Operating profits refers to the revenue incurred by a company owing to its core operation without accounting for the reduction of interest and taxes. It is obtained after deducting indirect and directs costs from sales revenue.

The measures of profitability include gross profit, net profit, and operating profit. Out of these, operating profit is a projection of the earnings from the core business and it depicts a firm’s cash flow scenario.

Operating income does not include the company’s earing from its ancillary activities, like earnings of a company in which the firm has invested.

How is operating profit calculated?

The formula for Operating profit is as follows:

Or simply put,

Revenue earned from the selling of the assets is not included in the operating profit. Only the products that are used for the purpose of being sold by the business are accounted in operating profit. Also, interest received through checking or cash market accounts by the firm are also not included in the calculation of operating profit.

Operating income does not include the investment income generated through the firm’s investment in another company, even if this investment is a part of core business for the other company. The sale of real estate and production equipment also can not be counted as operating profit.

The production costs, amortization and depreciation are removed from the operating revenue; however, this does not include any debt obligations that must be met by the company. These obligations may be linked to the company’s core business, however, since they do not generate direct costs for the operating busines, they are not excluded from the calculation.

What are direct costs and indirect costs?

Direct costs refer to the expenses incurred during the creation of the purchase of a product or while offering a service. It is also referred to as the cost of goods sold or the cost of sales. It is called direct cost because it is linked directly to the production process for providing goods and services. These costs can be fixed and variable both.

Some examples of direct costs include raw materials like parts, supplies and other logistics; labour costs accruing to the production process; commissions, etc which are incurred by businesses providing services like real estate insurance, consultancy; utility bills which are generated during the production process; shipment costs.

Indirect costs refer to those costs that are not directly linked to the core production process. The core business involves the production and sale of the underlying goods or services produced by the company. These costs are mostly accounted as fixed costs or overhead cost.

Some examples of indirect costs include salaries of employees and staff; property rent; maintenance costs, etc.

Selling and administrative costs are also subtracted from total revenue, these include the cost incurred in providing salaries and benefits to managers and staff; cost of office supplies; utilities like telephone lines, etc; depreciation of office building, machinery, etc; marketing and advertising costs, etc.

What is an example of operating cost calculation?

Consider the following figures for Company X:

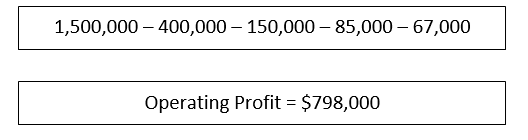

- Total revenue = $1.5 million

- Cost of Goods Sold = $400,000

- Labour Costs = $150,000

- Administrative Expenses = $85,000

- Depreciation and Amortization = $67,000

Now the operating profit for Company X would be:

Company X earned an operating profit worth $798,000, excluding the interest earned from investors and the taxes paid to the government.

Here, cost of goods and labour costs form a part of the direct costs; however, the administrative expenses as well as depreciation and amortization are a part of indirect costs.

How is operating revenue different from EBIT and gross profit?

Gross profit is the total revenue less of the expenses linked directly to the production of goods also known as the Cost of Goods Sold (COGS). It is reflective of how much revenue a company has left over after accounting for the production costs.

The operating profit is derived from gross profit itself. It is obtained by subtracting operating costs and depreciation and amortization from the gross profit. Both gross profit and operating profit do not include the interest payments on debt, tax deductions or income received from investments.

Operating profit is also sometimes referred to as Earnings Before Interest and Tax (EBIT). The only difference between EBIT and operating profit can be that the former may include non-operating revenue, however, the same is not a part of operating profit.

Why is operating profit important?

Income from external sources like investments or interest incomes may not entirely define how well a business is functioning at its core. Taxes do not define how well a company is doing in its operations, while interest expenses give an idea about whether the company is financed through debt or equity.

Operating revenue is a clear depiction of the running business and its management. Generally, EBIT is one of the most highly inspected financial indicators used by investors to judge a company’s strength. Operating revenue figures are also equally important and are highly reliable figures about the possible profitability of the company.

Please wait processing your request...

Please wait processing your request...