What is the national debt?

The national debt, also known as government debt, sovereign debt, or country debt, is the intragovernmental and public debt owed by a country's government to its creditors. Bonds and other debt securities account for most of it, but it can also come from direct borrowing from foreign institutions such as the World Bank.

Summary

- The total sum of all debts owed by a country's government is referred as the national debt.

- Bonds and debt securities, foreign institutions, and the World Bank are all options for the government to borrow money to pay off national debts.

- Debt restructuring, higher taxation, outright default, budget cuts, and debt monetisation are all options for reducing the national debt burden.

Frequently Asked Questions (FAQs)

What does a national debt imply?

The term "national debt" refers to a country's government's debts, which are largely made up of debt securities and bonds.

There are two types of debt in the national debt. The government owes this debt to bondholders.

- The first form of debt is owned by the public, which includes citizens, foreign governments, and foreign investors.

- The second form of debt is intragovernmental debt, which is owned by the government to other government agencies.

Source: © Icefields | Megapixl.com

With a larger economy, the country's capital markets are likely to expand, allowing the government to issue more debt. This assumes that the size of the debt as a percentage of the total economy, rather than the dollar sum, would be determined by the country's ability to repay debt and the impact the debt will have on the economy.

Some argue that the government's excess national debt affects the country's economic sustainability, with consequences for currency strength in trade, unemployment, and economic development. Others contend that the national debt is manageable and that there is no need to be concerned.

How is the national debt calculated?

Debt, though measured in trillions of dollars, is most commonly calculated as a percentage of gross domestic product(GDP) or the debt-to-GDP ratio. This is because as a country's economy increases, so does the amount of money available to pay off its debts.

How does the government receive the cash?

The government can borrow money in a variety of ways, adding to the national debt. Governments can borrow money from foreign institutions such as private financial organisations and the World Bank, as well as sell financial securities.

The national debt burden can be lowered by five mechanisms: debt restructuring, increased taxes, outright default, cutting spending, and debt monetisation.

Source: © Goosey | Megapixl.com

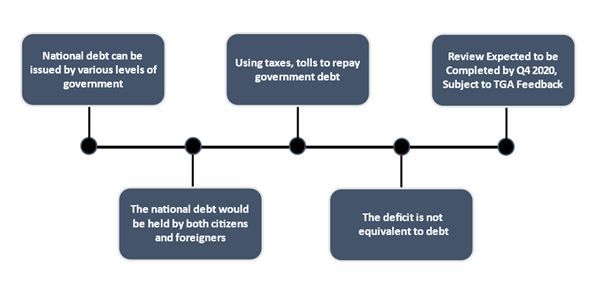

What is the classification of the national debt?

The issuer

Different levels of government may issue national debt. The debt's risk profile is determined by the issuer.

Holders of the national debt

Citizens and foreigners alike will hold the national debt, but citizens hold it in their currency, while foreigners hold it in their own currency. As a result of the foreign currency risk, the risk of default for debt held by citizens is much lower.

Repayment Methods

There are several mechanisms for repayment, such as using taxes to repay government debt, but repayments may also be obtained from a particular source, such as tolls if the debt has been used for highway construction.

Maturity

The national debt, like other types of debt, has various period spans, with the majority of the time having a long maturity.

What is the difference between Debt vs. Deficit?

Deficits are not the same as the national debt. When the government's expenses exceed its revenues in a given year, a deficit is created. To fund the deficit, the government can issue debt by raising taxes or selling assets. As a result, the deficit is not equivalent to debt, but if funded with debt, it would add to the debt.

Source: Kalkine Media

What instruments are used to issue the national debt?

Loans

Governments can also obtain funds through commercial bank loans. There are government-to-government syndicated loans. They are not tradeable, unlike bonds, although there may be financial securities linked to the performance of these loans, such as credit default swaps.

Bonds

The country's central bank issues government bonds in local currency. The central bank auctions liquid and tradeable bonds to citizens via financial institutions after lending money to the government.

Source: Copyright © 2021 Kalkine Media Pty Ltd

How is the Australian government dealing with the national debt?

The national debt of Australia is described as the debt of the Commonwealth of Australia's government, excluding the debts of Australia's states. The account is restricted to the government's loans and financial instruments.

Canberra's Treasury department oversees the government's debt and collecting funds. The minister in charge of the department is Australia's Treasurer. AOFM (The Australian Office of Financial Management) is the Treasury Department in charge of debt management in Australia.

Bonds and Treasury bills are the instruments used by the AOFM to raise money. The term "Australian government securities," or "AGSs," refers to all the financial instruments used by the government to raise money.

As per the International Monetary Fund, Australia's debt-to-GDP ratio is 41.6 percent (IMF). When combined with other factors, this is a very low figure, making Australian government debt an appealing investment for foreign investors. As a result, international holdings in Australian government bonds have always been substantial.

Australia's government has never defaulted on its debt, and its bonds are AAA accredited by all major credit rating agencies, rendering Australian debt instruments extremely stable to invest in.

Please wait processing your request...

Please wait processing your request...