What are Organic Sales?

Organic sales are the sales generated through the existing operations and internal processes in the company. Organic sales encompass those streams of revenues considered to be resulting from within a business.

The sales revenue which is generated from the existing business streams is called organic sales, as opposed to the revenue that is generated from buying new businesses.

Do You Know These Important Aspects About Organic Sales?

- The funds generated through mergers, acquisitions and borrowings are not a part of the organic sales.

- Usually, the sale or disposal of the sub businesses is not counted in the total sales figure while measuring organic sales.

- If a company's last year growth shows 15% because the company acquired another firm, the increase will not be considered as organic growth as it is resulted from external process.

- Most companies evaluate their organic sales year-on-year basis as it is essential to understand the growth generated through direct results of the company's internal processes. Some also assess the organic growth from quarter-to-quarter.

- Notably, an increase in the organic sales and development through its own resources results in the organic growth of the company.

- Organic sales could also be negative in numbers.

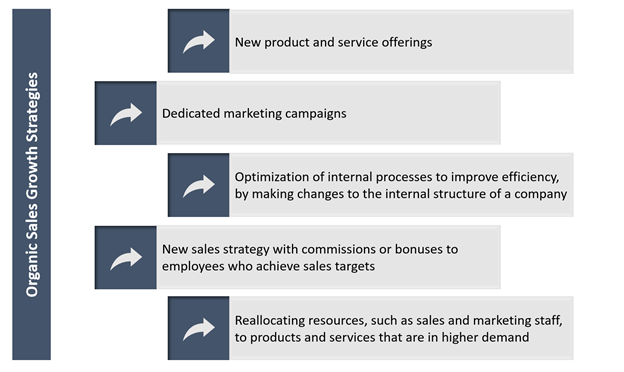

What are the Business Strategies to Enhance Organic Sales?

- Companies select the best of the business strategies to generate substantial revenues from organic sales. Robust business development plans and effective sales and marketing strategies are the driving forces behind organic sales.

- Targeting brand awareness and brand loyalty, along with dedicated focus on 4Ps of Marketing are some of the important tools.

- In order to grow sales organically, companies focus on improving their productivity.

- Apart from these, companies also work towards expanding market penetration to increase their market share.

- Product development and diversification also grow revenue organically.

- Another essential strategy used by companies is growing its assets through reinvesting profits.

- New sales strategy with incentive-based system and diverting resources towards business segment facing higher demand and also critical action points to boost sales organically.

Image: Kalkine

Why Are Organic Sales Essential for Companies to Grow?

- Organic sales result directly from the company's core internal processes. Increasing organic sales gives benefits to the company by strengthening the company's integral businesses.

- When a company effectively sells its products and services and generates organic sales, investors, shareholders, and management enjoy the revenue from it.

- Organic sales eventually result in the company's overall organic growth.

- The overall growth and well-executed business show efficiency in planning and strong management in the company.

- Moreover, organic growth provides flexibility, and the company can maintain its core values.

So, when we see a company with consistent strong organic growth, it is generally because of the robust business plan and its execution.

What Are the Challenges Companies Face to Grow Organically?

Given the market uncertainty and evolving market and consumer behavior scenario, below are some of the challenges companies have to face in their initiatives to grow organically:

- It is quite difficult for companies to accomplish targeted organic growth without the foreplay of external factors.

- The resources are limited in availability and the market is continually changing as well as consumer behavior.

- The growth is limited, and after a point, it gets stagnant. So, boosting organic sales after stagnancy required unique and dedicated business action points and initiatives.

- The current market situation is high-risk and uncertain.

- The competition is also continually growing, making it more difficult for companies to stay relevant in the market.

Why Are Companies Keen on Boosting Organic Sales Via Inorganic Channels?

Give the limitations associated with organic growth, companies consider inorganic channels such as mergers, acquisitions and borrowings to earn quick large profits.

For instance, a large vehicle for hire company is facing a reduction in market share in the transportation sector because of the increase in demand for two-wheelers-for-hire by the consumers.

The CEO of the vehicle for hire company then either launches an entirely new product to compete with the competitor or the company can instead directly spend $1 billion to acquire the largest two-wheeler for hire startup and take control of the market. It could restore the vehicle to hire company's market shares overnight.

So, in this situation, rather than spending months on investing in developing a new product and a new business unit, the company directly takes advantage of the set skills and resources to expand its business. Even though the company increases its sales and revenue, such growth is then not considered as organic and referred to as inorganic growth.

But when the startup is wholly integrated with the vehicle for hire company after a year, the revenue generated from the acquisition is accounted for in the organic sales.

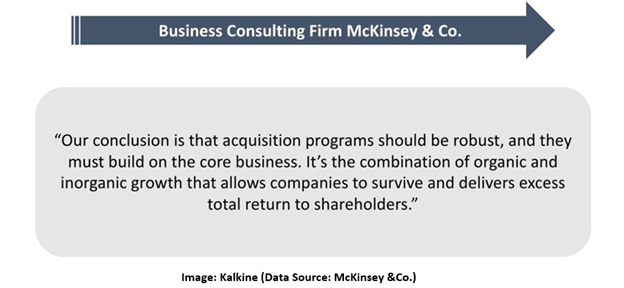

Organic sales have limitations; hence when companies are in the process of accessing new markets, products or services, inorganic sales is the typical way forward.

Notably, inorganic sales impact organic growth of the company. Hence while reporting financial results, companies show organic and inorganic sales differently.

Are Investors Keen on Understanding Organic or Inorganic Growth?

As an investor, some might consider growth on the whole and not care from how it is driven. As long as the company is growing the shareholder value, some investors are not keen on finding if the sales growth is generated organically or inorganically.

Whereas some investors take time to understand the risk and potential rewards associated with both organic and inorganic sales. They pay attention to the company's balance sheet. Let us consider you have invested in the vehicle for hire company, which showed a 25% increase in revenue after acquiring the startup dealing with two-wheelers for hire. Though it sounds great, it could also be a reason for worry.

The company's core business is a four-wheeled vehicle for hire, and it is showing a 15% decline in sales. As an investor, it is essential to note that inorganic sales are not lousy growth, but it should also positively impact the company's internal development.

Investors generally see the logic behind a company's decision making on acquisitions. If the correct acquisition decisions are strengthening a company's core businesses and growing its revenue, then it eventually complements its organic growth.

Please wait processing your request...

Please wait processing your request...