite the opposite for both the buyer and the seller of the option. The buyer of the option has a limited risk which is the maximum of total premium paid to the seller, and the reward against it is potentially unlimited.

Whereas it is entirely the opposite for the seller of the contract. The put option seller has the maximum profit potential of premium that he has collected at the time of entering the contract with the buyer, and the potential risk is theoretically unlimited.

There are two types of options namely

- Put options

- Call options

But here we are only going to talk about the Put option.

So, what exactly is a Put Option?

A put option is an options contract between two parties (buyer and seller) where the buyer of the contract gets the right but not the obligation to sell a specific quantity of underlying asset that he is holding or might be holding in the future at a pre-determined price (strike price) on or before a specific date (expiration date).

The seller of the put option incurs the obligation to buy the underlying asset from the buyer of the put option in case he chooses to exercise his right.

In a nutshell, put option is bought when the view on the underlying is bearish. On the contrary, it can be sold short when the view is neutral to bullish.

How the moneyness of a Put option is defined?

Moneyness of an option is a method with which each option can be categorized into three different categories, namely.

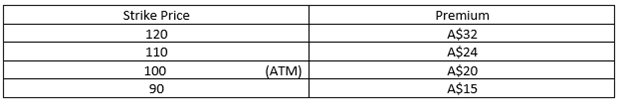

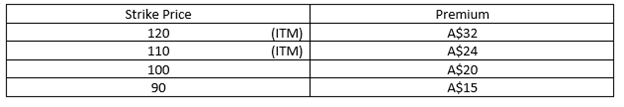

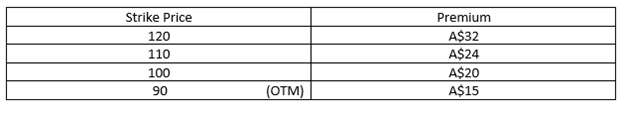

- At the money (ATM) - ATM option has the strike price which is the closest or preferably equal to the spot price of the underlying asset. For e.g., If XYZ stock is trading at A$100, then the closest strike price of the option to the 100 will be referred to as ATM option.

- In the money (ITM) - ITM put option are those options whose strike price is higher than the ATM option. For e.g., If XYZ stock is trading at A$100, then all options with a strike price higher than 100 are termed as ITM options.

- Out of the money option (OTM) – OTM put options are those options whose strike price is lower than the ATM option. In our, e.g. all put options having strike price below A$100 are OTM put options.

Let us take a few examples to understand this practically.

Let's assume person H is very bearish on XYZ stock which is currently trading at $100 and wants to bet on his assumption that the stock price will go down and that too within the expiration date. He buys an ATM put option of strike price 100 at a premium of $10, 30 days before expiration.

On the contrary person K is not that bearish on XYZ and thinks it might not go below the current price of $100 within the next 30 days. So, he goes on and sells the put option to H for $10.

Now at the expiration, one of the 3 cases would materialize.

Case 1 - XYZ closed below A$100

If XYZ closes below $100 at the expiration, say at $80 then clearly the assumption of the put option buyer stood right, and he would make a profit on his position. He would go on to exercise his right and sell XYZ at the pre-determined price of $100, whereas the current market price being quoted $80. His profit would be equal to the current premium of option - premium paid, i.e. $20 (intrinsic value) – $10 = $10.

As the market is a 0 sum game, so whatever profit person H has made would be the loss of person K in the same contract.

Case -2 - XYZ closed at A$100

If XYZ closes at $100 at the expiration, then there is no point in exercising his right as both the current price and pre-determined prices are same. In this case, the buyer of the put option will lose the entire premium that he had paid earlier at the time of entering the contract to the seller. The put option seller will keep the entire premium as his profit.

Case 3 - XYZ closed above A$100

If XYZ closes above $100, say at $110 at the expiration then clearly the buyer’s assumption has gone wrong, and he would not exercise his right to sell his underlying at $100 as he can get a better price directly from the spot market. In this case also, the seller of the option gets to keep the entire premium of $10 as his profit which is equal to the loss of the buyer.

Please wait processing your request...

Please wait processing your request...