What Is Offer Price?

When a fresh offer is made for any new security, the price at which the institution is willing to sell the security is called offer price. Offer price is a commonly used term during private placements and in share market parlance. When a private company decides to offer shareholding to the public, it launches its Initial Public Offer (IPO). Before the shares open for trading on the stock exchange, they are first purchased by investors, primarily institutional or accredited ones. The price at which such a purchase is made is called the offer price. The concept may be applicable to the issue of other securities liked bonds as well.

Summary

- Offer price is the price below which the issuer is not willing to sell an instrument.

- The process of book building is used to arrive at the offer price backed by market dynamics of demand and supply.

- An ideal offer price would be the one that balances the interest of the existing as well prospective investors. Thus, there exists a dilemma between under-pricing and a strong aftermarket performance.

Frequently Asked Questions (FAQs)

How Is an Offer Price Decided?

Since public market for these shares hasn’t existed earlier, there is no stock price benchmarking available. As a result, underwriters who help the companies sell their initial shares, set a price which may help the company to raise enough capital while being mindful to not price it too high for the investors among the general public. The main underwriter who leads the process for a company is called the bookrunner.

The group of such investors, who help companies sell their IPOs to public, is called an equity syndicate. The price at which the syndicate members sell the securities is called the re-offer price.

Is Offer Price same as the Opening Price?

Opening price is the first day’s price at which a company’s shares start trading on the stock exchange. Often the offer price is set below the opening price. Some use this as a tactic to attract investors. This gap may also be considered as the charge for being admitted into the public market. Often, there is a dilemma in making a choice between under-pricing a share and targeting a strong aftermarket performance and absolute returns. Also, based on simple demand supply mechanisms, if prices are high, full subscription may not happen while if there is under-pricing, the company’s potential of raising share capital is hampered.

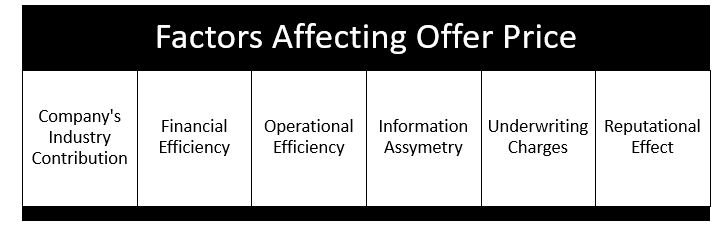

What Are The Factors Affecting Offer Price?

There may be asymmetry in information among the company, the investor and investment banker. Investors may not have complete knowledge about important factors like the company’s contribution to the respective industry, financial and operational efficiency, earning potential, underwriting charges, risk factors, competitors, long term strategies, industry performance etc. The management may not be known to them. Another factor may be reputational effect. In addition, there may be informed and uninformed potential investors in the stock market. The current market conditions in the economy may also have an impact on the pricing.

Copyright © 2021 Kalkine Media Pty Ltd

What Is The Process of Setting the Offer Price?

The investment bankers for the company, on the basis of primary information from the company on matters like management, operations, expansions, finances etc, prepare the prospectus with the price range. This is then forwarded to institutional investors who commit to buy at a price within the range- this is the firm price. It is to be noted that price band may differ for categories like High-Net-Worth Individuals (HNIs), Qualified Institutional Buyers (QIBs) and retail investors – with the lowest band being for retail investors. Based on the firm price received from various investors, the book of demand is built. This is called the book building. Accordingly, a price is set to ensure clearing and then allocation is done.

Financial modelling may be used for the purpose of valuation of the companies and then a deduction is made for IPO discount to arrive at the offer price. The discount typically ranges from 10 to 15%. However, there may be cases of heavy oversubscription, driving up prices even more than the valuation price. On the other hand, the lack of subscriptions may require re pricing below the offer price.

Where Else Is The Concept Of Offer Price Put To Use?

The concept is also useful in the context of raising private equity, which is a less complex alterative to IPOs. For the purpose of raising more capital, the securities are issued to select investors- individuals or institutions. However, it may lead to dilution of shares of existing shareholders.

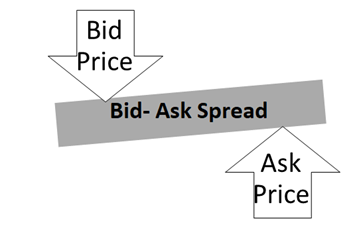

The concept of offer price prevails in the share markets too. Offer price is the lowest price that the issuer is willing to accept for a share. It is also called the ask price. Pitched opposite to this is the bid price which is the maximum amount that a buyer is willing to pay for the share. The gap between these two prices is called the bid- ask spread. Shares with lower spread have more liquidity.

Copyright © 2021 Kalkine Media Pty Ltd

How Offer Price Works?

Suppose a private company ABC Ltd is to issue shares to the public by means of an Initial Public Offer. The prospectus is prepared with the price range $3 to $4.5 for HNIs, $2 to $3.5 for retail investors and $4 to $6 for QIBs. 5 HNIs, 10 retail investors and a QIB commit the firm price at $4, $3 and $5, respectively. This completes the book building process. Now, the clearing price is set at $4 and allotment is done. This $4 is the offer price. The date of issue follows thereafter on the stock exchange.

Please wait processing your request...

Please wait processing your request...