Based on the classification scheme prepared by the largest member organization of oil and gas professionals worldwide, SPE (Society of Petroleum Engineers); Probable reserves are those unproved reserves that are calculated to be having at least 50 per cent probability of being recovered as per the estimation made using current geological and engineering data.

Understanding Reserves:

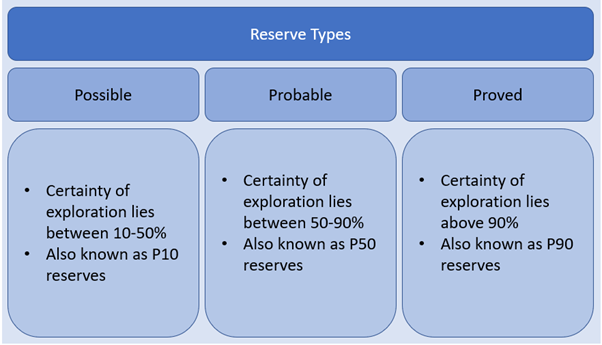

Broadly, reserves are classified into three main categories by SPE based on the certainty of recovery. The first category of reserves is Possible reserves, next is Proved reserves, and the last one is Probable reserves. These categories are used by various stakeholders to evaluate the total assets of a company which is also known as Fair Market Value. It is also used to forecast and plan. Reserve categorisation and determination of recovery volume from reservoirs is carried with the help of statistical modelling technique.

Source: Kalkine Group Image

Quantitative measurement of risk associated with various type of reserve categories is required to understand the amount of risk which is involved in the exploration of the reserve. However, in most of the cases, reserve estimation is not based on the mathematical, probabilistic measurement technique; instead, it is calculated based on the deterministic measurement technique. Ideally, the results of both methods should be the same.

What Probable reserve include:

Probable reserves may include:

- Reserves which are confirmed by normal drilling technique and the subsurface conditions are not favourable to be categorized under the proved banner.

- Reserves which are proved to be productive by any of the techniques like well log characteristics but lacks in definitive tests that can show similar results like shown in a proved reservoir within close proximity.

- Incremental reserves that are accounted to infill drilling that could have been classified as proved if the closer legal arrangement had been made at the time of the estimate.

- Reserves that are accounted with enhanced recovery techniques due to the advance technology which make it favourable to explore the commercial volumes from the reservoir.

- Reserves that are left out from a pre-existing proved reservoir due to some geological condition like faulting or any other geological event. But the present situation proves the extent to be on the larger side than predicted earlier.

- Reserves that are accounted by to an exploration condition like workover, treatment, retreatment, change of equipment, or new process implementation procedures which may increase the probability of recoverable.

- Reserves which are incremental reserves in proved reservoirs where a second or advance level of interpretation of volumetric data indicates the presence of more reserves than can be classified as proved. They are commonly known as P2 reserves which is the sum of Proved and Probable reserves.

Estimation of Reserves:

Reserve estimate of a reservoir is carried out using various geological and engineering methods which are widely accepted in the oil & gas industry. The technique which is used for estimation is also backed up by the previous similar experience of reservoir conditions found at some other place. Original Oil in Place and Gas in place in the reservoir is estimated based on the results obtained by the analysis of results obtained from various techniques. For example, structure maps can be used to find subsurface reservoirs. Isopach maps can be used to know the volume of reserves. Other methods like coring, logging can be used to estimate the porosity, permeability and saturation of the rocks present in the reservoir.

Based on the original reservoir pressure conditions, estimates on recovery factor is determined to OOIP & OGIP. The recovery factor helps to estimate the ultimate recovery volume, commonly known as EUR.

In a producing reservoir whose production rate started declining at a considerable rate, reserves are calculated based on declining curves or performance characteristics. For such specific cases where the reservoir is in producing stage, the estimates are based on the economic feasibility or the level of commercial production of reserves up to which a company can sustain.

The volume of gas estimates is expressed as Sales gas which is a raw natural gas in which further procession & fractionation is required. Typically, it is expressed at a temperature of 60 degrees Fahrenheit (°F) and a pressure base of 14.73 pounds per square inch absolute (psia). Sales gas is the amount of gas which is left out after flaring, shrinkage, fuel usage and field separation.

Please wait processing your request...

Please wait processing your request...