Opportunity cost is a tool or a method to determine the true and full value of any activity by taking into account the value of the next best alternative available. It helps in conducting cost-benefit analysis and integrates the cost-effectiveness and value considerations.

For instance, if I have $20 with myself. I could use it to buy a burger, and a drink for my lunch or I could have settled for a decent buffet where I could enjoy more varieties of food. Since the resource ($20) is limited, one has to consider the choices of using that resource best suited for oneself.

The concept of Opportunity Cost is widely used in the field of economics since the resources are limited or scarce while needs are limitless. The opportunity cost does not appear in any accounting books or financial report of any company. But the businesses try to evaluate their time and money invested in a venture with respect to best available alternative or forgone opportunity to check their decision making effectiveness.

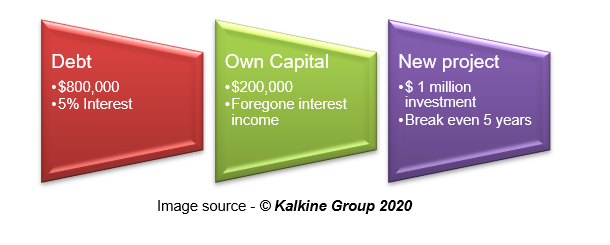

Suppose a business house plans to invest $1 million in a new project which will start giving returns after 5 years. Now there are many factors which will come into play while determining the opportunity cost of the project. The true value of money will enter into the dynamics as the profit or loss will happen in more than 5 years. Let us analyse the economics of the project in the purview of opportunity cost.

- Capital Investment

The business house may invest $1 million entirely from its reserves or could arrange for long term debt. Now the debt could be 100% for the project cost or may cover a part of it. For the sake of simplicity in the calculation, let us assume the firm gets 80% debt and rest 20% from its own reserves. Let us also assume that the rate of interest is 5% per annum.

Story So far-

- Project becomes operational

Now suppose that the project takes 1 year to become operational. The interest on the debt would come up to $40,000 @5% in one year. After one year, the project’s total capital cost would now be $1.04 million and plus the firm would have earned on the $200,000 through bank deposit interests or through investment in share market. In this case, the opportunity cost after one year would be the loss of interest/ return on investments for $200,000.

- The 3rd stage

The company starts generating revenue and starts paying for its operations and bank debt. There are two case scenarios from here. First, the company starts making good profits and soon reaches its breakeven point, and the project becomes profitable. Second, the business model flops and starts incurring losses on its operations.

In either case, the opportunity cost should be analysed with respect to another alternative that the company could have done with the resources it had. Well, running a firm or a business is not that easy and determining the outcomes based on simple assumptions would not work here. For actual results, actual data would have been required.

So a simple formula can be deduced from the above discussions for the opportunity cost.

A negative value of opportunity cost means the most appropriate decision has been made. One important aspect needs to be kept in mind always while determining the opportunity cost. The selection of the forgone option or the alternative is also of vital importance.

The best way to assess the options for determining the opportunity cost is to look for the alternatives that can yield the highest returns. The company, in the above example, could have invested its own capital in the stock market and could earn some returns without paying any interest or investing time in a new project. Alternatively, investment in the stock market comes with some degree of risk. The company would have earned more from the project.

There will be some opportunity cost involved whatever decision is made and is unavoidable.

Types of Opportunity Cost

Opportunity cost does not need to always involve monetary value. Sometimes, time or degree of satisfaction is also involved when the monetary factor is constant on all options involved. So opportunity cost can be classified into two categories:

- Explicit cost

The above discussed two examples are classic cases of explicit opportunity cost, where some sort of monetary value is involved. In both cases, the transaction of money is involved, and the opportunity cost for the foregone option will involve some monetary value.

- Implicit cost

No monetary transaction is involved. Factors like time or degree of satisfaction come into play here. Suppose I want to go for a walk during my free time. Now there is “n” number of possibilities to utilize that free time. May be one could have sat over a couch and watched a television or could enjoy some videogames. One could have read some interesting books while staying in the house. So the opportunity costs in these cases are intrinsic in nature and cannot be measured on monetary terms.

The crux of the entire discussion is that every activity, whether explicit or implicit costs, involves some opportunity cost. It is something which is unavoidable but comes in to play once the activity is completed.

Please wait processing your request...

Please wait processing your request...