What are Possible Reserves?

As per the SPE (Society of Petroleum Engineers) classification of reserves, possible reserves are those that have a successful extraction probability limit in the range 10 to 50 per cent, based on the assessment results obtained from engineering and geological data. The assessment is based on the existing economic and operating conditions.

Possible reserves are one of the three categories as per the SPE to assess an oil reserve’s quality.

What are the Main Types of Reserves?

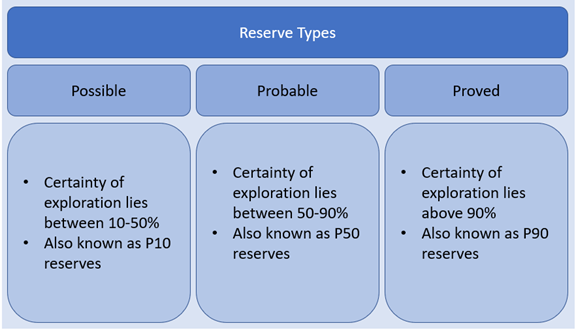

Broadly, reserves are divided into three main types, based on the likelihood of successful extraction. Amongst the three main types, the first one is Possible reserves, the second one is Proved reserves, and the third one is Probable reserves. These three types state the amount of reserves that can be technically recovered at a financially feasible cost. Majorly, companies need to publish their proved, and probable reserves to the investors and specialists use this for the company's Fair Market Value assessment.

Source: Kalkine Image

Possible reserves are considered to have a lower probability of success in extraction because of the ambiguous geological interpretation results, non-economic recovery of reserves, and seepage from adjoining areas or reserve projection being made based on future technology. They are also known as P10 reserves and have a cumulative reserve base of proven, probable, and possible reserves. In industrial terms, it is known as "3P". Quantitative risk analysis is required for proper investment planning, decision making and predicting future forecast.

What do Possible Reserves Include?

Possible Reserves may include:

- The reserves which cannot be kept under Possible and Probable reserves based on the interpretation results of geological and geophysical data.

- The reserves which confirm their presence in the subsurface formations by any of the exploration methods but are not commercially recoverable due to some challenges like unavailability of advance technology, falling commodity prices in global market, complex geology etc.

- The reserves which are kept on hold for exploration due to technical challenges in exploration and advance technology is awaited.

- Reserves which are kept on hold for exploration and require further confirmation through some pilot project.

- Reserves which are kept on hold for exploration due to some dicey situation arising on the commercial feasibility of project due to ambiguity in assessment results of reservoir characteristics.

- The reserves which are falling in a structurally lower area that is separated from the proved area by faulting or any other geological event.

How are Estimates of Reserves Prepared?

Estimates are made based on the results obtained from engineering and geological information. The main objective of reserve estimation is to evaluate the EUR (Estimated Ultimate Recovery), which is carried out on the basis of reservoir parameters. The estimation helps in proper forecasting, planning and decision making. The base of estimation is the original volume of gas (OOIG) and the original volume of oil (OOIP) present in the place. Reservoir parameters like porosity, permeability and saturation justify the recoverable volume in the reservoir and help to calculate EUR.

Why Possible Reserves are Important?

Generally, Proved (1P) and Proved plus Probable (2P) reserves data are used by petroleum companies worldwide. However, due to non-obligation of government on the use of (3P) Proved plus Probable plus Possible reserve information, it is published when the company intends to publish. This means that the evaluation cost of 3P reserves can be weighed up against the overall potential investment a company can get from publicising the findings. Therefore, most of the companies choose not to publish the full band to the investors.

Nowadays, many new and small companies are reporting their 3P reserves. They will buy limited but prospective fields, spend their initial few years to prove the field commercial and then merge or get acquired by a big player who can take care of all the operation costs. Early days of field assessment does not require too much capital, and a little amount is needed to explore the field. Therefore, 3P reserves are essential if a company has most of its project in the early development stage, or the focus is being made on the potential of a particular asset.

Please wait processing your request...

Please wait processing your request...